A) never pay back.

B) have a negative net present value.

C) have a negative internal rate of return.

D) produce more cash inflows than outflows in today's dollars.

E) have an internal rate of return that equals the required return.

G) None of the above

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

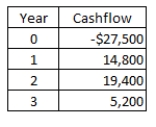

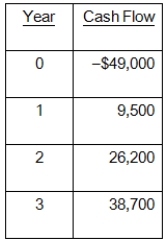

What is the net present value of a project with the following cash flows if the discount rate is 12 percent?

A) $ 4,881.10

B) $11,900.00

C) $ 4,358.13

D) $11,035.24

E) $ 8,129.06

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

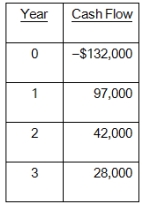

Soft and Cuddly is considering a new toy that will produce the following cash flows.Should the company produce this toy based on IRR if the firm requires a rate of return of 17.5 percent?

A) Yes, because the project's rate of return is 16.45 percent

B) Yes, because the project's rate of return is 11.47 percent

C) No, because the project's rate of return is 16.45 percent

D) No, because the project's rate of return is 11.47 percent

E) No, because the internal rate of return is zero percent

G) A) and E)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Joe and Rich are both considering investing in a project that costs $25,500 and is expected to produce cash inflows of $15,800 in Year 1 and $15,300 in Year 2.Joe has a required return of 8.5 percent but Rich demands a return of 12.5 percent.Who, if either, should accept this project?

A) Joe, but not Rich

B) Rich, but not Joe

C) Neither Joe nor Rich

D) Both Joe and Rich

E) Joe, and possibly Rich, who will be neutral on this decision as his net present value will equal zero

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The possibility that more than one discount rate can cause the net present value of an investment to equal zero is referred to as:

A) duplication.

B) the net present value profile.

C) multiple rates of return.

D) the AAR problem.

E) the dual dilemma.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the IRR of the following set of cash flows?

A) 12.93 percent

B) 14.90 percent

C) 23.86 percent

D) 16.33 percent

E) 17.78 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following methods of analysis ignores cash flows?

A) Profitability index

B) Payback

C) Average accounting return

D) Modified internal rate of return

E) Internal rate of return

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following methods of analysis has the greatest bias toward short-term projects?

A) Net present value

B) Internal rate of return

C) Average accounting return

D) Profitability index

E) Payback

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You were recently hired by a firm as a project analyst.The owner of the firm is unfamiliar with financial analysis and wants to know only what the expected dollar return is per dollar spent on a given project.Which financial method of analysis will provide the information that the owner requests?

A) Internal rate of return

B) Modified internal rate of return

C) Net present value

D) Profitability index

E) Payback

G) A) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Chasteen, Inc., is considering an investment with an initial cost of $145,000 that would be depreciated straight-line to a zero book value over the life of the project.The cash inflows generated by the project are estimated at $76,000 for the first two years and $30,000 for the following two years.What is the internal rate of return?

A) 21.44 percent

B) 21.29 percent

C) 17.43 percent

D) 17.55 percent

E) 20.11 percent

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Murphy's Authentic is considering a project with an initial cost of $124,000.The project will not produce any cash flows for the first three years.Starting in Year 4, the project will produce cash inflows of $85,000 a year for three years.This project is risky, so the firm has assigned it a discount rate of 15 percent.What is the project's net present value?

A) $105,222

B) $3,136.43

C) -$3,140.95

D) $131,000

E) $3,606.89

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Both Projects A and B are acceptable as independent projects.However, the selection of either one of these projects eliminates the option of selecting the other project.Which one of the following terms best describes the relationship between Project A and Project B?

A) Mutually exclusive

B) Conventional

C) Multiple choice

D) Dual return

E) Crosswise

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the most recent survey information presented in your textbook, CFOs tend to use which two methods of investment analysis the most frequently?

A) Payback and net present value

B) Payback and internal rate of return

C) Internal rate of return and net present value

D) Net present value and profitability index

E) Profitability index and internal rate of return

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

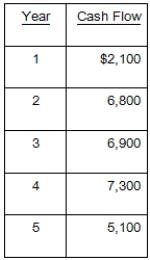

What is the payback period for a $16,700 investment with the following cash flows?

A) 3.12 years

B) 3.89 years

C) 2.12 years

D) 3.44 years

E) 3.67 years

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

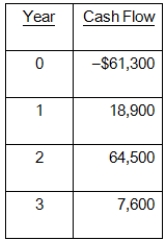

The Flour Baker is considering a project with the following cash flows.Should this project be accepted based on its internal rate of return if the required return is 18 percent?

A) Yes; because the project's rate of return is 7.78 percent

B) Yes; because the project's rate of return is 16.08 percent

C) Yes; because the project's rate of return is 19.47 percent

D) No; because the project's rate of return is 19.47 percent

E) No; because the project's rate of return is 16.08 percent

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is the primary advantage of payback analysis?

A) Incorporation of the time value of money concept

B) Ease of use

C) Research and development bias

D) Arbitrary cutoff point

E) Long-term bias

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

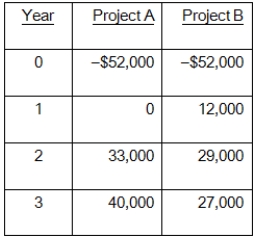

You are considering the following two mutually exclusive projects.What is the crossover point?

A) 20.76 percent

B) 23.72 percent

C) 25.89 percent

D) 18.79 percent

E) 22.08 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Steel Factory is considering a project that will produce annual cash flows of $43,800, $40,200, $46,200, and $41,800 over the next four years, respectively.What is the internal rate of return if the initial cost of the project is $127,900?

A) 13.00 percent

B) 10.19 percent

C) 11.28 percent

D) 12.24 percent

E) 12.83 percent

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

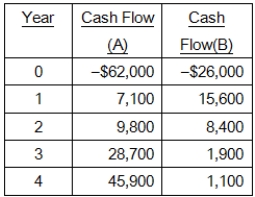

Baker's Supply imposes a payback cutoff of 3.5 years for its international investment projects.If the company has the following two projects available, which project(s) , if either, should it accept?

A) Reject both Projects A and B

B) Accept Project A but not Project B

C) Accept Project B but not Project A

D) Both Project A and B are acceptable but you can select only one project

E) Accept both Projects A and B

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net present value:

A) decreases as the required rate of return increases.

B) is equal to the initial investment when the internal rate of return is equal to the required return.

C) method of analysis cannot be applied to mutually exclusive projects.

D) ignores cash flows that are distant in the future.

E) is unaffected by the timing of an investment's cash flows.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 116

Related Exams