B) False

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer's note or promise to pay satisfies the "actually paid" requirement for the cash basis method of accounting.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

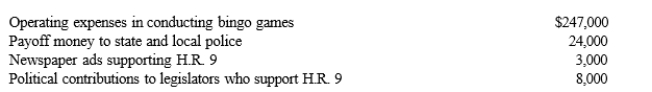

Rex, a cash basis calendar year taxpayer, runs a bingo operation that is illegal under state law.During 2019, a bill designated H.R.9 is introduced into the state legislature, which, if enacted, would legitimize bingo games.In 2019, Rex had the following expenses:  Of these expenditures, Rex may deduct:

Of these expenditures, Rex may deduct:

A) $247,000.

B) $250,000.

C) $258,000.

D) $282,000.

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The inclusion amount for a leased automobile is adjusted by a business usage percentage.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On May 5 of the current tax year, Byrne purchased a patent that qualifies as a § 197 intangible.The cost of the patent was $207,000 and Byrne is a calendar year taxpayer.In the current tax year, how much of the patent's cost may Byrne amortize?

A) $1,150.

B) $4,600.

C) $9,200.

D) $13,800.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Under MACRS, equipment falling in the 7-year MACRS class will be cost recovered over seven tax years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On May 30, 2018, Jane purchased a factory building to use for her business.In August 2019, Jane paid $300,000 for improvements to the building.Determine Jane's total deduction with respect to the building improvements for 2019.

A) $2,889

B) $4,173

C) $4,815

D) $25,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Regarding research and experimental expenditures, which of the following are not qualified expenditures?

A) Costs of ordinary testing of materials.

B) Costs to develop a plant process.

C) Costs of developing a formula.

D) Depreciation on a building used for research.

E) All of these are qualified expenditures.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bhaskar purchased a new factory building and land on September 10, 2019, for $3,700,000.($500,000 of the purchase price was allocated to the land.) He elected the alternative depreciation system (ADS) .Determine the cost recovery deduction for 2020.

A) $23,328

B) $80,000

C) $82,048

D) $92,500

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a publicly traded corporation hires a new CEO in 2019 and she earns $12,000,000 from a performance-based compensation plan, the corporation can deduct the entire $12,000,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Orange Corporation begins business on April 2, 2019.The corporation reports startup expenditures of $64,000 all incurred last year.Determine the total amount that Orange can elect to deduct in 2019.

A) $0

B) $3,200

C) $4,267

D) $7,950

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

All listed property is subject to the substantiation requirements of § 274.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Taxpayers may elect to use the straight-line method under MACRS for personalty.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Property that is classified as personalty may be depreciated.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A baseball team that pays a star player an annual salary of $25 million can deduct the entire $25 million as salary expense.If the same amount is paid to the CEO of IBM, only $1 million is deductible.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tommy, an automobile mechanic employed by an auto dealership, is considering opening a fast-food franchise.If Tommy decides not to acquire the fast-food franchise, any investigation expenses are:

A) A deduction for AGI.

B) A deduction from AGI, subject to the 2% floor.

C) A deduction from AGI, not subject to the 2% floor.

D) Deductible up to $5,000 in the current year with the balance being amortized over a 180-month period.

E) Not deductible.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On July 17, 2018, Kevin places in service a used automobile that cost $25,000.The car is used 80% for business and 20% for personal use.In 2019, he used the automobile 40% for business and 60% for personal use.Determine the cost recovery recapture for 2019.

A) $0

B) $528

C) $2,000

D) $2,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A used $35,000 automobile that is used 100% for business is placed in service in 2019.If the automobile fails the 50% business usage test in the second year, no cost recovery will be recaptured.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Property used for the production of income is not eligible for § 179 expensing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blue Corporation incurred the following expenses in connection with the development of a new product:  Blue expects to begin selling the product next year.If Blue elects to amortize research and experimental expenditures over 60 months, determine the amount of the deduction for research and experimental expenditures for the current year.

Blue expects to begin selling the product next year.If Blue elects to amortize research and experimental expenditures over 60 months, determine the amount of the deduction for research and experimental expenditures for the current year.

A) $0

B) $118,000

C) $143,000

D) $152,000

E) $160,000

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 143

Related Exams