A) equilibrium GDP will now be $350.

B) equilibrium GDP will now be $400.

C) equilibrium GDP will now be $300.

D) the equilibrium GDP cannot be determineD.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The major basic premise of the aggregate expenditures model is that if the total demand for output increases, then firms will raise their prices.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

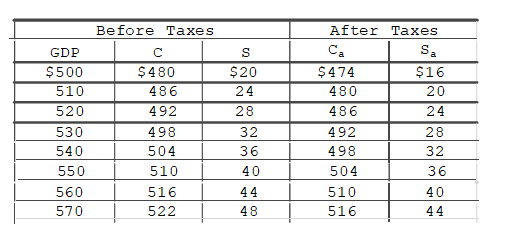

Refer to the accompanying table.The tax in the economy is a

Refer to the accompanying table.The tax in the economy is a

A) 10 percent proportional tax.

B) lump-sum tax of $20.

C) lump-sum tax of $10.

D) progressive tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Classical economists held the view that in the economy,

A) demand creates its own supply.

B) unemployment is temporary and is soon eliminated.

C) there is an imbalance between saving and investment.

D) it is difficult for an economy to adjust because wages and prices are inflexible.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a lump-sum income tax of $25 billion is levied and the MPS is 0.20, the

A) saving schedule will shift upward by $5 billion.

B) consumption schedule will shift downward by $25 billion.

C) consumption schedule will shift downward by $20 billion.

D) consumption schedule will shift upward by $25 billion.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2008 during the Great Recession, the Federal government provided tax rebate checks to taxpayers in the hope that

A) C would shift down.

B) C would shift up.

C) G would shift down.

D) G would shift up.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If government decreases its purchases by $20 billion and the MPC is 0.8, equilibrium GDP will decrease by $100 billion.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an unintended increase in business inventories occurs,

A) we can expect aggregate production to be unaffected.

B) we can expect businesses to increase the level of production.

C) we can expect businesses to lower the level of production.

D) aggregate expenditures must exceed the domestic output.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

When there are unplanned increases in inventories, then actual investment ends up being less than planned investment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things being equal, a decrease in an economy's exports will

A) increase domestic aggregate expenditures and the equilibrium level of GDP.

B) decrease domestic aggregate expenditures and the equilibrium level of GDP.

C) have no effect on domestic GDP, because imports will offset the change in exports.

D) increase the amount of imports consumed by the private sector.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A $20 billion decrease in investment in a private closed economy that has an MPS of 0.5 will reduce saving by $10 billion once the multiplier process has ended.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) Assume the saving schedule for a private closed economy is S = -20 + 0.2Y, where S is saving and Y is gross domestic product.The multiplier for this economy is

A) 3.

B) 4.

C) 5.

D) 10.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount by which an aggregate expenditures schedule must shift upward to achieve the full-employment GDP is a(n)

A) inflationary expenditure gap

B) recessionary expenditure gap.

C) expenditure multiplier gap.

D) negative net export gap.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Positive net exports increase aggregate expenditures beyond what they would be in a closed economy and thus have an expansionary effect on domestic GDP.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the economy is operating at its full-employment, noninflationary GDP and the MPC is 0.75.The federal government now finds that it must increase spending on military goods by $21 billion in response to deterioration in the international political situation.To sustain full-employment, noninflationary GDP, government must

A) reduce taxes by $28 billion.

B) reduce transfer payments by $21 billion.

C) increase taxes by $21 billion.

D) increase taxes by $28 billion.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In an open mixed economy, the inflationary expenditure gap may be described as the

A) excess of GDP over Ca + Ig + Xn + G at the full-employment output.

B) excess of Sa + M + T over Ig + X + G at the full-employment GDP.

C) extra consumption that occurs when investment increases in a full-employment economy.

D) excess of Ca + Ig + Xn + G at the full-employment GDP.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an increase in aggregate expenditures results in no increase in real GDP, we can surmise that the

A) economy is in a deep recession.

B) MPC equals 1.

C) economy is already operating at full employment.

D) price level has fallen.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Planned investment is $20 billion and saving is $15 billion when GDP in the economy is $180 billion.The economy

A) is at the equilibrium level of GDP.

B) is disequilibrium and its GDP will increase.

C) is disequilibrium and its GDP will decrease.

D) has a GDP level that is greater than its aggregate expenditures.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which event would most likely decrease an economy's exports?

A) a decline in the tariff on products imported from abroad

B) an increase the prosperity of trading partners for this economy

C) an appreciation of the nation's currency relative to foreign currencies

D) a depreciation of the nation's currency relative to foreign currencies

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

GDP C S Ig $100 $100 $0 $80 200 160 40 80 300 220 80 80 400 280 120 80 500 340 160 80 600 400 200 80 700 460 240 80 Refer to the accompanying information for a closed economy.If government now spends $80 billion at each level of GDP and taxes remain at zero, the equilibrium GDP

A) will rise to $700.

B) will rise to $600.

C) will rise to $500.

D) may either rise or fall.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 199

Related Exams