A) $6,508.54

B) -$320.81

C) $560.24

D) $1,410.10

E) $8,211.15

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kite Flite is considering making and selling custom kites in two sizes.The small kites would be priced at $12 and the large kites would be $39.The variable cost per unit is $5 and $14, respectively.Jill, the owner, feels that she can sell 1,900 of the small kites and 1,400 of the large kites each year.The fixed costs would be only $1,890 a year and the tax rate is 34 percent.What is the annual operating cash flow if the annual depreciation expense is $380?

A) $26,064.12

B) $30,759.80

C) $29,848.20

D) $28,309.40

E) $30,630.60

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scrapping Products is implementing a project that will initially increase accounts payable by $3,000, increase inventory by $1,800, and decrease accounts receivable by $1,200.All net working capital will be recouped when the project terminates.What is the cash flow related to the net working capital for the last year of the project?

A) $2,400

B) $2,100

C) -$2.400

D) -$2,100

E) $3,300

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

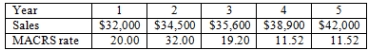

The Blue Lagoon is considering a project with a five-year life.The project requires $32,000 of fixed assets that are classified as five-year property for MACRS.Variable costs equal 67 percent of sales, fixed costs are $12,600, and the tax rate is 34 percent.What is the operating cash flow for Year 4 given the following sales estimates and MACRS depreciation allowance percentages?

A) -$1,806.67

B) $640.89

C) $1,311.16

D) $1,409.80

E) -$2,276.60

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario analysis:

A) determines the impact a $1 change in sales has on a project's internal rate of return.

B) determines which variable has the greatest impact on a project's net present value.

C) helps determine the reasonable range of expectations for a project's anticipated outcome.

D) evaluates a project's net present value while sensitivity analysis evaluates a project's internal rate of return.

E) determines the absolute worst and absolute best outcome that could ever occur.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net working capital invested in a project is generally:

A) a sunk cost.

B) an opportunity cost.

C) recouped in the first year of the project.

D) recouped at the end of the project.

E) depreciated to a zero balance over the life of the project.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jamie is analyzing the estimated net present value of a project under various conditions by revising the sales quantity, sales price, and the cost estimates.The type of analysis that Jamie is doing is best described as:

A) sensitivity analysis.

B) erosion planning.

C) scenario analysis.

D) benefit planning.

E) opportunity evaluation.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of these has the least potential to increase the net present value of a proposed investment? Assume the project has a positive net present value in at least one set of circumstances.

A) Ability to wait until the economy improves before making the investment

B) Ability to immediately shut down a project should the project become unprofitable

C) Option to increase production beyond that initially projected

D) Option to place the investment on hold until a more favorable discount rate becomes available

E) Option to discontinue a project at the end of its intended life

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario analysis is best described as the determination of the:

A) most likely outcome for a project.

B) reasonable range of project outcomes.

C) variable that has the greatest effect on a project's outcome.

D) effect that a project's initial cost has on the project's net present value.

E) change in a project's net present value given a stated change in projected sales.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An asset used in a three-year project falls in the three-year MACRS class for tax purposes.The MACRS percentage rates starting with Year 1 are: 33.33, 44.45, 14.81, and 7.41.The asset has an acquisition cost of $2.6 million and will be sold for $1.1 million at the end of the project.If the tax rate is 34 percent, what is the aftertax salvage value of the asset?

A) $742,519.10

B) $726,000.00

C) $832,056.60

D) $791,504.40

E) $887,560.15

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ignoring the option to wait:

A) may overestimate the internal rate of return on a project.

B) may underestimate the net present value of a project.

C) ignores the ability of a manager to increase output after a project has been implemented.

D) is the same as ignoring all strategic options.

E) ignores the value of discontinuing a project early.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

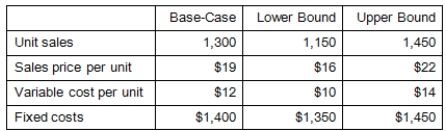

You are analyzing a project and have developed the following estimates.The depreciation is $1,020 a year and the tax rate is 35 percent.What is the worst-case operating cash flow?

A) -$110.50

B) -$64.10

C) $909.50

D) $209.00

E) $660.50

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Any changes to a firm's projected future cash flows that are caused by adding a new project are referred to as:

A) eroded cash flows.

B) deviated projections.

C) incremental cash flows.

D) directly impacted flows.

E) opportunity cash flows.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Northern Lighting purchased some three-year MACRS property three years ago.What is the current book value of this equipment if the original cost was $385,000? The MACRS allowance percentages are as follows, commencing with Year 1: 33.33, 44.45, 14.81, and 7.41 percent.

A) $0

B) $57,037.75

C) $28,528.50

D) $85,547.00

E) $96,250.00

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jim's Hardware is adding a new product to its sales lineup.Initially, the firm will stock $36,000 of the new inventory, which will be purchased on 30 days' credit from a supplier.The firm will also invest $13,000 in accounts receivable and $11,000 in equipment.What amount should be included in the initial project costs for net working capital?

A) -$49,000

B) -$47,000

C) -$3,000

D) -$13,000

E) -$24,000

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Global Water Treatment, Inc.is analyzing a proposed investment that would initially require $750,000 of new equipment.This equipment would be depreciated on a straight-line basis to a zero balance over the four-year life of the project.The estimated salvage value is $150,000.The project requires $50,000 initially for net working capital, all of which will be recouped at the end of the project.The projected operating cash flow is $ 265,000 a year.What is the internal rate of return on this project if the relevant tax rate is 21 percent?

A) 15.51 percent

B) 15.98 percent

C) 20.12 percent

D) 17.64 percent

E) 17.99 percent

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Phil's Diner, a sole proprietorship purchased some new equipment two years ago for $32,600.Today, it is selling this equipment for $22,000.What is the aftertax cash flow from this sale if the tax rate is 35 percent? The applicable MACRS allowance percentages are as follows, commencing with Year 1: 20.00, 32.00, 19.20, 11.52, 11.52, and 5.76 percent.

A) $19,776.80

B) $18,846.67

C) $24,223.20

D) $20,408.20

E) $25,153.33

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Golf Range is considering adding an additional driving range to its facility.The range would cost $229,000, would be depreciated on a straight-line basis over its seven-year life, and would have a zero salvage value.The anticipated revenue from the project is $62,500 a year with $18,400 of that amount being variable cost.The fixed cost would be $15,700.The firm believes that it will earn an additional $22,500 a year from its current operations should the driving range be added.The project will require $3,000 of net working capital, which is recoverable at the end of the project.What is the internal rate of return on this project at a tax rate of 34 percent?

A) 8.32 percent

B) 8.68 percent

C) 7.47 percent

D) 11.09 percent

E) 12.14 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cinram Machines has the following estimates for its new gear assembly project: price = $1,870 per unit; variable costs = $949 per unit; fixed costs = $1.4 million; quantity = 42,000 units.Suppose the company believes all of its estimates are accurate only to within ± 3 percent.What value should the company use for its total variable costs when performing its best-case scenario analysis?

A) $38,578,064

B) $39,822,128

C) $38,216,051

D) $41,802,137

E) $40,864,538

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your local athletic center is planning a $1.2 million expansion to its current facility.This cost will be depreciated on a straight-line basis over a 20-year period.The expanded area is expected to generate $745,000in additional annual sales.Variable costs are 39* percent of sales, the annual fixed costs are $140,000, and the tax rate is 21percent.What is the operating cash flow for the first year of this project?

A) $218,336.00

B) $201,015.00

C) $261,015.50

D) $371,615.50

E) $314,450.00

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 116

Related Exams