B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the debt-to-assets ratio is 0.63, it means that 37% of the company's financing has been provided by stockholders' equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a current ratio of 2.0 and a quick ratio of 1.4. If the company then collects an accounts receivable, which of the following is a true statement?

A) The current ratio will not change and the quick ratio will increase.

B) The current ratio will increase and the quick ratio will increase.

C) The current ratio and the quick ratio will not change.

D) The current ratio will increase and the quick ratio will decrease.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is calculated by dividing net income by net sales?

A) Return on equity.

B) Current ratio.

C) Net profit margin.

D) Total asset turnover.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compute the earnings per share for the current year.

A) $10.00

B) $20.00

C) $7.25

D) $7.50

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

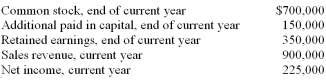

A company provided the following information:  There was no change in contributed capital this year and there were no dividends declared in the current year. The return on equity ratio for the current year is:

There was no change in contributed capital this year and there were no dividends declared in the current year. The return on equity ratio for the current year is:

A) 20.7%

B) 75%

C) 3.8%

D) 1.33%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a common size income statement, each item on the income statement is expressed as a percentage of:

A) Net income

B) Gross margin (gross profit)

C) Total expenses

D) Sales revenue

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company X has a capital acquisitions ratio of 0.8. Company Y has a capital acquisitions ratio of 1.2. Which of the following statements is true?

A) Company X is more likely to have a higher quality of income ratio than Company Y.

B) Company Y is less likely to need external financing than Company X.

C) Company X is more likely to have a higher times interest earned ratio than Company Y.

D) Company X is less likely to need external financing than Company Y.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost of goods sold divided by average inventory is the calculation for which of the following ratios?

A) Net profit margin ratio.

B) Current ratio.

C) Inventory turnover ratio.

D) Asset turnover ratio.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company X has net sales revenue of $780,000, cost of goods sold of $343,200, and all other expenses of $327,600. The gross profit percentage is:

A) 32%

B) 56%

C) 86%

D) 14%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which ratio is used to evaluate how a company is managing its property, plant and equipment?

A) Accounts receivable turnover

B) Inventory turnover

C) Fixed asset turnover

D) Net profit margin

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following measures would assist in assessing the profitability of a company?

A) Quality of income ratio

B) Times interest earned ratio

C) Inventory turnover ratio

D) Capital acquisitions ratio

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ratio that measures the company's ability to meet required interest payments is the:

A) Debt-to-equity ratio.

B) Current ratio.

C) Price/earnings ratio.

D) Times interest earned ratio.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the fixed asset turnover ratio for 2011?

A) 1.28

B) 1.24

C) 0.75

D) 1.64

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost-benefit constraint recognizes that:

A) the costs of providing information to users should be less than the benefits.

B) the expenses of an operation should be less than the revenues.

C) the expenses and revenues associated with a transaction should be reported at the same time.

D) all the information that is possible to be gathered should be reported.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an analyst wants to examine a company's current ability to generate income, which of the following would best be considered?

A) Liquidity

B) Market share

C) Profitability

D) Solvency

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following could indicate bad news?

A) An increase in asset turnover ratio.

B) A decrease in days to sell.

C) A decrease in EPS.

D) An increase in capital acquisition ratio.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the debt-to-assets ratio for 2011?

A) 39

B) 61

C) 35

D) 0

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If sales revenue for 2012 is $850,000, what is the asset turnover ratio for 2012?

A) 68

B) 63

C) 0

D) 74

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's comparative balance sheets show total assets for 2012 and 2011 as $990,000 and $900,000, respectively. What is the percentage change to be reported in the horizontal analysis?

A) Increase of 10%

B) Increase of 9%

C) Increase of 5%

D) Increase of 4%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 143

Related Exams