A) fiscal policy is more powerful than monetary policy.

B) monetary policy is more powerful than fiscal policy.

C) fiscal and monetary policy are not likely to achieve their stated aims.

D) fiscal policy works only to the extent that it is accompanied by fully anticipated changes in the money supply.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Answer the question on the basis of the following information for a hypothetical economy.All values are in nominal terms. M = $100 V = 2 Ca = $160 Xn = $10 G = $10 In equilibrium, Ig is

A) $20.

B) $10.

C) $5.

D) $50.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Rational expectations theory suggests that changes in people's expectations in response to changes in fiscal and monetary policy changes will make such policy changes ineffective.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Consider This) According to economist Milton Friedman (1912-2006) , the source of instability in the economy could be thought of as a

A) baseball manager (the Fed) who removes his starting pitcher too soon and sees a five-run lead evaporate in a single inning.

B) duck hunter (the Fed) who starts shooting at ducks well before they fly over.

C) camp councilor (the Fed) who is wearing a baseball cap that has two bills and says, "I am the leader; which way did they go?"

D) backseat car passenger (the Fed) who occasionally leans over the front seat and abruptly jerks the steering wheel to the left or to the right.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If money supply is $800 billion and nominal GDP is $2 trillion, then the average number of times that money is spent and changes hands is

A) 2.5 times per year.

B) 2 times per year.

C) 1.6 times per year.

D) 16 times per year.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The view that excessive growth of the money supply over long periods leads to inflation

A) is accepted by the monetarists but not by mainstream macroeconomists.

B) is the main contribution of the rational expectations theory.

C) had been absorbed into the mainstream of macroeconomics.

D) is known as the monetary rule.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Mainstream economists contend that monetary policy tends to be destabilizing, in contrast to monetarists who believe that monetary policy is a stabilizing factor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Proponents of inflation targeting generally think that

A) the economy will have fewer, shorter, and less severe business cycles if the Fed holds the rate of inflation to low, targeted levels from year to year.

B) low interest rates are inflationary and high interest rates are deflationary.

C) fiscal policy is more effective in stabilizing the economy than monetary policy.

D) the Fed should strive to achieve zero inflation.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to monetarists, an expansionary fiscal policy is a weak stabilization tool because

A) the asset demand for money varies inversely with the rate of interest.

B) government borrowing to finance a deficit will raise the interest rate and reduce private investment.

C) government borrowing will reduce the supply of money in circulation and depress the GDP.

D) government borrowing to finance a deficit will lower interest rates, increase money balances, and lower velocity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If M is $1,000, P is $8, and Q is 500, then V must be 6.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The equation of exchange indicates that

A) MQ equals VP.

B) the velocity of money and the supply of money vary proportionately with one another.

C) other things being equal, an increase in V will increase P and/or Q.

D) other things being equal, M and P are inversely related.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to monetarists, the Great Depression in the United States largely resulted from

A) contractionary fiscal policy.

B) excessive imports relative to exports.

C) significant changes in technology and resource availability.

D) inappropriate monetary policy.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

So-called market monetarists suggest that the Fed, based on economic performance data over the past many decades, should aim for which of the following targets?

A) a 5 percent per year growth in nominal GDP

B) a 5 percent per year inflation rate

C) a 5 percent unemployment rate

D) a 5 percent per year expansion of real GDP

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Last Word) Market monetarists believe that to inform changes in monetary policy, the Fed should set up a prediction market for

A) the money supply.

B) nominal GDP.

C) real GDP.

D) the inflation rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The policy rule recommended by monetarists is that the money supply should be increased at the same rate as the potential growth in

A) real GDP.

B) population.

C) the level of prices.

D) the velocity of money.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In the theory of coordination failures, shifts of the nation's long-run aggregate supply curve are the main cause of business cycles.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The mainstream view of macro instability is that

A) changes in the money supply directly cause changes in aggregate demand and thus cause changes in real GDP.

B) changes in investment shift the aggregate demand curve and thus cause changes in real GDP.

C) bursts of innovation put the economy on an unsustainable growth path, eventually producing recession.

D) changes in technology and resource availability are the two main sources of fluctuations of real GDP.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Crowding-out results from

A) an increase in the supply of money and a decrease in the velocity of money.

B) a decrease in the supply of money and an increase in the velocity of money.

C) the inverse relationship between the supply of money and nominal GDP.

D) deficit financing that increases interest rates and reduces investment.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The velocity of money is equal to

A) 1/MPS.

B) nominal GDP/M.

C) 1/reserve ratio.

D) nominal GDP/P.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

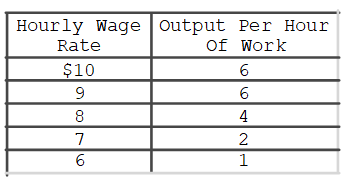

Refer to the table.The efficiency wage is

Refer to the table.The efficiency wage is

A) $10.

B) $9.

C) $8

D) $6.Type: Table

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 225

Related Exams