Correct Answer

verified

Correct Answer

verified

Multiple Choice

The support department cost that will be allocated to the Macro Division is

A) $405,000

B) $175,000

C) $130,000

D) $305,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Responsibility accounting reports for profit centers are normally in the form of income statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a measure that management can use in evaluating and controlling investment center performance?

A) return on investment (ROI)

B) negotiated price

C) residual income

D) operating income

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Materials used by Jefferson Company in producing Division C's product are currently purchased from outside suppliers at a cost of $10.00 per unit. However, the same materials are available from Division A. Division A has unused capacity and can produce the materials needed by Division C at a variable cost of $8.50 per unit. A transfer price of $9.50 per unit is negotiated and 25,000 units of material are transferred, with no reduction in Division A's current sales. -Division C's operating income will increase by

A) $0

B) $75,000

C) $12,500

D) $50,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following phrases as describing (a) an advantage, (b) a disadvantage, or (c) neither of decentralization. -Operational issues are made by managers closest to the operations A)Advantage of decentralization B)Disadvantage of decentralization C)Neither an advantage nor a disadvantage

Correct Answer

verified

Correct Answer

verified

True/False

Operating expenses directly traceable to or incurred for the sole benefit of a specific department and usually subject to the control of the department manager are termed direct operating expenses.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the negotiated price approach, the transfer price is the price at which the product or service transferred could be sold to outside buyers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The formula for the return on investment (ROI) is

A) Invested Assets ÷ Operating Income

B) Sales ÷ Invested Assets

C) Operating Income ÷ Sales

D) Operating Income ÷ Invested Assets

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Operating expenses incurred by support departments are indirect expenses to a profit center.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Central Division for Chemical Company has a return on investment of 22% and an investment turnover of 1.4. The profit margin is

A) 20%

B) 15.7%

C) 14%

D) 6.36%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Transfer prices may be used when decentralized units are organized as cost, profit, or investment centers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If operating income for a division is $5,000, invested assets are $25,000, and sales are $30,000, the profit margin is 20%.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

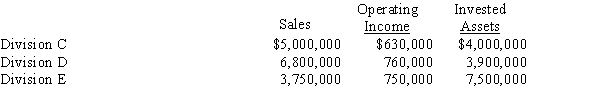

The sales, operating income, and invested assets for each division of Wren Company are as follows:  Management has established a minimum acceptable return on investment of 8%.

a.Determine the residual income for each division.

b.Based on residual income, which division is the most profitable?

Management has established a minimum acceptable return on investment of 8%.

a.Determine the residual income for each division.

b.Based on residual income, which division is the most profitable?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ratio of sales to invested assets, which is also a factor in the DuPont formula for determining the return on investment (ROI) , is called

A) profit margin

B) indirect margin

C) investment turnover

D) cost ratio

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Under the cost price approach, the transfer price is the price at which the product or service transferred could be sold to outside buyers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The major shortcoming of operating income as an investment center performance measure is that it ignores the amount of assets invested in the center.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following expressions is termed the profit margin factor as used in the DuPont formula for determining the return on investment (ROI) ?

A) Sales ÷ Operating Income

B) Operating Income ÷ Sales

C) Invested Assets ÷ Sales

D) Sales ÷ Invested Assets

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

International Boot Company has operating income of $80,000, invested assets of $500,000, and sales of $1,525,000. -The profit margin for International Boot Company is

A) 33.3%

B) 5.2%

C) 16.0%

D) 19.1%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two divisions of Oregano Company (Divisions TX and OY) have the same profit margins. Division TX's investment turnover is larger than that of Division OY (1.2 to 1.0) . Operating income for Division TX is $55,000, and operating income for Division OY is $43,000. Division TX has a higher return on investment than Division OY by

A) using operating income as a performance measure

B) comparing the profit margins

C) applying a negotiated price measure

D) using its assets more efficiently in generating sales

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 210

Related Exams