A) $45.00

B) $44.02

C) $47.26

D) $37.60

E) $40.09

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What percentage of capital gains are excluded from taxation for corporate shareholders?

A) 0 percent

B) 10 percent

C) 25 percent

D) 70 percent

E) 75 percent

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The common stock of Woods Bowling Balls closed at $59.65 a share today.Tomorrow morning, the stock goes ex-dividend.The dividend that is being paid this quarter is $1.37 per share.Assume the tax rate on dividends is 21 percent.All else equal, what should the opening stock price be tomorrow morning?

A) $59.64

B) $58.43

C) $58.38

D) $58.57

E) $58.72

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The common stock of Tina's Tires closed at $68.25 a share today.Tomorrow morning, the stock goes ex-dividend.The dividend that is being paid this quarter is $1.56 per share.Assume the tax rate on dividends is 21 percent.All else equal, what should the opening stock price be tomorrow morning?

A) $68.09

B) $66.88

C) $66.83

D) $67.02

E) $67.17

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Davidson International has 13,700 shares of stock outstanding at a price per share of $28.The firm has decided to repurchase 500 of those shares in the open market.What will the price per share be after the share repurchase is completed? Ignore taxes and market imperfections.

A) $29.14

B) $28.84

C) $28.89

D) $28.00

E) $29.06

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your portfolio is 700 shares of Conglomerated International that currently sells for $26.50 a share.The company has announced a cash dividend of $0.45 per share with an ex-dividend date of tomorrow.Assume there are no taxes.What should you expect your portfolio value to be tomorrow morning assuming all else is held constant?

A) $16,236

B) $16,500

C) $16,646

D) $16,764

E) $16,830

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cookies and Cream has 5,000 shares of stock outstanding at a market price of $8.29 per share.What will be the price per share after a stock dividend of 8 percent? Ignore taxes and market imperfections.

A) $7.24

B) $7.68

C) $7.45

D) $7.96

E) $8.03

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

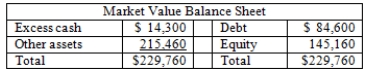

Dixie's has a market value balance sheet as shown below.The firm currently has 2,200 shares of stock outstanding and net income of $10,500.  The firm has decided to spend $6,500 on new equipment and use the remaining excess cash to pay an extra cash dividend.What will the firm's PE ratio be after this dividend is paid, all else held constant? Ignore taxes.

The firm has decided to spend $6,500 on new equipment and use the remaining excess cash to pay an extra cash dividend.What will the firm's PE ratio be after this dividend is paid, all else held constant? Ignore taxes.

A) 14.20

B) 16.67

C) 13.08

D) 11.22

E) 14.57

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kaylor's Tool Shoppe has 8,600 shares of stock outstanding at a market price of $8 a share.Which one of the following stock splits should the firm declare if it wants to increase the stock price to exactly $36a share? Ignore any taxes or market imperfections.

A) 3-for-4 stock split

B) 2-for-11 stock split

C) 2-for-7 reverse stock split

D) 2-for-9 reverse stock split

E) 2-for-8 reverse stock split

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pluto United has 14,200 shares of stock outstanding at a price per share of $23.How many shares will be outstanding if the firm does a 4-for-3 stock split?

A) 18,300 shares

B) 19,033 shares

C) 18,667 shares

D) 19,100 shares

E) 18,933 shares

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is correct?

A) Tax rates are the key determinant to a company's dividend policy.

B) Firms are equally likely to increase or decrease their normal dividends per share.

C) Dividends tend to be more erratic than earnings.

D) Mature firms are less apt to pay dividends than young firms.

E) Dividend growth tends to lag earnings growth.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lexington Stables just declared a 15 percent stock dividend.Which one of the following increased by 15 percent as a result of this dividend?

A) Book value of firm's equity

B) Shareholders' wealth

C) Number of shares outstanding

D) Firm's cash balance

E) Stock price

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following best defines a regular cash dividend?

A) Distribution by a firm to its shareholders

B) Payment from any source by a firm to its owners

C) One-time payment of cash by a firm to its shareholders

D) Cash payment by a firm to its owners as part of a firm's normal operations

E) Distribution of the proceeds from the sale of a portion of a firm's operations

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the US, stock dividends:

A) tend to change in direct proportion to changes in earnings.

B) have steadily declined in nominal terms over the years.

C) tend to decrease in amount just as frequently as they increase.

D) are concentrated in a few mature firms.

E) have steadily declined in real terms over the years.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fried Foods recently liquidated its fast-food division.That unit represented 30 percent of the firm's overall market value.Prior to the liquidation, the firm's stock was selling for $46 a share, the annual dividend was steady at $1.20 per share, and there were 18,000 shares outstanding.The firm is preparing to distribute the entire liquidation proceeds to shareholders.How much should shareholders expect to receive per share from this liquidating dividend? Ignore taxes.

A) $14.24

B) $13.30

C) $14.10

D) $13.10

E) $13.80

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these is a noncash payment made by a firm to its shareholders that lessens the value of each outstanding share?

A) Reverse stock split

B) Cash distribution

C) Stock dividend

D) Regular dividend

E) Liquidating dividend

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jerry Springs Company has 20,000 shares of stock outstanding at a market price of $10 a share.The current earnings per share are $0.55.The firm has total assets of $200,000 and total liabilities of $86,500.Next week, the firm will be repurchasing $25,000 worth of stock.Ignore taxes.What will be the earnings per share after the stock repurchase?

A) $0.715

B) $0.664

C) $0.452

D) $0.629

E) $0.563

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) Dividends are irrelevant.

B) Flotation costs are a good reason to support a high-dividend payout.

C) Current tax laws favor high current dividends for individual investors.

D) Dividend policy is the time pattern of dividend payout.

E) Corporate investors tend to prefer low-dividend payouts on securities they own.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following would tend to favor a low-dividend payout?

A) Higher tax rates on capital gains than on dividend income

B) High flotation cost for equity issues

C) Endowment fund investors who cannot spend principal

D) Investors' desire for a high-dividend yield

E) Elimination of the tax deferral on capital gains

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Modern Homes just declared a 4-for-3 stock split.Which of the following occurred as a result of this split? I.Number of shares outstanding increased by one-third II.Number of shares outstanding decreased by one-fourth III.Price per share increased by one-third IV.Price per share decreased by one-fourth

A) I only

B) I and III only

C) I and IV only

D) II and III only

E) II and IV only

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 96

Related Exams