A) $38,835.50

B) $36,082.15

C) $36,121.44

D) $37,671.44

E) $35,721.45

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ezmerelda Jewelers has a marginal tax rate of 32 percent and an average tax rate of 20.9percent.If the firm owes $$34,330 in taxes, how much taxable income did it earn?

A) $127,584

B) $116,649

C) $164,500

D) $157,500

E) $168,500

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gino's Winery has net working capital of $29,800, net fixed assets of $64,800, current liabilities of $34,700, and long-term debt of $23,000.What is the value of the owners' equity?

A) $36,900

B) $66,700

C) $71,600

D) $89,400

E) $106,300

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting statement that measures the revenues, expenses, and net income of a firm over a period of time is called the:

A) statement of cash flows.

B) income statement.

C) GAAP statement.

D) balance sheet.

E) net working capital schedule.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net working capital increases when:

A) fixed assets are purchased for cash.

B) inventory is purchased on credit.

C) inventory is sold at cost.

D) a credit customer pays for his or her purchase.

E) inventory is sold at a profit.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flow to stockholders is defined as:

A) cash flow from assets plus cash flow to creditors.

B) operating cash flow minus cash flow to creditors.

C) dividends paid plus the change in retained earnings.

D) dividends paid minus net new equity raised.

E) net income minus the addition to retained earnings.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sunny Disposition, Inc.has net working capital of $32,500, current assets of $59,000, equity of $74,500, and long-term debt of $42,500.What is the amount of the net fixed assets?

A) $58,000

B) $111,000

C) $94,600

D) $63,900

E) $84,500

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is included in the market value of a firm but not in the book value?

A) Raw materials

B) Partially built inventory

C) Long-term debt

D) Reputation of the firm

E) Value of a partially depreciated machine

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

National Importers paid $38,600 in dividends and $24,615 in interest over the past year while net working capital increased from $15,506 to $17,411.The company purchased $38,700 in net new fixed assets and had depreciation expenses of $14,784.During the year, the firm issued $20,000 in net new equity and paid off $23,800 in long-term debt.What is the amount of the cash flow from assets?

A) $21,811

B) $41,194

C) $36,189

D) $26,410

E) $67,015

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Roscoe's fixed assets were purchased three years ago for $1.8 million.These assets can be sold to Stewart's today for $1.2 million.Roscoe's current balance sheet shows net fixed assets of $960,000, current liabilities of $348,000, and net working capital of $121,000.If all the current assets were liquidated today, the company would receive $518,000 cash.The book value of the firm's assets today is _____ and the market value is ____.

A) $1,081,000; $1,308,000

B) $1,081,000; $1,718,000

C) $1,307,000; $1,429,000

D) $1,429,000; $1,308,000

E) $1,429,000; $1,718,000

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm's liquidity level decreases when:

A) inventory is purchased with cash.

B) inventory is sold on credit.

C) inventory is sold for cash.

D) an account receivable is collected.

E) proceeds from a long-term loan are received.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Highly liquid assets:

A) increase the probability a firm will face financial distress.

B) appear on the right side of a balance sheet.

C) generally produce a high rate of return.

D) can be sold quickly at close to full value.

E) include all intangible assets.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taylor Industries has current liabilities of $54,900 and accounts receivable of $88,700.The firm has total assets of $395,000 and net fixed assets of $265,100.The owners' equity has a book value of $147,500 ) What is the amount of the net working capital?

A) $77,400

B) $75,000

C) $33,800

D) $8,500

E) -$2,400

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in which one of the following will increase operating cash flow for a profitable, tax-paying firm?

A) Fixed expenses

B) Marginal tax rate

C) Net capital spending

D) Inventory

E) Depreciation

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Carpentry Shop has sales of $398,600, costs of $254,800, depreciation expense of $26,400, interest expense of $1,600, and a tax rate of 34 percent.What is the net income for this firm?

A) $61,930

B) $66,211

C) $67,516

D) $76,428

E) $83,219

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial leverage:

A) increases as the net working capital increases.

B) is equal to the market value of a firm divided by the firm's book value.

C) is inversely related to the level of debt.

D) is the ratio of a firm's revenues to its fixed expenses.

E) increases the potential return to the stockholders.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

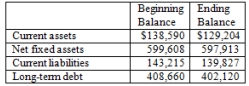

The Plaza Cafe has an operating cash flow of $83,770, depreciation expense of $43,514, and taxes paid of $21,590.A partial listing of its balance sheet accounts is as follows:  What is the amount of the cash flow from assets?

What is the amount of the cash flow from assets?

A) $26,359

B) $47,949

C) $61,487

D) $43,909

E) $35,953

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the year, Movers United has net income of $31,800, net new equity of $7,500, and an addition to retained earnings of $24,200.What is the amount of the dividends paid?

A) $100

B) $7,500

C) $7,600

D) $15,100

E) $16,700

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the recognition principle, revenue is recorded on the financial statements when the: I.payment is collected for the sale of a good or service. II.earnings process is virtually complete. III.value of a sale can be reliably determined. IV.product is physically delivered to the buyer.

A) I and II only

B) I and IV only

C) II and III only

D) II and IV only

E) I and III only

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the maximum average tax rate for corporations?

A) 38 percent

B) 25 percent

C) 33 percent

D) 39 percent

E) 35 percent

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 109

Related Exams