A) $11,309.11

B) $11,628.04

C) $12,737.26

D) $14,438.78

E) $14,900.41

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a firm faces hard rationing,:

A) all positive net present value projects will be accepted.

B) each division within a firm will be allocated an amount for capital expenditures that will be less than the total value of its positive net present value projects.

C) there will be no available funds for capital expenditures.

D) the firm will fund only those projects that create value for its shareholders.

E) the firm will finance only the projects that have the highest profitability index values.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following refers to a method of increasing the rate at which an asset is depreciated?

A) Noncash expense

B) Straight-line depreciation

C) Depreciation tax shield

D) Accelerated cost recovery system

E) Market-based depreciation

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flo is considering three mutually exclusive options for the additional space she plans to add to her specialty women's store.The cost of the expansion will be $148,000.She can use this additional space to add children's clothing, an exclusive gifts department, or a home décor section.She estimates the present value of the cash inflows from these projects are $121,000 for children's clothing, $178,000 for exclusive gifts, and $145,000 for decorator items.Which option(s) , if any, should she accept?

A) None of these options

B) Children's clothing only

C) Exclusive gifts only

D) Exclusive gifts and decorator items only

E) All three options

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Boyertown Industrial Tools is considering a three-year project to improve its production efficiency.Buying a new machine press for $578,000 is estimated to result in $184,000 in annual pretax cost savings.The press falls in the MACRS five-year class, which has percentage rates starting with Year 1, of 20, 32, 19.20,11.52, 11.52, and 5.76.The salvage value at the end of the project of $162,000.The press also requires an initial investment in spare parts inventory of $19,000, along with an additional $1,500 in inventory for each succeeding year of the project.The inventory will all be recovered when the project ends.If the tax rate is 35 percent and the discount rate is 12 percent, should the company buy and install the machine press? Why or why not?

A) Yes; the NPV is $51,613.33

B) Yes; the NPV is $45,602.57

C) No; the NPV is -$22,311.09

D) No; the NPV is -$52,918.78

E) Yes; the NPV is $64,728.29

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sensitivity analysis:

A) looks at the most reasonably optimistic and pessimistic results for a project.

B) helps identify the variable within a project that presents the greatest forecasting risk.

C) is used for projects that cannot be analyzed by scenario analysis because the cash flows are unconventional.

D) is generally conducted prior to scenario analysis just to determine if the range of potential outcomes is acceptable.

E) illustrates how an increase in operating cash flow caused by changing both the revenue and the costs simultaneously will change the net present value for a project.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lake City Plastics currently produces plastic plates and silverware.The company is considering expanding its product offerings to include plastic serving trays.All of the following are relevant costs to this project with the exception of:

A) the cost of additional utilities required to operate the serving tray production operation.

B) any change in the expected sales of plates and silverware gained from offering trays also.

C) a percentage of the current operating overhead.

D) the additional plastic raw materials that would be required.

E) the cost to acquire the forms needed to mold the trays.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are analyzing a project and have developed the following estimates: unit sales = 2,600, price per unit = $109, variable cost per unit = $67, fixed costs per year = $38,000.The depreciation is $12,000 a year and the tax rate is 34 percent.What effect would the sale of one more unit have on the operating cash flow?

A) $24.18

B) $16.66

C) $13.10

D) $27.72

E) $15.70

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

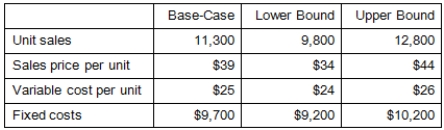

You are analyzing a project and have developed the following estimates.The depreciation is $47,900 a year and the tax rate is 35 percent.What is the worst-case operating cash flow?

A) -$2,545

B) $11,145

C) $88,855

D) $27,556

E) $61,095

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following create cash inflows from net working capital?

A) Decrease in accounts payable and increase in accounts receivable

B) Decrease in both accounts receivable and accounts payable

C) Increase in accounts payable and decrease in inventory

D) Increase in both accounts receivable and inventory

E) Increase in inventory and decrease in cash

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Burke's Corner currently sells blue jeans and T-shirts.Management is considering adding fleece tops to its inventory.The tops would sell for $49 each with expected sales of 3,200 tops annually.By adding the fleece tops, management feels the company will sell an additional 150 pairs of jeans at $79 a pair and 220 fewer T-shirts at $18 each.The variable cost per unit is $36 on the jeans, $7 on the T-shirts, and $21 on the fleece tops.The project's depreciation expense is $23,000 a year and the fixed costs are $21,000 annually.The tax rate is 34 percent.What is the project's operating cash flow?

A) $47,935.80

B) $52,201.20

C) $55,755.80

D) $43,209.90

E) $38,419.70

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kyle Electric has three positive net present value opportunities.Unfortunately, the firm has not been able to find financing for any of these projects.Which one of the following terms best fits the situation facing the firm?

A) Sensitivity analysis

B) Capital rationing

C) Soft rationing

D) Contingency planning

E) Sunk cost

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shannon's Irish Cookware is implementing a project that will initially increase accounts payable by $5,000, increase inventory by $3,200, and decrease accounts receivable by $1,800.All net working capital will be recouped when the project terminates.What is the cash flow related to the net working capital for the last year of the project?

A) $500,00

B) $600

C) -$3,600

D) $2,500

E) $5,600

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An all-equity firm has net income of $78,500, depreciation of $6,250, and taxes of $20,867.What is the firm's operating cash flow?

A) $50,965

B) $72,250

C) $46,250

D) $84,750

E) $78,500

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

British Metals is reviewing its current accounts to determine how a proposed project might affect the account balances.The firm estimates the project will initially require $81,000 in additional current assets and $57,000 in additional current liabilities.The firm also estimates the project will require an additional $8,000 a year in current assets in each of the first three of the four years of the project.How much net working capital will the firm recoup at the end of the project assuming that all net working capital can be recaptured?

A) $105,000

B) $24,000

C) $48,000

D) $68,000

E) $81,000

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thrill Rides is considering adding a new roller coaster to its amusement park.The addition is expected to increase its overall ticket sales.In particular, the company expects to sell more tickets for its current roller coaster and experience extremely high demand for its new coaster.Sales for its boat ride are expected to decline but food and beverage sales are expected to increase significantly.All of the following are side effects associated with the new roller coaster with the exception of the:

A) increased food sales.

B) additional sales for the existing coaster.

C) increased food costs.

D) reduced sales for the boat ride.

E) ticket sales for the new coaster.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a three-year project with the following information: initial fixed asset investment = $347,600; straight-line depreciation to zero over the three-year life; zero salvage value; price per unit = $49.99; variable costs per unit = $30.82; fixed costs per year = $187,000; quantity sold per year = 65,500 units; tax rate = 35 percent.How sensitive is OCF to an increase of one unit in the quantity sold?

A) $12.46

B) $11.67

C) $8.67

D) $9.08

E) $13.40

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A five-year project is expected to generate annual revenues of $159,000, variable costs of $72,500, and fixed costs of $15,000.The annual depreciation is $19,500 and the tax rate is 21 percent.What is the annual operating cash flow?

A) $71,500

B) $117,855

C) $72.430

D) $41,080

E) $60,580

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dismal Outlook is unable to obtain financing for any new projects under any circumstances.This company is faced with:

A) contingency planning.

B) soft rationing.

C) hard rationing.

D) real options.

E) sunk costs.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shay Hand Outfitters has a proposed project that will generate sales of 3,100 units annually at a selling price of $37.00 each.The fixed costs are $25,000 and the variable costs per unit are $11.95.The project requires $72,000 of fixed assets that will be depreciated on a straight-line basis to a zero book value over the four-year life of the project.The salvage value of the fixed assets is $9,700 and the tax rate is 21 percent.What is the operating cash flow for Year 4?

A) $ 45,377.45

B) $ 27,377.45

C) $ 41,597.45

D) $ 52,655.00

E) $ 22,564.00

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 116

Related Exams