A) the Cost of Goods Sold.

B) net purchases + beginning merchandise inventory.

C) the ending inventory.

D) the beginning inventory.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the account's nature (permanent/temporary). -

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which amount is directly found on the worksheet?

A) Cost of Goods Sold

B) Gross Profit

C) Net Sales

D) None of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After the closing entries have been posted:

A) the temporary accounts are zeroed out.

B) the Capital account includes the current net profit or loss.

C) the post-closing trial balance is prepared.

D) All of these answers are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An item that can be converted into cash or used up during the normal operating cycle is:

A) a current asset.

B) Revenue.

C) a current liability.

D) a long-term liability.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the account's nature (permanent/temporary). -

Correct Answer

verified

Correct Answer

verified

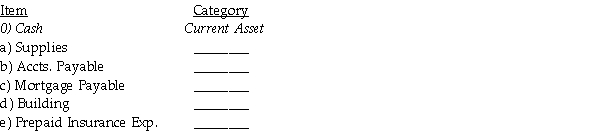

Essay

Identify the category(s)of each of the accounts below.

Current Asset

Plant and Equipment

Current Liabilities

Long-Term Liabilities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which section does Interest Revenue appear in the Income Statement?

A) Other Income

B) Other Expense

C) Revenue

D) Administrative Expenses

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to close the Freight-In account will include which of the following?

A) Debit to Freight-In

B) Credit to Income Summary

C) Debit to Income Summary

D) Debit to Freight-Out

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other Expense is used to record:

A) selling expenses.

B) administrative expenses.

C) operating expenses.

D) None of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Determine the ending Capital amount of a business having: Beginning Capital amount of $20,000 Withdrawals of $ 2,500 Net sales of $200,000 Net purchases of $80,000 Freight-in of $2,000 Beginning inventory of $6,000 Ending inventory of $7,000 Operating expenses of $ 30,000 $ ________

Correct Answer

verified

Correct Answer

verified

True/False

Not all adjusting entries can be reversed.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the account's nature (permanent/temporary). -

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The reversing entry for Salaries is:

A) debit Salaries Expense;credit Salaries Payable.

B) debit Salaries Payable;credit Income Summary.

C) debit Salaries Payable;credit Salaries Expense.

D) debit Salaries Expense;credit Accounts Payable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the account's nature (permanent/temporary). -

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Closing entries:

A) are posted to the general ledger.

B) are done to update Cash.

C) can be done before adjusting entries.

D) are done to update accounts receivable.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to close the Withdrawal account was entered in reverse-the Withdrawal account was debited and Capital credited.This error would cause:

A) Capital to be understated.

B) net income to be overstated.

C) net income to be understated.

D) Withdrawals to be overstated.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts will appear on the post-closing trial balance?

A) Capital

B) Purchases

C) Rent Expense

D) Withdrawals

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Determine the ending inventory of a business having: Beginning Capital $6,000 Net sales of $50,000 Net purchases of $30,500 Freight-in of $2,000 Beginning inventory of $4,000 Ending Capital of $15,000 Operating expenses of $10,000 No additional investments or withdrawals. $ ________

Correct Answer

verified

Correct Answer

verified

True/False

A balance sheet where assets and liabilities are broken down into more detail is called a comprehensive balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 123

Related Exams