Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most commonly used state income tax apportionment formula is:

A) Sales factor only.

B) Sales factor double-weighted.

C) Sales factor equally weighted with property and payroll.

D) Payroll factor only.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Double weighting the sales factor effectively decreases the corporate income tax burden on taxpayers based in a state such as entities with in-state headquarters.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

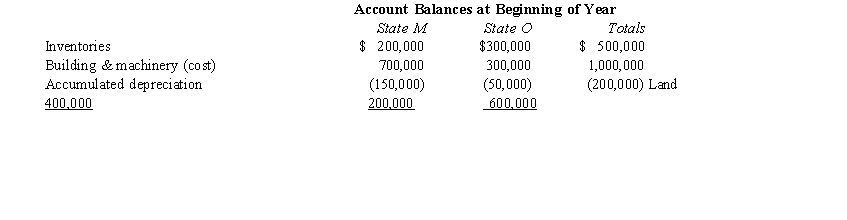

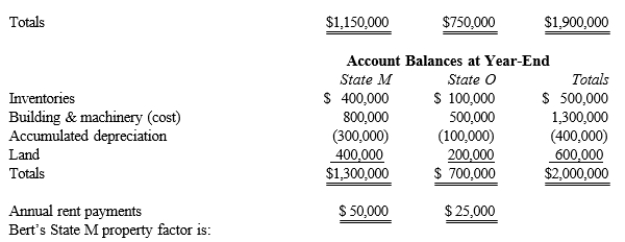

Bert Corporation, a calendar year taxpayer, owns property in States M and O. Both states require that the average value of assets be included in the property factor. State M requires that the property be valued at its historical cost, and State O requires that the property be included in the property factor at its net depreciated book value.

A) 75.0%.

B) 66.7%.

C) 64.9%.

D) 64.5%.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

If a gift card is unused after a specified period of time, the state can collect the amount of the card proceeds from the seller as ____________________ property.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following terms with the appropriate description in the state income tax formula. Apply the UDITPA rules in your responses. -State-level NOL.

A) Addition modification

B) Subtraction modification

C) No modification

E) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefits of a passive investment company employed in a nonunitary state typically include:

A) Reduced state income taxes.

B) Isolation of the entity's portfolio income from taxation in other nonunitary states.

C) Exclusion of the subsidiary's portfolio income from the parent corporation's apportionment formula denominator in other nonunitary states.

D) All of these are benefits.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hendricks Corporation sells widgets in two states. State A levies a 9% effective tax rate, and State B levies a 3% rate. A and B have adopted sales-factor-only apportionment formulas. To reduce overall multistate income tax liabilities, Hendricks should:

A) Move its home office from B to A.

B) Remove all stored inventory from A.

C) Establish a personal training center in A.

D) Convert to employee status the independent contractors that it uses to sell widgets in A.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

General Corporation is taxable in a number of states. This year, General made a $100,000 sale from its State A headquarters to a customer in State B. General has not established nexus with State B. State A does not apply a throwback rule. In which states) will the sale be included in the sales factor numerator?

A) In all of the states, according to the apportionment formulas of each, as the U.S. government is present in all states.

B) $100,000 in State A.

C) $100,000 in State B.

D) $0 in State A and $0 in State B.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Typically exempt from the sales/use tax base is the purchase of clothing from a neighbor's garage sale.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Helene Corporation owns manufacturing facilities in States A, B, and C. State A uses a three-factor apportionment formula under which the sales, property, and payroll factors are equally weighted. State B uses a three-factor apportionment formula under which sales are double-weighted. State C employs a single-factor apportionment factor based solely on sales. Helene's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows: Helene's apportionable income assigned to State A is:

A) $0

B) $266,667

C) $311,100

D) $1,000,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Usually a business chooses a location where it will build a new plant based chiefly on tax considerations.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

_________describes) the degree of business activity that must be present before a taxing jurisdiction has the right to impose a tax on an out-of-state entity's income.

Correct Answer

verified

Correct Answer

verified

True/False

Most states begin the computation of corporate taxable income with an amount from the Federal income tax return.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer automatically has nexus with a state for sales and use tax purposes if it has income tax nexus with the same state.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Simpkin Corporation owns manufacturing facilities in States A, B, and C. State A uses a three-factor apportionment formula under which the sales, property, and payroll factors are equally weighted. State B uses a three-factor apportionment formula under which sales are double-weighted. State C employs a single-factor apportionment factor, based solely on sales. Simpkin's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows: Simpkin's apportionable income assigned to State B is:

A) $1,000,000

B) $533,333

C) $475,000

D) $0

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

General Corporation is taxable in a number of states. This year, General made a $100,000 sale from its State A headquarters to a customer in State B. This activity is not sufficient for General to create nexus with State B. State A applies a throwback rule but State B does not. In which states) will the sale be included in the sales factor numerator?

A) $0 in both State A and State B.

B) $100,000 in State A.

C) $100,000 in State B.

D) In both State A and State B, according to the apportionment formulas of each.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In determining a corporation's taxable income for state income tax purposes, which of the following does not constitute a subtraction modification from Federal income?

A) Interest on U.S. obligations.

B) Expenses that are directly or indirectly related to state and municipal interest that is taxable for state purposes.

C) The amount by which the state depreciation deduction exceeds the corresponding Federal amount.

D) The amount by which the Federal depreciation deduction exceeds the corresponding state amount.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adams Corporation owns and operates two manufacturing facilities, one in State X and the other in State Y. Due to a temporary decline in the corporation's sales, Adams has rented 20% of its Y facility to an unaffiliated corporation. Adams generated $1,000,000 net rental income and $5,000,000 income from manufacturing. Adams is incorporated in Y. For X and Y purposes, rental income is classified as allocable nonbusiness income. By applying the statutes of each state, Adams determined that its apportionment factors are 0.65 for X and 0.35 for Y. Adams's income attributed to X is:

A) $0.

B) $3,250,000.

C) $3,900,000.

D) $5,000,000.

E) $6,000,000.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

By making a water's edge election, a multinational taxpayer can limit the reach of unitary principles to the apportionment factors and income of its U.S. and E.U. affiliates.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 184

Related Exams