A) 4.03 years

B) 4.95 years

C) 5.48 years

D) 5.62 years

E) The project never pays back.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You're trying to determine whether or not to expand your business by building a new manufacturing plant.The plant has an installation cost of $29 million, which will be depreciated straight-line to zero over its three-year life.If the plant has projected net income of $1,848,000, $2,080,000, and $2,720,000 over these three years, what is the project's average accounting return (AAR) ?

A) 14.69 percent

B) 14.14 percent

C) 15.03 percent

D) 15.28 percent

E) 14.21 percent

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Trident Office is considering remodeling the office building it leases to Robert Roberts, CPA.The remodeling costs are estimated at $ $225,000.If the building is remodeled, Robert Roberts, CPA has agreed to pay an additional $75,000 per year in rent for the next five years.The discount rate is 10 percent.What is the benefit of the remodeling project to Professional Properties?

A) $59,309.01

B) -$69,158.56

C) $69,158.56

D) $68,399.15

E) -61,417.03

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which one of the following situations would the payback method be the preferred method of analysis?

A) A long-term capital-intensive project

B) Two mutually exclusive projects

C) A proposed expansion of a firm's current operations

D) Different-sized projects

E) Investment funds available only for a limited period of time

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

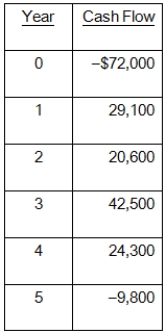

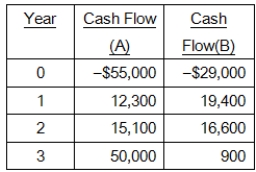

Miller and Sons is evaluating a project with the following cash flows:  The company uses a 10 percent interest rate on all of its projects.What is the MIRR of the project using the reinvestment approach? The discounting approach? The combination approach?

The company uses a 10 percent interest rate on all of its projects.What is the MIRR of the project using the reinvestment approach? The discounting approach? The combination approach?

A) 18.54 percent; 17.29 percent; 14.61 percent

B) 13.96 percent; 14.38 percent; 14.61 percent

C) 18.54 percent; 17.29 percent; 13.67 percent

D) 13.96 percent; 17.85 percent; 13.67 percent

E) 18.54 percent; 18.23 percent; 18.61 percent

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following indicates that an independent project is definitely acceptable?

A) Profitability index greater than 1.0

B) Negative net present value

C) Modified internal rate return that is lower than the requirement

D) Zero internal rate of return

E) Positive average accounting return

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are using a net present value profile to compare Projects A and B, which are mutually exclusive.Which one of the following statements correctly applies to the crossover point between these two?

A) The internal rate of return for Project A equals that of Project B, but generally does not equal zero.

B) The internal rate of return of each project is equal to zero.

C) The net present value of each project is equal to zero.

D) The net present value of Project A equals that of Project B, but generally does not equal zero.

E) The net present value of each project is equal to the respective project's initial cost.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Miller Brothers is considering a project that will produce cash inflows of $32,500, $38,470, $40,805, and $41,268 a year for the next four years, respectively.What is the internal rate of return if the initial cost of the project is $184,600?

A) 7.39 percent

B) 6.86 percent

C) 6.47 percent

D) 7.62 percent

E) 6.24 percent

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is an indicator that an investment is acceptable? Assume cash flows are conventional.

A) Modified internal rate of return that is equal to zero

B) Profitability index of zero

C) Internal rate of return that exceeds the required return

D) Payback period that exceeds the required period

E) Negative average accounting return

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

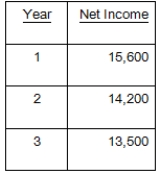

You are considering an equipment purchase costing $167,000.This equipment will be depreciated straight-line to zero over its three-year life.What is the average accounting return if this equipment produces the following net income?

A) 18.29 percent

B) 18.38 percent

C) 15.67 percent

D) 17.29 percent

E) 16.67 percent

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

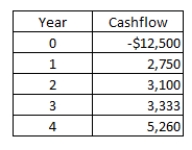

A project has the following cash flows.What is the internal rate of return?

A) 5.43 percent

B) 5.50 percent

C) 5.92 percent

D) 5.57 percent

E) 5.53 percent

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Black Horse is currently considering a project that will produce cash inflows of $11,000 a year for three years followed by $6,500 in Year 4.The cost of the project is $38,000.What is the profitability index if the discount rate is 9 percent?

A) .85

B) .93

C) 1.04

D) 1.09

E) 1.12

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A proposed project requires an initial cash outlay of $75,000 for equipment and an additional cash outlay of $25,000 in Year 1 to cover operating costs.During Years 2 through 4, the project will generate cash inflows of $50,000 a year.What is the net present value of this project at a discount rate of 12.2 percent?

A) $9,385.06

B) $9,432.42

C) $8,851.67

D) $7,441.33

E) $ $53,948.34

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

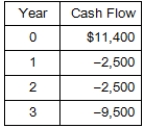

What is the net present value of the following cash flows if the relevant discount rate is 5.75 percent?

A) -$1,482.15

B) -$1,232.68

C) $507.19

D) $1,211.40

E) $1,402.02

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

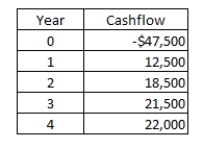

Jefferson International is trying to choose between the following two mutually exclusive design projects:  The required return is 13 percent.If the company applies the profitability index (PI) decision rule, which project should the firm accept? If the company applies the NPV decision rule, which project should it take? Given your first two answers, which project should the firm actually accept?

The required return is 13 percent.If the company applies the profitability index (PI) decision rule, which project should the firm accept? If the company applies the NPV decision rule, which project should it take? Given your first two answers, which project should the firm actually accept?

A) Project A; Project B; Project A

B) Project A; Project B; Project B

C) Project B; Project A; Project A

D) Project B; Project A; Project B

E) Project B; Project B, Project B

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generally speaking, payback is best used to evaluate which type of projects?

A) Low-cost, short-term

B) High-cost, short-term

C) Low-cost, long-term

D) High-cost, long-term

E) Any size of long-term project

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the net present value of the following set of cash flows at a discount rate of 6 percent? At 12 percent?

A) $17,586; $10,332.46

B) $16,235.26; $7,693.47

C) -$1,190.80; -$6,287.92

D) $15,316.29; $6,869.17

E) $17,220.90; $8,673.98

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Charles Henri is considering investing $37,800 in a project that is expected to provide him with cash inflows of $11,600 at the end of each of the first two years and $20,000 at the end of the third year.What is the project's NPV at a discount rate of 0 percent? At 5 percent? At 10 percent?

A) $0; $1,045.91; -$2,641.47

B) $4,468.39; $38.29; -$2,784.08

C) $5,400; $1,045.91; -$2,641.47

D) $5,400; $417.92; -$3,406.10

E) $4,468.39; $38.29; -$2,641.47

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mary has just been asked to analyze an investment to determine if it is acceptable.Unfortunately, she is not being given sufficient time to analyze the project using various methods.She must select one method of analysis and provide an answer based solely on that method.Which method do you suggest she use in this situation?

A) Internal rate of return

B) Payback

C) Average accounting rate of return

D) Net present value

E) Profitability index

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is most closely related to the net present value profile?

A) Internal rate of return

B) Average accounting return

C) Profitability index

D) Payback

E) Discounted payback

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 116

Related Exams