A) 1.08

B) 1.15

C) 1.04

D) 1.11

E) .99

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following best exemplifies unsystematic risk?

A) Unexpected economic collapse

B) Unexpected increase in interest rates

C) Unexpected increase in the variable costs for a firm

D) Sudden decrease in inflation

E) Expected increase in tax rates

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of these represents systematic risk?

A) Major layoff by a regional manufacturer of power boats

B) Increase in consumption created by a reduction in personal tax rates

C) Surprise firing of a firm's chief financial officer

D) Closure of a major retail chain of stores

E) Product recall by one manufacturer

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of systematic risk present in a particular risky asset relative to that in an average risky asset is measured by the:

A) squared deviation.

B) beta coefficient.

C) standard deviation.

D) mean.

E) variance.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Popular Finger Foods stock is expected to return 20 percent in a booming economy, 14 percent in a normal economy, and -5 percent in a recession.The probabilities of an economic boom, normal state, or recession are 8 percent, 87 percent, and 5percent, respectively.What is the expected rate of return on this stock?

A) 13.53 percent

B) 12.92 percent

C) 13.20 percent

D) 14.16 percent

E) 13.95 percent

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

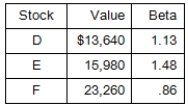

Currently, you own a portfolio comprised of the following three securities.How much of the riskiest security should you sell and replace with risk-free securities if you want your portfolio beta to equal 90 percent of the market beta?

A) $7,023.15

B) $7,811.29

C) $8,666.67

D) $7,753.51

E) $8,318.50

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Portfolio diversification eliminates:

A) all investment risk.

B) the portfolio risk premium.

C) market risk.

D) unsystematic risk.

E) the reward for bearing risk.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $36,000 portfolio is invested in a risk-free security and two stocks.The beta of Stock A is 1.29 while the beta of Stock B is .90.One-half of the portfolio is invested in the risk-free security.How much is invested in Stock A if the beta of the portfolio is .58?

A) $6,000

B) $9,000

C) $12,000

D) $15,000

E) $18,000

G) None of the above

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Midwest Fastener Supply stock is expected to return 16 percent in a booming economy, 12percent in a normal economy, and -3 percent in a recession.The probabilities of an economic boom, normal state, or recession are 12 percent, 80 percent, and 8 percent, respectively.What is the expected rate of return on this stock?

A) 11.28 percent

B) 10.67 percent

C) 10.95 percent

D) 11.91 percent

E) 11.70 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the economy has an 6 percent chance of booming, am 8 percent chance of being recessionary, and being normal the remainder of the time.A stock is expected to return 22.5 percent in a boom, 11.5 percent in a normal economy, and -8 percent in a recession.What is the expected rate of return on this stock?

A) 5.5 percent

B) 9.15 percent

C) 6.69 percent

D) 10.60 percent

E) 10.38 percent

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bama Entertainment has common stock with a beta of 1.22.The market risk premium is 8.1 percent and the risk-free rate is 3.9 percent.What is the expected return on this stock?

A) 13.31 percent

B) 12.67 percent

C) 12.40 percent

D) 13.78 percent

E) 14.13 percent

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Systematic risk is:

A) totally eliminated when a portfolio is fully diversified.

B) defined as the total risk associated with surprise events.

C) risk that affects a limited number of securities.

D) measured by beta.

E) measured by standard deviation.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) The risk premium on a risk-free security is generally considered to be one percent.

B) The expected rate of return on any security, given multiple states of the economy, must be positive.

C) There is an inverse relationship between the level of risk and the risk premium given a risky security.

D) If a risky security is correctly priced, its expected risk premium will be positive.

E) If a risky security is priced correctly, it will have an expected return equal to the risk-free rate.

G) A) and E)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

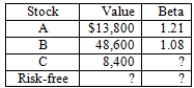

You currently own a portfolio valued at $76,000 that is equally as risky as the market.Given the information below, what is the beta of Stock C?

A) .91

B) .95

C) .81

D) 1.03

E) 1.06

G) B) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Systematic risk is defined as:

A) any risk that affects a large number of assets.

B) the total risk of an individual security.

C) diversifiable risk.

D) asset-specific risk.

E) the risk unique to a firm's management.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is the best example of an announcement that is most apt to result in an unexpected return?

A) A news bulletin that the anticipated layoffs by a firm will occur as expected on December 1

B) Announcement that the CFO of the firm is retiring June 1 as previously announced

C) Announcement that a firm will continue its practice of paying a $3 a share annual dividend

D) Statement by a firm that it has just discovered a manufacturing defect and is recalling its product

E) The verification by senior management that the firm is being acquired as had been rumored

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock is expected to return 13 percent in an economic boom, 10 percent in a normal economy, and 3 percent in a recessionary economy.Which one of the following will lower the overall expected rate of return on this stock?

A) An increase in the rate of return in a recessionary economy

B) An increase in the probability of an economic boom

C) A decrease in the probability of a recession occurring

D) A decrease in the probability of an economic boom

E) An increase in the rate of return for a normal economy

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock has a beta of 0.95, the expected return on the market is 13.25, and the risk-free rate is 3.66.What must the expected return on this stock be?

A) 10.59 percent

B) 39.02 percent

C) 14.26 percent

D) 19.86 percent

E) 12.77 percent

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Malone Imports stock should return 12 percent in a boom, 10 percent in a normal economy, and 2 percent in a recession.The probabilities of a boom, normal economy, and recession are 5 percent, 85 percent, and 10 percent, respectively.What is the variance of the returns on this stock?

A) ..000522

B) ..000611

C) ..024718

D) ..006107

E) ..015254

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The security market line is defined as a positively sloped straight line that displays the relationship between the:

A) beta and standard deviation of a portfolio.

B) systematic and unsystematic risks of a security.

C) nominal and real rates of return.

D) expected return and beta of either a security or a portfolio.

E) risk premium and beta of a portfolio.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 99

Related Exams