Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 32

True/False

As a firm's sales grow, its current assets also tend to increase. For instance, as sales increase, the firm's inventories generally increase, and purchases of inventories result in more accounts payable. Thus, spontaneous liabilities that reduce AFN arise from transactions brought on by sales increases.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 33

True/False

Errors in the sales forecast can be offset by similar errors in costs and income forecasts. Thus, as long as the errors are not large, sales forecast accuracy is not critical to the well-being of the firm.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 34

True/False

One of the first steps in arriving at a firm's forecasted financial statements is a review of industry-average operating ratios relative to these same ratios for the firm to determine whether changes to the ratios need to be made.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 35

True/False

A rapid build-up of inventories normally requires additional financing, unless the increase is matched by an equally large decrease in some other asset.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 36

Multiple Choice

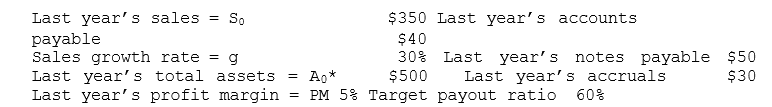

Clayton Industries is planning its operations for next year, and Ronnie Clayton, the CEO, wants you to forecast the firm's additional funds needed (AFN) . The firm is operating at full capacity. Data for use in your forecast are shown below. Based on the AFN equation, what is the AFN for the coming year?

A) $102.8

B) $108.2

C) $113.9

D) $119.9

E) $125.9

F) B) and C)

G) D) and E)

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 46 of 46

Related Exams