A) single plantwide rate

B) multiple production department rates

C) factory costing

D) activity-based costing

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

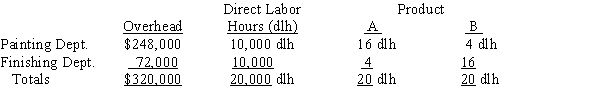

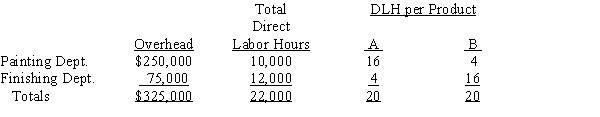

Blue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours.

-The overhead from both production departments allocated to each unit of Product B if Blue Ridge Marketing Inc. uses the multiple production department factory overhead rate method is

-The overhead from both production departments allocated to each unit of Product B if Blue Ridge Marketing Inc. uses the multiple production department factory overhead rate method is

A) $425.60 per unit

B) $115.20 per unit

C) $214.40 per unit

D) $320.00 per unit

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

ABC is used to allocate selling and administrative expenses to each product based on the product's individual differences in consuming these activities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Use of a plantwide factory overhead rate does not distort product costs when products require different ratios of allocation-base usage in each production department.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Zorn Co. budgeted $600,000 of factory overhead cost for the coming year. Its plantwide allocation base, machine hours, is budgeted at 100,000 hours. Budgeted units to be produced are 200,000 units. Zorn's plantwide factory overhead rate is $3 per hour.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the budgeted factory overhead cost is $460,000, the budgeted direct labor hours are 80,000, and the actual direct labor hours are 6,700 for the month, the factory overhead rate for the month is $68.65 (if the allocation is based on direct labor hours).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kaumajet Factory produces two products: table lamps and desk lamps. It has two separate departments: Fabrication and Assembly. The factory overhead budget for the Fabrication Department is $550,000, using 500,000 direct labor hours. The factory overhead budget for the Assembly Department is $400,000, using 80,000 direct labor hours. -If a desk lamp requires 1 hour of fabrication and 2 hours of assembly, the total amount of factory overhead that Kaumajet Factory will allocate to desk lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours if 26,000 units are produced is

A) $540,000

B) $187,200

C) $475,000

D) $288,600

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Everest Co. uses a single plantwide factory overhead rate based on direct labor hours. Overhead costs would be overcharged to which of the following departments?

A) a labor-intensive department

B) a capital-intensive department

C) a materials-intensive department

D) all of these choices

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In an effort to simplify the multiple production department factory overhead rate method, the same rate can be used for all departments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

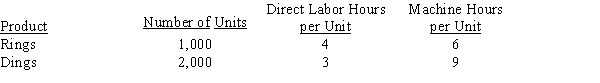

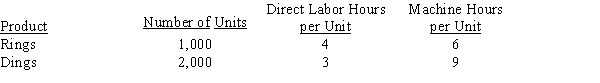

Aleutian Company produces two products: Rings and Dings. They are manufactured in two departments: Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $90,000. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $105,000.Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours.

-The Fabrication Department's factory overhead rate is

All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $90,000. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $105,000.Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours.

-The Fabrication Department's factory overhead rate is

A) $10.50 per direct labor hour

B) $9.00 per direct labor hour

C) $8.12 per machine hour

D) $3.75 per machine hour

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Challenger Factory produces two similar products: regular widgets and deluxe widgets. The total factory overhead budget is $675,000 with 300,000 estimated direct labor hours. Deluxe widget production requires 3 direct labor hours for each unit, and regular widget production requires 2 direct labor hours for each unit. -Using a single plantwide factory overhead rate with an allocation base of direct labor hours, the factory overhead that Challenger Factory will allocate to regular widget production if budgeted production of regular widgets for the period is 75,000 units and actual production of regular widgets for the period is 72,000 units would be

A) $168,750

B) $324,000

C) $162,000

D) $337,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based costing is much easier to apply than single plantwide factory overhead allocation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Challenger Factory produces two similar products: regular widgets and deluxe widgets. The total factory overhead budget is $675,000 with 300,000 estimated direct labor hours. Deluxe widget production requires 3 direct labor hours for each unit, and regular widget production requires 2 direct labor hours for each unit. -Using a single plantwide factory overhead rate with an allocation base of direct labor hours, the factory overhead that Challenger Factory will allocate to deluxe widget production if budgeted production for the period for deluxe widgets is 50,000 units and actual production of deluxe widgets for the period is 58,000 units would be

A) $391,500

B) $225,000

C) $261,000

D) $337,500

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

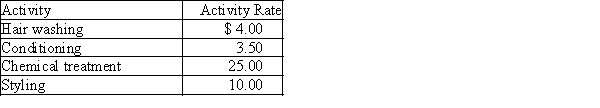

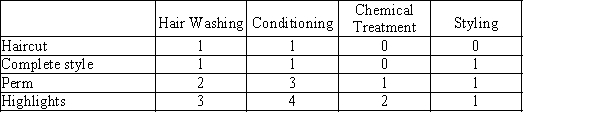

Beauty Beyond Words Salon uses an activity-based costing system to determine the cost of services. The salon has determined the costs of services by activity and activity usage as follows:

-The cost of services for a haircut is

-The cost of services for a haircut is

A) $4.00

B) $7.50

C) $3.50

D) $11.50

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

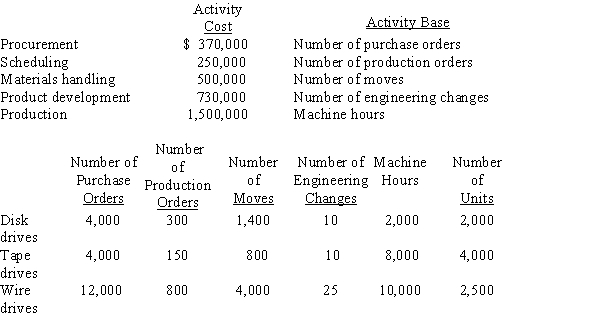

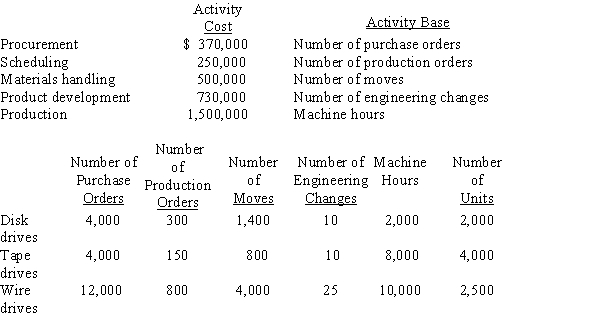

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to five separate activity pools. The budgeted activity cost and activity base data by product are provided below.

-The activity-based cost for each disk drive unit is

-The activity-based cost for each disk drive unit is

A) $92.25

B) $130.69

C) $394.12

D) $279.57

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aleutian Company produces two products: Rings and Dings. They are manufactured in two departments: Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $90,000. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $105,000.Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours.

-The total factory overhead allocated per unit of Dings is

All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $90,000. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $105,000.Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours.

-The total factory overhead allocated per unit of Dings is

A) $65.25

B) $56.75

C) $23.25

D) $64.50

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the activities causing overhead costs are different across different departments and products, use of a plantwide factory overhead rate will cause distorted product costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to five separate activity pools. The budgeted activity cost and activity base data by product are provided below.

-The activity rate for the product development cost pool is

-The activity rate for the product development cost pool is

A) $73,000 per engineering change

B) $8,588 per engineering change

C) $30,417 per engineering change

D) $16,222 per engineering change

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kaumajet Factory produces two products: table lamps and desk lamps. It has two separate departments: Fabrication and Assembly. The factory overhead budget for the Fabrication Department is $550,000, using 500,000 direct labor hours. The factory overhead budget for the Assembly Department is $400,000, using 80,000 direct labor hours. -Using multiple department factory overhead rates instead of a single plantwide factory overhead rate

A) results in more accurate product costs

B) results in distorted product costs

C) is simpler and less expensive to compute than a plantwide rate

D) applies overhead costs to all departments equally

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adirondack Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead.

-The single plantwide factory overhead rate for Adirondack Marketing Inc. is

-The single plantwide factory overhead rate for Adirondack Marketing Inc. is

A) $25.00 per dlh

B) $0.07 per dlh

C) $14.77 per dlh

D) $ 6.25 per dlh

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 109

Related Exams