B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Travis and Andrea were divorced in 2016.Their only marital property consisted of a personal residence fair market value of $400,000, cost of $200,000) , and publicly-traded stocks fair market value of $800,000, cost basis of $500,000) .Under the terms of the divorce agreement, Andrea received the personal residence and Travis received the stocks.In addition, Andrea was to receive $50,000 for eight years. I.If the $50,000 annual payments are to be made to Andrea or her estate if she dies before the end of the eight years) , the payments will qualify as alimony. II.Andrea has a taxable gain from an exchange of her one-half interest in the stocks for Travis' one-half interest in the house and cash. III.If Travis sells the stocks for $900,000, he must recognize a $400,000 gain.

A) Only III is true.

B) Only I and III are true.

C) Only I and II are true.

D) I, II, and III are true.

E) None of these are true.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

For all of the current year, Randy a calendar year taxpayer) allowed the Salvation Army to use a building he owns rent-free.The building normally rents for $24,000 a year.Randy will be allowed a charitable contribution deduction this year of $24,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The alimony rules applicable to divorces entered into before 2019:

A) Are based on the principle that the person who earns the income should pay the tax.

B) Permit tax deductions for property divisions.

C) Look to state law to determine the definition of alimony.

D) Distinguish child support payments from alimony.

E) None of these.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the terms of a divorce agreement entered into in 2018, Kim was to pay her husband Tom $7,000 per month in alimony.Kim's payments will be reduced to $3,000 per month when their 9 year-old son becomes 21.The husband has custody of their son.For a twelve-month period, Kim can deduct from gross income and Tom must include in gross income) :

A) $60,000.

B) $48,000.

C) $36,000.

D) $0.

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

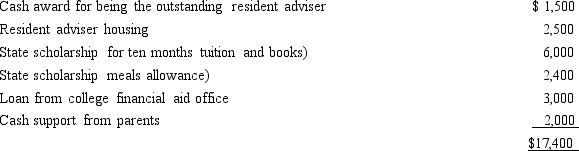

Ron, age 19, is a full-time graduate student at City University.During 2018, he received the following payments:

Ron served as a resident adviser in a dormitory and, therefore, the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2018?

Ron served as a resident adviser in a dormitory and, therefore, the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2018?

A) $1,500.

B) $3,900.

C) $9,000.

D) $15,400.

E) None of these.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Child care payments to a relative are not eligible for the credit for child and dependent care expenses if the relative is a child under age 19) of the taxpayer.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thelma and Mitch were divorced in 2017.The couple had a joint brokerage account that included stocks with a basis of $600,000 and a fair market value of $1,000,000.Under the terms of the divorce agreement, Mitch would receive the stocks and Mitch would pay Thelma $100,000 each year for 6 years, or until Thelma's death, whichever should occur first.Thelma and Mitch lived apart when the payments were made by Mitch.Mitch paid the $600,000 to Thelma over the six-year period.The divorce agreement did not contain the word "alimony." Then, Mitch sold the stocks for $1,300,000.Mitch's recognized gain from the sale is:

A) $0.

B) $1,000,000 $1,300,000 - $300,000) .

C) $700,000 $1,300,000 - $600,000) .

D) $300,000 $1,300,000 - $1,000,000) .

E) None of these.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Sadie mailed a check for $2,200 to a qualified charitable organization on December 31, 2018.The $2,200 contribution is deductible on Sadie's 2018 tax return if she itemizes her deductions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

This year Allison drove 800 miles to volunteer in a project sponsored by a qualified charitable organization in Utah.In addition, she spent $250 for meals while away from home.In total, Allison may take a charitable contribution deduction of $112 800 miles × $.14) relating to her volunteer work.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

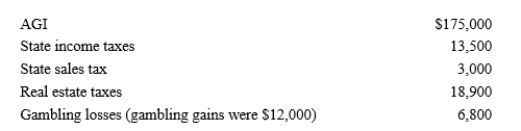

Paul, a calendar year single taxpayer, has the following information for 2018:  Paul’s allowable itemized deductions for 2018 are:

A) $10,000.

B) $16,800.

C) $39,200.

D) $42,200.

E) None of the above.

Paul’s allowable itemized deductions for 2018 are:

A) $10,000.

B) $16,800.

C) $39,200.

D) $42,200.

E) None of the above.

Correct Answer

verified

Correct Answer

verified

True/False

Qualifying tuition expenses paid from the proceeds of a tax-exempt scholarship do not give rise to an education tax credit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The taxable portion of Social Security benefits may be affected by:

A) The taxpayer's itemized deductions.

B) The individual's tax-exempt interest income.

C) The number of quarters the individual worked.

D) The individual's standard deduction.

E) None of these.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the current year, Jerry pays $8,000 to become a charter member of Mammoth University's Athletic Council.The membership ensures that Jerry will receive choice seating at all of Mammoth's home basketball games.Also this year, Jerry pays $2,200 the regular retail price) for season tickets for himself and his wife.For these items, how much qualifies as a charitable contribution?

A) $0

B) $6,400

C) $8,000

D) $10,200

E) None of the above

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Gambling losses may be deducted to the extent of the taxpayer's gambling winnings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

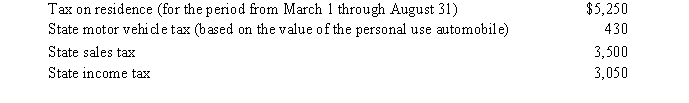

Nancy paid the following taxes during the year:  Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for Nancy?

Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for Nancy?

A) $9,180

B) $9,130

C) $7,382

D) $5,382

E) None of the above

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In 2018, Theresa was in an automobile accident and suffered physical injuries.The accident was caused by Ramon's negligence.In 2019, Theresa collected from his insurance company.She received $15,000 for loss of income, $10,000 for pain and suffering, $50,000 for punitive damages, and $6,000 for medical expenses which she had deducted on her 2018 tax return the amount in excess of 7.5% of adjusted gross income).As a result of the above, Theresa's 2019 gross income is increased by $56,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The child tax credit is based on the number of the taxpayer's qualifying children under age 17.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Herbert is the sole proprietor of a furniture store.He can deduct real property taxes on his store building as a business deduction but he cannot deduct state income taxes related to his net income from the furniture store as a business deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The tax benefits resulting from tax credits and tax deductions are affected by the tax rate bracket of the taxpayer.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 119

Related Exams