A) $691.013

B) $707,413

C) $704,700

D) $697,213

E) $719,900

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following terms is defined as the total tax paid divided by the total taxable income?

A) Average tax rate

B) Variable tax rate

C) Marginal tax rate

D) Absolute tax rate

E) Contingent tax rate

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firms that compile financial statements according to GAAP:

A) record income and expenses at the time they affect the firm's cash flows.

B) have no discretion over the timing of recording either revenue or expense items.

C) must record all expenses when incurred.

D) can still manipulate their earnings to some degree.

E) record both income and expenses as soon as the amount for each can be ascertained.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cornerstone Markets has beginning long-term debt of $64,500, which is the principal balance of a loan payable to Centre Bank.During the year, the company paid a total of $16,300 to the bank, including $4,100 of interest.The company also borrowed $11,000.What is the value of the ending long-term debt?

A) $45,100

B) $53,300

C) $58,200

D) $63,300

E) $85,900

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is an intangible fixed asset?

A) Inventory

B) Machinery

C) Copyright

D) Account receivable

E) Building

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net capital spending is equal to:

A) ending net fixed assets minus beginning net fixed assets plus depreciation.

B) beginning net fixed assets minus ending net fixed assets plus depreciation.

C) ending net fixed assets minus beginning net fixed assets minus depreciation.

D) ending total assets minus beginning total assets plus depreciation.

E) ending total assets minus beginning total assets minus depreciation.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shareholders' equity is best defined as:

A) the residual value of a firm.

B) positive net working capital.

C) the net liquidity of a firm.

D) cash inflows minus cash outflows.

E) the cumulative profits of a firm over time.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Underground Cafe has an operating cash flow of $187,000 and a cash flow to creditors of $71,400 for the past year.The firm reduced its net working capital by $28,000 and incurred net capital spending of $47,900.What is the amount of the cash flow to stockholders for the last year?

A) -$171,500

B) -$86,700

C) $21,200

D) $95,700

E) $39,700

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following will increase the cash flow from assets for a tax-paying firm, all else constant?

A) An increase in net capital spending

B) A decrease in the cash flow to creditors

C) An increase in depreciation

D) An increase in the change in net working capital

E) A decrease in dividends paid

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Victoria Photography, a sole proprietorship owes $190,874in taxes on a taxable income of $608,606.The company has determined that it will owe $$195,246 in tax if its taxable income rises to $620,424.What is the marginal tax rate at this level of income?

A) 39 percent

B) 38 percent

C) 37 percent

D) 35 percent

E) 32 percent

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shareholders' equity is equal to:

A) total assets plus total liabilities.

B) net fixed assets minus total liabilities.

C) net fixed assets minus long-term debt plus net working capital.

D) net working capital plus total assets.

E) total assets minus net working capital.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Andersen's Nursery has sales of $318,400, costs of $199,400, depreciation expense of $28,600, interest expense of $1,100, and a tax rate of 35 percent.The firm paid out $23,400 in dividends.What is the addition to retained earnings?

A) $36,909

B) $34,645

C) $44,141

D) $37,208

E) $40,615

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Andre's Dog House had current assets of $67,200 and current liabilities of $71,100 last year.This year, the current assets are $82,600 and the current liabilities are $85,100.The depreciation expense for the past year is $9,600 and the interest paid is $8,700.What is the amount of the change in net working capital?

A) -$2,800

B) -$1,400

C) $1,400

D) $2,100

E) $2,800

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

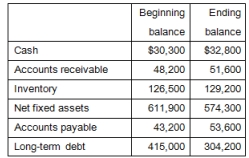

The balance sheet of Binger, Inc.has the following balances:  What is the amount of the change in net working capital?

What is the amount of the change in net working capital?

A) -$1,800

B) -$7,400

C) $1,800

D) -$8,100

E) $8,100

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Holly Farms has sales of $509,600, costs of $448,150, depreciation expense of $36,100, and interest paid of $12,400.The tax rate is 28 percent.How much net income did the firm earn for the period?

A) $7,778

B) $9,324

C) $10,380

D) $8,671

E) $5,886

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Donner United has total owners' equity of $18,800.The firm has current assets of $23,100, current liabilities of $12,200, and total assets of $36,400.What is the value of the long-term debt?

A) $5,400

B) $12,500

C) $13,700

D) $29,800

E) $43,000

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zoey Pet Supply had $314,000 in net fixed assets at the beginning of the year.During the year, the company purchased $98,200 in new equipment.It also sold, at a price of $10,000, some old equipment that had a book value of $12,500.The depreciation expense for the year was $24,500.What is the net fixed asset balance at the end of the year?

A) $260,000

B) $283,700

C) $424,200

D) $375,200

E) $277,000

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net working capital includes:

A) a land purchase.

B) an invoice from a supplier.

C) non-cash expenses.

D) fixed asset depreciation.

E) the balance due on a 15-year mortgage.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flow from assets is defined as:

A) the cash flow to shareholders minus the cash flow to creditors.

B) operating cash flow plus the cash flow to creditors plus the cash flow to shareholders.

C) operating cash flow minus the change in net working capital minus net capital spending.

D) operating cash flow plus net capital spending plus the change in net working capital.

E) cash flow to shareholders minus net capital spending plus the change in net working capital.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance sheet of a firm shows beginning net fixed assets of $348,200 and ending net fixed assets of $371,920.The depreciation expense for the year is $46,080 and the interest expense is $11,460.What is the amount of the net capital spending?

A) -$22,360

B) -$4,780

C) $23,720

D) $58,340

E) $69,800

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 109

Related Exams