A) Opportunity cost

B) Sunk cost

C) Erosion

D) Replicated flows

E) Pirated flows

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Newton Industries is considering a project and has developed the following estimates: unit sales = 4,800, price per unit = $67, variable cost per unit = $42, annual fixed costs = $11,900.The depreciation is $14,700 a year and the tax rate is 34 percent.What effect would an increase of $1 in the selling price have on the operating cash flow?

A) $3,168

B) $4,823

C) $1

D) $83,448

E) $82,368

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Shoe Box is considering adding a new line of winter footwear to its product lineup.When analyzing the viability of this addition, the company should include all of the following in its analysis with the exception of:

A) any expected changes in the sales levels of current products caused by adding the new product line.

B) cost of new display counters for the additional winter footwear.

C) increased taxes from winter footwear profits.

D) the research and development costs to produce the current winter footwear samples.

E) the expected revenue from winter footwear sales.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The pro forma income statements for a proposed investment should include all of the following except:

A) fixed costs.

B) forecasted sales.

C) depreciation expense.

D) taxes.

E) changes in net working capital.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lee's currently sells 13,800 motor homes per year at $87,900 each, and 1,100 luxury motor coaches per year at $139,900 each.The company wants to introduce a low-range camper to fill out its product line; it hopes to sell 7,200 of these campers per year at $17,500 each.An independent consultant has determined that if the company introduces the new campers, it should boost the sales of its existing motor homes by 1,100 units per year, and reduce the sales of its luxury motor coaches by 610 units per year.What amount should be used as the annual sales figure when evaluating this project?

A) $128,309,000

B) $97,480,000

C) $137,351,000

D) $106,542,000

E) $128,787,000

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project will reduce costs by $62,750 but increase depreciation by $14,812.What is the operating cash flow of this project based on the tax shield approach if the tax rate is 34 percent?

A) $41,415.00

B) $31,639.08

C) $38,211.19

D) $42,006.20

E) $46,451.08

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has sales of $600,000, costs of $366,500, depreciation of $34,500, interest expense of $5,500, and a tax rate of 21 percent.What is the value of the depreciation tax shield?

A) $7,245.00

B) $7,645.00

C) $6,200.00

D) $98,800.00

E) $10,810,200.00a

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has an initial requirement of $311,700 for fixed assets and $47,600 for net working capital.The fixed assets will be depreciated to a zero book value over the four-year life of the project and will be worthless at the end of the project.All of the net working capital will be recouped after four years.The expected annual operating cash flow is $108,315.What is the project's internal rate of return if the tax rate is 34 percent?

A) 12.06 percent

B) 11.99 percent

C) 10.69 percent

D) 12.15 percent

E) 10.87 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debt-free firm has net income of $210,000, taxes of $55,822.78, and depreciation of $42,000.What is the operating cash flow?

A) $213.300

B) $248,800

C) $202.400

D) $252,000

E) $244,200

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has an initial requirement of $ 260,000 for fixed assets and $16,500 for net working capital.The fixed assets will be depreciated to a zero book value over the four-year life of the project and have an estimated salvage value of $50,000.All of the net working capital will be recouped at the end of the project.The annual operating cash flow is $82,500 and the discount rate is 12 percent.What is the project's net present value if the tax rate is 21 percent?

A) $15,684.29

B) $12,345,34

C) $9,670.33

D) -$15.432.63

E) $16,343.27

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firm A uses straight-line depreciation.Firm B uses MACRS depreciation.Both firms bought $75,000 worth of equipment last year that has a tax life of 5 years.The 5-year MACRS percentage rates, starting with Year 1, are: 20, 32, 19.2, 11.52, 11.52, and 5.76.Both firms have a marginal tax rate of 34 percent and identical operating cash flows except for the depreciation effects.Given this, you know the:

A) depreciation expense for Firm A will be greater than Firm B's expense every year.

B) equipment has a higher value on Firm B's books than on Firm A's at the end of Year 2.

C) operating cash flow of Firm A is greater than that of Firm B for Year 3.

D) market value of Firm A's equipment is greater than the market value of Firm B's at end the first year.

E) market value of Firm B's equipment is greater than the market value of Firm A's equipment at the end of Year 2.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Left Eye Promotions is a specialty retailer offering T-shirts, sweatshirts, and caps.Its most recent annual sales consisted of $27,000 of T-shirts, $21,000 of sweatshirts, and $3,500 of caps.The company is adding polo shirts to the lineup and projects that this addition will result in sales next year of $25,000 of T-shirts, $17,000 of sweatshirts, $14,000 of Polo shirts, and $3,000 of caps.What sales amount should be used when evaluating the Polo shirt project?

A) $13,300

B) $7,500

C) $6,700

D) $6,800

E) $7,900

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ed owns a store that caters primarily to men.Each of the answer options represents an item related to a planned store expansion.Each of these items should be included in the expansion analysis with the exception of the cost:

A) of the property insurance premium increase.

B) of the exterior landscaping that will be required once the expansion is complete.

C) of the additional sales person that will be required.

D) of the inventory required to fill the additional retail space.

E) of the blueprints that have been drawn of the expansion area.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has annual depreciation of $15,028, costs of $82,592, and sales of $138,765.The applicable tax rate is 34 percent.What is the operating cash flow according to the tax shield approach?

A) $21,540.09

B) $27,666.67

C) $27,157.02

D) $42,183.70

E) $39,878.84

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following will increase the operating cash flow as computed using the tax shield approach?

A) Decrease in depreciation

B) Decrease in sales

C) Increase in variable costs

D) Decrease in fixed costs

E) Increase in the tax rate

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax shield approach to computing the operating cash flow, given a tax-paying firm:

A) ignores both interest expense and taxes.

B) separates cash inflows from cash outflows.

C) considers the changes in net working capital resulting from a new project.

D) ignores all noncash expenses and their effects.

E) recognizes that depreciation creates a cash inflow.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

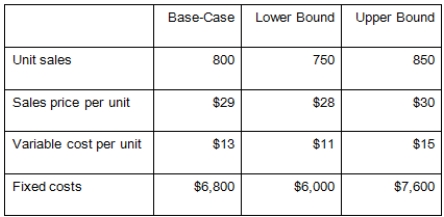

You are analyzing a project and have developed the following estimates.The depreciation is $5,800 a year and the tax rate is 35 percent.What is the best-case operating cash flow?

A) $7,473.00

B) $4,196.80

C) $5,377.50

D) $6,701.40

E) $8,627.50

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cost-cutting project will decrease costs by $37,000 a year.The annual depreciation on the project's fixed assets will be $2,750 and the tax rate is 21 percent.What is the amount of the change in the firm's operating cash flow resulting from this project?

A) $27,057.50

B) $31.980.00

C) $29,230.50

D) $26,080.00

E) $29,807.50

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider an asset that costs $311,000 and is depreciated straight-line to zero over its six-year tax life.The asset is to be used in a four-year project; at the end of the project, the asset can be sold for $58,000.If the relevant tax rate is 34 percent, what is the aftertax cash flow from the sale of this asset?

A) $73,526.67

B) $68,411.19

C) $70,103.33

D) $40,466.67

E) $42,473.33

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are analyzing a project and have developed the following estimates: unit sales = 2,150, price per unit = $84, variable cost per unit = $57, fixed costs per year = $13,900.The depreciation is $8,300 a year and the tax rate is 35 percent.What effect would an increase of $1 in the selling price have on the operating cash flow?

A) $1,397.50

B) $1,249.65

C) $1,320.65

D) $3,773.25

E) $1,430.35

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 116

Related Exams