A) unique

B) diversifiable

C) asset-specific

D) market

E) unsystematic

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected rate of return on Delaware Shores stock is based on three possible states of the economy.These states are boom, normal, and recession which have probabilities of occurrence of 20 percent, 75 percent, and 5 percent, respectively.Which one of the following statements is correct concerning the variance of the returns on this stock?

A) The variance must decrease if the probability of occurrence for a boom increases.

B) The variance will remain constant as long as the sum of the economic probabilities is 100 percent.

C) The variance can be positive, zero, or negative, depending on the expected rate of return assigned to each economic state.

D) The variance must be positive provided that each state of the economy produces a different expected rate of return.

E) The variance is independent of the economic probabilities of occurrence.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is true?

A) The expected rate of return on any portfolio must be positive.

B) The arithmetic average of the betas for each security held in a portfolio must equal 1.0.

C) The beta of any portfolio must be 1.0.

D) The weights of the securities held in any portfolio must equal 1.0.

E) The standard deviation of any portfolio must equal 1.0.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

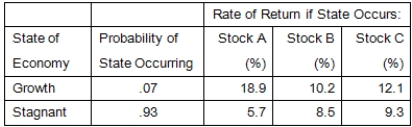

Given the following information, what is the standard deviation of the returns on a portfolio that is invested 40 percent in Stock A, 35 percent in Stock B, and the remainder in Stock C?

A) 1.68 percent

B) 6.72 percent

C) 3.16 percent

D) 2.43 percent

E) 16.57 percent

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The capital asset pricing model:

A) assumes the market has a beta of zero and the risk-free rate is positive.

B) rewards investors based on total risk assumed.

C) considers the relationship between the fluctuations in a security's returns versus the market's returns.

D) applies to portfolios but not to individual securities.

E) assumes the market risk premium is constant over time.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

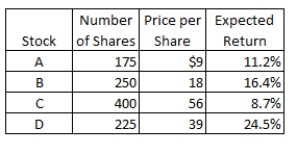

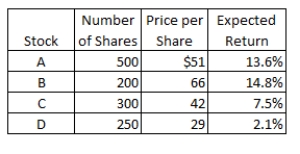

You own a portfolio consisting of the securities listed below.The expected return for each security is as shown.What is the expected return on the portfolio?

A) 13.81 percent

B) 12.91 percent

C) 13.28 percent

D) 14.14 percent

E) 13.46 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock has an expected return of 14.3 percent, the risk-free rate is 3.9 percent, and the market risk premium is 7.8 percent.What must the beta of this stock be?

A) 1.67

B) .94

C) 1.08

D) 1.21

E) 1.33

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock has a beta of 1.48 and an expected return of 17.3 percent.A risk-free asset currently earns 4.6 percent.If a portfolio of the two assets has a beta of .98, then the weight of the stock must be ___ and the risk-free weight must be___.

A) .56; .44

B) .34; .66

C) .44; .56

D) .66; .34

E) .72; .28

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume you own a portfolio of diverse securities which are each correctly priced.Given this, the reward-to-risk ratio:

A) for the portfolio must equal 1.0.

B) for the portfolio must be less than the market risk premium.

C) for each security must equal zero.

D) of each security is equal to the risk-free rate.

E) of each security must equal the slope of the security market line.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a portfolio comprised of four risky securities.Assume the economy has three economic states with varying probabilities of occurrence.Which one of the following will guarantee that the portfolio variance will equal zero?

A) The portfolio beta must be 1.0.

B) The portfolio expected rate of return must be the same for each economic state.

C) The portfolio risk premium must equal zero.

D) The portfolio expected rate of return must equal the expected market rate of return.

E) There must be equal probabilities that the state of the economy will be a boom or a bust.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of these is the best example of systematic risk?

A) Discovery of a major gas field

B) Decrease in textile imports

C) Increase in agricultural exports

D) Decrease in gross domestic product

E) Decrease in management bonuses for banking executives

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

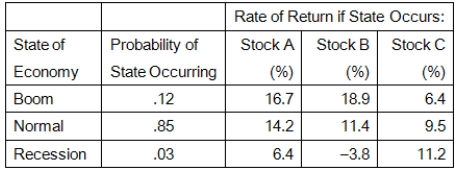

Given the following information, what is the variance of the returns on a portfolio that is invested 40 percent in both Stocks A and B, and 20 percent in Stock C?

A) .000602

B) .001490

C) .000513

D) .000205

E) .001143

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mary owns a risky stock and anticipates earning 16.5 percent on her investment in that stock.Which one of the following best describes the 16.5 percent rate?

A) Expected return

B) Real return

C) Market rate

D) Systematic return

E) Risk premium

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own a portfolio equally invested in a risk-free asset and two stocks.If one of the stocks has a beta of 1.86 and the total portfolio is equally as risky as the market, what must the beta be for the other stock in your portfolio?

A) 1.07

B) .54

C) 1.14

D) .14

E) .97

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio is comprised of 35 securities with varying betas.The lowest beta for an individual security is .74 and the highest of the security betas of 1.51.Given this information, you know that the portfolio beta:

A) must be 1.0 because of the large number of securities in the portfolio.

B) is the geometric average of the individual security betas.

C) must be less than the market beta.

D) will be between 0 and 1.0.

E) will be greater than or equal to .74 but less than or equal to 1.51.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

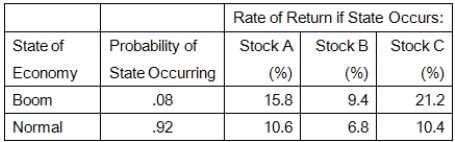

Given the following information, what is the expected return on a portfolio that is invested 35 percent in Stock A, 45 percent in Stock B, and the balance in Stock C?

A) 12.04 percent

B) 12.16 percent

C) 12.91 percent

D) 13.46 percent

E) 11.87 percent

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blue Bell stock is expected to return 8.4 percent in a boom, 8.9 percent in a normal economy, and 9.2 percent in a recession.The probabilities of a boom, normal economy, and a recession are 6 percent, 92 percent, and 2 percent, respectively.What is the standard deviation of the returns on this stock?

A) .38 percent

B) .55 percent

C) .13 percent

D) .42 percent

E) .06 percent

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the capital asset pricing model, the expected return on a security will be affected by all of the following except the:

A) market risk premium.

B) risk-free rate.

C) market rate of return.

D) security's standard deviation.

E) security's beta.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have compiled the following information on your investments.What rate of return should you expect to earn on this portfolio?

A) 11.57 percent

B) 11.13 percent

C) 11.87 percent

D) 11.30 percent

E) 11.61 percent

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected return on a security is not affected by the:

A) security's unique risks.

B) risk-free rate.

C) security's risk premium.

D) security's beta.

E) market rate of return.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 99

Related Exams