A) efficient.

B) equitable.

C) communistic.

D) capitalistic.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A tax system exhibits vertical equity when taxpayers with similar abilities to pay contribute the same amount.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-1 -Refer to Table 12-1. Assume that the price of a weekend ski pass is $55 and that the price reflects the actual unit cost of the trip. Suppose the government imposes a tax of $12 on white water rafting, which raises the price to $67. How much tax revenue is collected from these four participants?

A) $200

B) $159

C) $36

D) $83

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Government spending is projected to rise over the next few decades. Three of the most important reasons are spending on Social Security, Medicare, and healthcare.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If your income is $50,000, your income tax liability is $10,000, and you paid $0.25 in taxes on the last dollar you earned, your

A) marginal tax rate is 20 percent.

B) average tax rate is 5 percent.

C) marginal tax rate is 25 percent.

D) average tax rate is 25 percent.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why do some policymakers support a consumption tax rather than an income tax?

A) The average tax rate would be lower under a consumption tax.

B) A consumption tax would encourage people to save earned income.

C) A consumption tax would raise more revenues than an income tax.

D) The marginal tax rate would be higher under an income tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The government raises revenue through taxation to pay for the services it provides.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

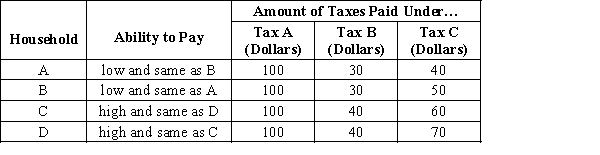

Table 12-6

The table below provides information on the four households that make up a small economy and how much they would pay in taxes under three types of taxes.

-Refer to Table 12-6. In this economy Tax A exhibits

-Refer to Table 12-6. In this economy Tax A exhibits

A) horizontal and vertical equity.

B) horizontal equity but not vertical equity.

C) vertical equity but not horizontal equity.

D) neither horizontal nor vertical equity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An efficient tax system is one that imposes small deadweight losses and small administrative burdens.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One reason that deadweight losses are so difficult to avoid is that

A) taxes affect the decisions that people make.

B) income taxes are not paid by everyone.

C) consumption taxes must be universally applied to all commodities.

D) the administrative burden is hard to calculate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

The largest category of expenditures for state and local governments is __________.

Correct Answer

verified

Correct Answer

verified

True/False

Individual income taxes and social insurance taxes generate the highest tax revenue for the federal government.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If all taxpayers pay the same percentage of income in taxes, the tax system is proportional.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

One reason for the projected increase, over the next several decades, in government spending as a percentage of GDP is the projected increase in the size of the elderly population.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If James earns $80,000 in taxable income and pays $20,000 in taxes, his average tax rate is 25 percent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Athos, Porthos, and Aramis each like to take fencing lessons. The price of a fencing lesson is $10. Athos values a lesson at $17, Porthos at $15, and Aramis at $12. Suppose that if the government taxes fencing lessons at $3 each, the price will rise to $13. A consequence of the tax is that consumer surplus shrinks by

A) $3 and tax revenues increase by $9, so there is a deadweight loss of $3.

B) $6 and tax revenues increase by $9, so there is no deadweight loss.

C) $9 and tax revenues increase by $6, so there is no deadweight loss.

D) $9 and tax revenues increase by $6, so there is a deadweight loss of $3.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The revenue that the federal government collects from payroll taxes is mostly earmarked to pay for

A) national defense and income security (welfare) programs

B) national defense and Medicare

C) Social Security and public schools

D) Social Security and Medicare

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a payroll tax?

A) A tax on the wages that a firm pays its workers

B) An excise tax on distilled alcohol

C) A tax on corporate profits

D) The portion of federal income taxes earmarked to pay for national defense

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Rob's income rises from $50,000 to $60,000 and his income tax increases from $6,000 to $7,500.His marginal tax rate is 12.5%.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-2 Suppose Regina and Ben receive great satisfaction from their consumption of cheesecake. Regina would be willing to purchase only one slice and would pay up to $13 for it. Ben would be willing to pay $17 for his first slice, $14 for his second slice, and $10 for his third slice. The current market price is $10 per slice. -Refer to Scenario 12-2. How much consumer surplus does Regina receive from consuming her slice of cheesecake?

A) $3

B) $7

C) $4

D) $0

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 225

Related Exams