B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Eileen transfers property worth $200,000 basis of $190,000) to Goldfinch Corporation.In return, she receives 80% of the stock in Goldfinch Corporation fair market value of $180,000) and a long-term note fair market value of $20,000) executed by Goldfinch and made payable to Eileen.Eileen recognizes gain on the transfer of:

A) $0.

B) $10,000.

C) $20,000.

D) $190,000.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

To help avoid the thin capitalization problem, it is advisable to make the repayment of the debt contingent upon the corporation's earnings.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The limitation on the deduction of business interest does not apply to noncorporate taxpayers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A transferor who receives stock for both property and services may not be included in the control group in determining whether an exchange meets the requirements of § 351.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kirby and Helen form Red Corporation.Kirby transfers property, basis of $20,000 and value of $300,000, for 100 shares in Red Corporation.Helen transfers property, basis of $40,000 and value of $280,000, and provides legal services in organizing the corporation.The value of her services is $20,000.In return Helen receives 100 shares in Red Corporation.With respect to the transfers:

A) Kirby will recognize gain.

B) Helen will not recognize any gain or income.

C) Red Corporation will have a basis of $280,000 in the property it acquired from Helen.

D) Red will have a business deduction of $20,000.

E) None of the above.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

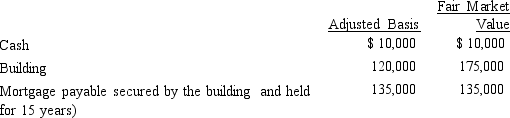

Dick, a cash basis taxpayer, incorporates his sole proprietorship.He transfers the following items to newly created Orange Corporation.  With respect to this transaction:

With respect to this transaction:

A) Orange Corporation's basis in the building is $120,000.

B) Dick has no recognized gain.

C) Dick has a recognized gain of $5,000.

D) Dick has a recognized gain of $10,000.

E) None of the above.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Quail Corporation is a C corporation with net income of $125,000 during the current year.If Quail paid dividends of $25,000 to its shareholders, the corporation must pay tax on $100,000 of net income.Shareholders must report the $25,000 of dividends as income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Allen transfers marketable securities with an adjusted basis of $120,000, fair market value of $300,000, for 85% of the stock of Heron Corporation.In addition, he receives cash of $40,000.Allen recognizes a capital gain of $40,000 on the transfer.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a § 351 transfer, a shareholder receives boot of $10,000 but ends up with a realized loss of $3,000.Only $7,000 of the boot will be taxed to the shareholder.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The control requirement under § 351 requires that the person or persons transferring property to the corporation, immediately after the transfer, own stock possessing at least 80% of the total combined voting power of all classes of stock entitled to vote and at least 80% of the total number of shares of all other classes of stock of the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to induce Yellow Corporation to build a new manufacturing facility in Knoxville, Tennessee, the city donates land fair market value of $400,000) and cash of $100,000 to the corporation.Several months after the donation, Yellow Corporation spends $450,000 which includes the $100,000 received from Knoxville) on the construction of a new plant located on the donated land.

A) Yellow recognizes income of $100,000 as to the donation.

B) Yellow has a zero basis in the land and a basis of $450,000 in the plant.

C) Yellow recognizes income of $500,000 as to the donation.

D) Yellow has a zero basis in the land and a basis of $350,000 in the plant.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

On December 31, 2018, Flamingo, Inc., a calendar year, accrual method C corporation, accrues a bonus of $50,000 to its president a cash basis taxpayer), who owns 75% of the corporation's outstanding stock.The $50,000 bonus is paid to the president on February 4, 2019.For Flamingo's 2018 Form 1120, the $50,000 bonus will be a subtraction item on Schedule M-1.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wade and Paul form Swan Corporation with the following investments.Wade transfers machinery basis of $40,000 and fair market value of $100,000) , while Paul transfers land basis of $20,000 and fair market value of $90,000) and services rendered worth $10,000) in organizing the corporation.Each is issued 25 shares in Swan Corporation.With respect to the transfers:

A) Wade has no recognized gain; Paul recognizes income/gain of $80,000.

B) Neither Wade nor Paul has recognized gain or income on the transfers.

C) Swan Corporation has a basis of $30,000 in the land transferred by Paul.

D) Paul has a basis of $30,000 in the 25 shares he acquires in Swan Corporation.

E) None of the above.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In determining whether § 357c) applies, assess whether the liabilities involved exceed the bases of all assets a shareholder transfers to the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hunter and Warren form Tan Corporation.Hunter transfers equipment basis of $210,000 and fair market value of $180,000) while Warren transfers land basis of $15,000 and fair market value of $150,000) and $30,000 of cash.Each receives 50% of Tan's stock.As a result of these transfers:

A) Hunter has a recognized loss of $30,000, and Warren has a recognized gain of $135,000.

B) Neither Hunter nor Warren has any recognized gain or loss.

C) Hunter has no recognized loss, but Warren has a recognized gain of $30,000.

D) Tan Corporation will have a basis in the land of $45,000.

E) None of the above.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The transfer of an installment obligation in a transaction qualifying under § 351 is a disposition of the obligation that causes gain to be recognized by the transferor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Eve transfers property basis of $120,000 and fair market value of $400,000) to Green Corporation for 80% of its stock worth $350,000) and a long-term note worth $50,000) , executed by Green Corporation and made payable to Eve.As a result of the transfer:

A) Eve recognizes no gain.

B) Eve recognizes a gain of $230,000.

C) Eve recognizes a gain of $280,000.

D) Eve recognizes a gain of $50,000.

E) None of the above.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Double taxation of corporate income results because dividend distributions are included in a shareholder's gross income but are not deductible by the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wren Corporation a minority shareholder in Lark Corporation) has made loans to Lark Corporation that become worthless in the current year.

A) Wren Corporation is not permitted a deduction for the loans.

B) The loans result in a nonbusiness bad debt deduction to Wren Corporation.

C) The loans provide Wren Corporation with a business bad debt deduction.

D) Wren claims a capital loss due to the uncollectible loans.

E) None of the above.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 128

Related Exams