A) 2.782 years; 3.25 years; $ 7.090.12; $12,011.48; accept both Projects

B) 3.92 years; 3.79 years; -$6,197.89; $14,693.39; accept Project B only

C) 3.60 years; 3.95 years; -$6,197.89; -$14,693.39; reject both projects

D) 3.96 years; 3.42 years; $17,780.85; -$1,211.48; accept Project A only

E) 4.06 years; 3.79 years; $211.60; -$7,945.93; accept Project A only

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The reinvestment approach to the modified internal rate of return:

A) individually discounts each separate cash flow back to the present.

B) reinvests all the cash flows, including the initial cash flow, to the end of the project.

C) discounts all negative cash flows to the present and compounds all positive cash flows to the end of the project.

D) discounts all negative cash flows back to the present and combines them with the initial cost.

E) compounds all of the cash flows, except for the initial cash flow, to the end of the project.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

John is considering a project with cash inflows of $1,750, $1,850, $2,000, and $2,550 over the next four years, respectively.The relevant discount rate is 14 percent.What is the net present value of this project if it the start-up cost is $5,000?

A) $818.35

B) $947.56

C) -$600.00

D) $693.61

E) $379.75

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) The net present value is a measure of profits expressed in today's dollars.

B) The net present value is positive when the required return exceeds the internal rate of return.

C) If the initial cost of a project is increased, the net present value of that project will also increase.

D) If the internal rate of return equals the required return, the net present value will equal zero.

E) Net present value is equal to an investment's cash inflows discounted to today's dollars.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

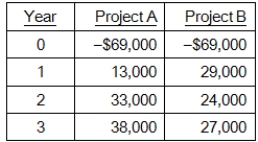

You are considering the following two mutually exclusive projects.The crossover point is _____ percent and Project _____ should be accepted at a discount rate of 9 percent.

A) 15.68 percent; B

B) 11.38 percent; A

C) 11.38 percent; B

D) 15.68 percent; A

E) 14.02 percent; B

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following indicators offers the best assurance that a project will produce value for its owners?

A) PI equal to zero

B) Negative rate of return

C) Positive AAR

D) Positive IRR

E) Positive NPV

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The internal rate of return is the:

A) discount rate that causes a project's aftertax income to equal zero.

B) discount rate that results in a zero net present value for the project.

C) discount rate that results in a net present value equal to the project's initial cost.

D) rate of return required by the project's investors.

E) project's current market rate of return.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Performance Needlework needs to purchase a new machine costing $1.25 million.Management is estimating the machine will generate cash inflows of $175,000 the first year and $ 500,000 for the following three years.If management requires a minimum 10 percent rate of return, should the firm purchase this particular machine based on its IRR? Why or why not?

A) Yes, because the IRR is 10.75 percent

B) Yes, because the IRR is 11.28 percent

C) No, because the IRR is 10.75 percent

D) No, because the IRR is 11.28 percent

E) The answer cannot be determined as there are multiple IRRs

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average net income of a project divided by the project's average book value is referred to as the project's:

A) required return.

B) market rate of return.

C) internal rate of return.

D) average accounting return.

E) discounted rate of return.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

China Importers would like to spend $215,000 to expand its warehouse.However, the company has a loan outstanding that must be repaid in 2.5 years and thus will need the $215,000 at that time.The warehouse expansion project is expected to increase the cash inflows by $60,000 in the first year, $140,000 in the second year, and $150,000 a year for the following 2 years.Should the firm expand at this time? Why or why not?

A) Yes; because the money will be recovered in 1.69 years

B) Yes; because the money will be recovered in 1.87 years

C) Yes; because the money will be recovered in 2.10 years

D) No; because the project never pays back

E) No; because the money will not be recovered in time to repay the loan

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following can be defined as a benefit-cost ratio?

A) Net present value

B) Internal rate of return

C) Profitability index

D) Accounting rate of return

E) Modified internal rate of return

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payback method of analysis ignores which one of the following?

A) Initial cost of an investment

B) Arbitrary cutoff point

C) Cash flow direction

D) Time value of money

E) Timing of each cash inflow

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payback period is the length of time it takes an investment to generate sufficient cash flows to enable the project to:

A) produce a positive annual cash flow.

B) produce a positive cash flow from assets.

C) offset its fixed expenses.

D) offset its total expenses.

E) recoup its initial cost.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Daniel's Market is considering a project with an initial cost of $176,500.The project will not produce any cash flows for the first three years.Starting in Year 4, the project will produce cash inflows of $127,500 a year for three years.This project is risky, so the firm has assigned it a discount rate of 17 percent.What is the project's net present value?

A) $105,222

B) -$6,500

C) $ 29,301.80

D) $ 621.30

E) -$601.03

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average accounting return:

A) measures profitability rather than cash flow.

B) discounts all values to today's dollars.

C) is expressed as a percentage of an investment's current market value.

D) will equal the required return when the net present value equals zero.

E) is used more often by CFOs than the internal rate of return.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) The internal rate of return is the most reliable method of analysis for any type of investment decision.

B) The payback method is biased toward short-term projects.

C) The modified internal rate of return is most useful when projects are mutually exclusive.

D) The average accounting return is the most difficult method of analysis to compute.

E) The net present value method is applicable only if a project has conventional cash flows.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

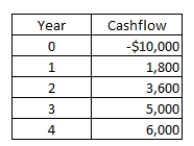

A project has the following cash flows.What is the payback period?

A) 2.83 years

B) 2.38 years

C) 2.75 years

D) 2.92 years

E) 3.03 years

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Auto Detailers is buying some new equipment at a cost of $188,900.This equipment will be depreciated on a straight-line basis to a zero book value its eight-year life.The equipment is expected to generate net income of $11,000 a year for the first four years and $24,000 a year for the last four years.What is the average accounting rate of return?

A) 15.48 percent

B) 17.76 percent

C) 18.09 percent

D) 22.68 percent

E) 18.53 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct? Assume cash flows are conventional.

A) If the IRR exceeds the required return, the profitability index will be less than 1.0.

B) The profitability index will be greater than 1.0 when the net present value is negative.

C) When the internal rate of return is greater than the required return, the net present value is positive.

D) Projects with conventional cash flows have multiple internal rates of return.

E) If two projects are mutually exclusive, you should select the project with the shortest payback period.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

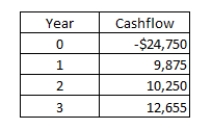

A project has the following cash flows.What is the internal rate of return?

A) 14.79 percent

B) 13.58 percent

C) 12.96 percent

D) 13.67 percent

E) 13.10 percent

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 116

Related Exams