A) opportunity costs involved with a project.

B) sunk costs related to a project.

C) economic effects on a project's profitability.

D) managerial options implicit in a project.

E) optional capital requirements of a project.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your local athletic center is planning a $500,000 expansion to its current facility.This cost will be depreciated on a straight-line basis over a 20-year period.The expanded area is expected to generate $175,000 in additional annual sales.Variable costs are 32 percent of sales, the annual fixed costs are $40,000, and the tax rate is 21 percent.What is the operating cash flow for the first year of this project?

A) $62,410.00

B) $99,260.00

C) $67.660.00

D) $42,660.00

E) $31,450.00

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The operating cash flows of a project:

A) are unaffected by the depreciation method selected.

B) are equal to the project's total projected net income.

C) decrease when net working capital increases.

D) include any aftertax salvage values.

E) include erosion effects.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project requires $428,000 of equipment that is classified as seven-year property.What is the depreciation expense in Year 3 given the following MACRS depreciation allowances, starting with Year 1: 14.29, 24.49, 17.49, 12.49, 8.93, 8.92, 8.93, and 4.46 percent?

A) $89,038.42

B) $48,447.30

C) $56,038.15

D) $74,857.20

E) $104,817.20

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Northern Companies has three separate divisions.Each year, the company determines the amount it can afford to spend in total for capital expenditures and then allocates one-third of that amount to each division.This allocation process is called:

A) soft rationing.

B) hard rationing.

C) opportunity cost allocation.

D) divisional separation.

E) strategic planning.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Tattle Teller has a printing press sitting idly in its back room.The press has no market value to another printer because the machine utilizes old technology.The firm could get $480 for the press as scrap metal.The press is six years old and originally cost $174,000.The current book value is $3,570.The president of the firm is considering a new project and feels he can use this press for that project.What value, if any, should be assigned to the press as an initial cost of the new project?

A) $0

B) $480

C) $3,570

D) $3,090

E) $4,050

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A new project is expected to generate an operating cash flow of $75,560 and will initially free up $12,250 in net working capital.Purchases of fixed assets costing $75,000 will be required to start up the project.What is the total cash flow for this project at Time zero?

A) -$64,410

B) - $62,750

C) -$75,000

D) -87,250

E) $62,250

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

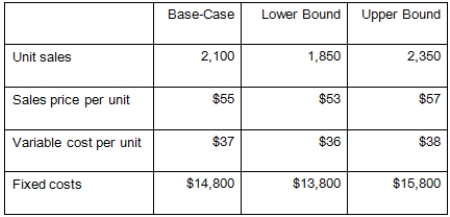

You are analyzing a project and have developed the following estimates.The depreciation is $13,600 a year and the tax rate is 34 percent.What is the base-case operating cash flow?

A) $8,770

B) $6,204

C) $11,433

D) $19,804

E) $20,410

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is a correct value to use if you are conducting a best-case scenario analysis?

A) Sales price that is most likely to occur

B) Lowest expected level of sales quantity

C) Lowest expected salvage value

D) Highest expected need for net working capital

E) Lowest expected value for fixed costs

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following refers to the option to expand into related businesses in the future?

A) Strategic option

B) Contingency option

C) Soft rationing

D) Hard rationing

E) Capital rationing option

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

CrossTown Builders is considering remodeling an old building it currently owns.The building was purchased ten years ago for $1.2 million.Over the past ten years, the firm rented out the building and used the rent to pay off the mortgage.The building is now owned free and clear and has a current market value of $1.9 million.The company is considering remodeling the building into industrial-type apartments at an estimated cost of $1.6 million.The estimated present value of the future income from these apartments is $4.1 million.Which one of the following defines the opportunity cost of the remodeling project?

A) Present value of the future income

B) Cost of the remodeling

C) Current market value of the building

D) Initial cost of the building plus the remodeling costs

E) Current market value of the building plus the remodeling costs

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ability to delay an investment:

A) is commonly referred to as the best-case scenario.

B) is valuable provided there are conditions under which the investment will have a positive net present value.

C) ensures that the investment will have an expected net present value that is positive.

D) offsets the need to conduct sensitivity analysis.

E) is referred to as the option to abandon.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has an annual operating cash flow of $52,620.Initially, this four-year project required $5,160 in net working capital, which is recoverable when the project ends.The firm also spent $39,700 on equipment to start the project.This equipment will have a book value of $17,014 at the end of Year 4.What is the cash flow for Year 4 of the project if the equipment can be sold for $15,900 and the tax rate is 35 percent?

A) $63,749.90

B) $73,680.00

C) $74,069.90

D) $73,862.00

E) $73,290.10

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

JL & Co.is contemplating the purchase of a new $428,000 computer-based order entry system.The system will be depreciated straight-line to zero over the project's six-year life.The pretax resale value is $215,000.The system will save $148,000 before taxes per year in order processing costs and will reduce working capital by $46,000 at the beginning of the project.Working capital will revert back to normal at the end of the project.If the tax rate is 34 percent, what is the IRR for this project?

A) 15.51 percent

B) 22.79 percent

C) 25.32 percent

D) 31.08 percent

E) 14.20 percent

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bruce Moneybags owns several restaurants and hotels near a local interstate.One restaurant, Beef and More, originally cost $1.8 million, is currently fully paid for, but needs modernized.Bruce is trying to decide whether to accept an offer and sell Beef and More, as is, for the offer price of $1.1 million or renovate the restaurant himself.The projected renovation cost is $1.3 million.The restaurant would need to be shut down completely during the renovation which would cause an aftertax net loss of $90,000 in today's dollars.The estimated present value of the cash inflows from the renovated restaurant is $3.2 million.When analyzing the renovation project, what cost, if any, should be included for the current restaurant?

A) $0

B) $1.1 million

C) $1.1 million + $90,000

D) $1.8 million + 1.3 million + 90,000

E) $3.2 million -($1.8 million + 1.3 million + 90,000)

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sandy Bottom, Inc., purchased some seven-year MACRS welding equipment six years ago at a cost of $60,000.Today, the company is selling this equipment for $10,000.The tax rate is 21 percent.What is the aftertax cash flow from this sale? The MACRS allowance percentages are as follows, commencing with Year 1: 14.29, 24.49, 17.49, 12.49, 8.93, 8.92, 8.93, and 4.46 percent.

A) $6,212.86

B) $8.461.96

C) $9,587.14

D) $10,711.06

E) $11,824.41

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are analyzing a project and have developed the following estimates.The depreciation is $17,340 a year and the tax rate is 34 percent.What is the best-case operating cash flow?

A) $190,035.60

B) $172,695.60

C) $167,904.00

D) $173,799.60

E) $166,240.00

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Logan Hunting has a proposed project that will generate sales of 2,200 units annually at a selling price of $29.95 each.The fixed costs are $15,000 and the variable costs per unit are $6.95.The project requires $42,000 of fixed assets that will be depreciated on a straight-line basis to a zero book value over the four-year life of the project.The salvage value of the fixed assets is $5,500 and the tax rate is 21 percent.What is the operating cash flow for Year 4?

A) $ 30,329

B) $ 19,829

C) $ 21,124

D) $ 42,179

E) $ 22,564

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following terms refers to the best option that was foregone when a particular investment is selected?

A) Side effect

B) Erosion

C) Sunk cost

D) Opportunity cost

E) Marginal cost

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cost-cutting project will decrease costs by $52,000 a year.The annual depreciation on the project's fixed assets will be $5,000 and the tax rate is 21 percent.What is the amount of the change in the firm's operating cash flow resulting from this project?

A) $37,130

B) $52,000

C) $41,080

D) $46,080

E) $42,130

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 116

Related Exams