A) $ 7,126.22

B) $ 8,297.15

C) $ 20,700.00

D) -$ 7,126.22

E) -$ 6,456.23

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

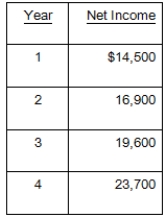

An investment has an initial cost of $300,000 and a life of four years.This investment will be depreciated by $60,000 a year and will generate the net income shown below.Should this project be accepted based on the average accounting rate of return (AAR) if the required rate is 9.5 percent? Why or why not?

A) Yes, because the AAR less than 9.5 percent

B) Yes, because the AAR is 9.5 percent

C) Yes, because the AAR is greater than 9.5 percent

D) No, because the AAR is 9.5 percent

E) No, because the AAR is greater than 9.5 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

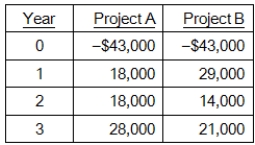

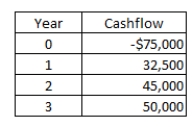

You are considering the following two mutually exclusive projects.The crossover point is _____ and Project _____ should be accepted if the discount rate is 14 percent.

A) 13.28 percent; B

B) 13.28 percent; A

C) 0 percent; B

D) 15.96 percent; A

E) 15.96 percent; B

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investment has an initial cost of $2.7 million and net income of $189,400, $178,600, and $172,500 for Years 1 to 3.This investment will be depreciated by $900,000 a year over the three-year life of the project.Should this project be accepted based on the average accounting rate of return if the required rate is 12.5 percent? Why or why not?

A) Yes, because the AAR is 12.5 percent

B) Yes, because the AAR is less than 12.5 percent

C) Yes, because the AAR is greater than 12.5 percent

D) No, because the AAR is greater than 12.5 percent

E) No, because the AAR is less than 12.5 percent

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

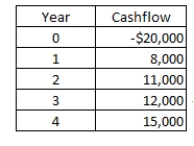

A project has the following cash flows.What is the payback period?

A) 2.50 years

B) 2.24 years

C) 2.25 years

D) 2.08 years

E) 2.95 years

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Golden Goose is considering a project with an initial cost of $46,700.The project will produce cash inflows of $10,000 a year for the first two years and $12,000 a year for the following three years.What is the payback period?

A) 2.87 years

B) 3.23 years

C) 3.41 years

D) 3.79 years

E) 4.23 years

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

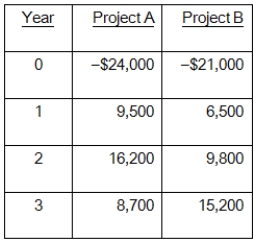

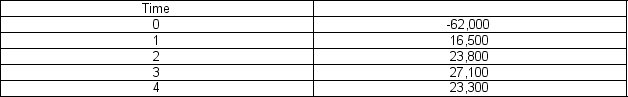

You are considering the following two mutually exclusive projects.The required return on each project is 14 percent.Which project should you accept and what is the best reason for that decision?

A) Project A; because it pays back faster

B) Project A; because it has the higher profitability index

C) Project B; because it has the higher profitability index

D) Project B; because it has the higher net present value

E) Project A; because it has the higher net present value

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an investment is producing a return that is equal to the required return, the investment's net present value will be:

A) positive.

B) greater than the project's initial investment.

C) zero.

D) equal to the project's net profit.

E) less than, or equal to, zero.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following will occur when the internal rate of return equals the required return?

A) The average accounting return will equal 1.0.

B) The profitability index will equal 1.0.

C) The profitability index will equal 0.

D) The net present value will equal the initial cash outflow.

E) The profitability index will equal the average accounting return.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A proposed project requires an initial cash outlay of $25,000 for equipment and an additional cash outlay of $8,000 in Year 1 to cover operating costs.During Years 2 through 4, the project will generate cash inflows of $16,000 a year.What is the net present value of this project at a discount rate of 9 percent?

A) $4.817.17

B) $4,864.53

C) $4,238.78

D) $2,873.44

E) $3,948.34

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following analytical methods is based on net income?

A) Profitability index

B) Internal rate of return

C) Average accounting return

D) Modified internal rate of return

E) Payback

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following methods of analysis ignores the time value of money?

A) Net present value

B) Internal rate of return

C) Discounted cash flow analysis

D) Payback

E) Profitability index

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diamond Enterprises is considering a project that will produce cash inflows of $41,650 a year for three years followed by $49,000 in Year 4.What is the internal rate of return if the initial cost of the project is $219,000?

A) 9.43 percent

B) 8.29 percent

C) 7.81 percent

D) 8.42 percent

E) 7.55 percent

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the payback period for a project with the following cash flows?

A) 2.56 years

B) 2.89 years

C) 3.08 years

D) 3.24 years

E) Never

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following methods of analysis is most similar to computing the return on assets (ROA) ?

A) Internal rate of return

B) Profitability index

C) Average accounting return

D) Net present value

E) Payback

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

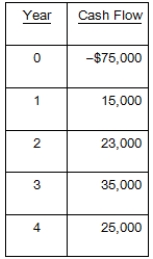

What is the net present value of a project with the following cash flows if the discount rate is 13 percent?

A) -$ 17,126.22

B) $ 23,655.17

C) $ 20,933.78

D) $ 17,126.22

E) -$16,456.23

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are making an investment of $110,000 and require a rate of return of14.6 percent.You expect to receive $48,000 in the first year, $52,500 in the second year, and $55,000 in the third year.There will be a cash outflow of $900 in the fourth year to close out the investment.What is the net present value of this investment?

A) $7,881.55

B) $4,305.56

C) $1,879.63

D) $633.33

E) $8,534.25

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net present value profile illustrates how the net present value of an investment is affected by which one of the following?

A) Project's initial cost

B) Discount rate

C) Timing of the project's cash inflows

D) Inflation rate

E) Real rate of return

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Empire Industries is considering adding a new product to its lineup.This product is expected to generate sales for four years after which time the product will be discontinued.What is the project's net present value at a required rate of return of 14.8 percent?

A) $1,505.52

B) $1,067.24

C) $1,758.71

D) $1,519.58

E) $902.71

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Services United is considering a new project that requires an initial cash investment of $26,000.The project will generate cash inflows of $2,500, $11,700, $13,500, and $10,000 over each of the next four years, respectively.How long will it take to recover the initial investment?

A) 2.74 years

B) 2.87 years

C) 2.99 years

D) 3.27 years

E) 3.68 years

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 116

Related Exams