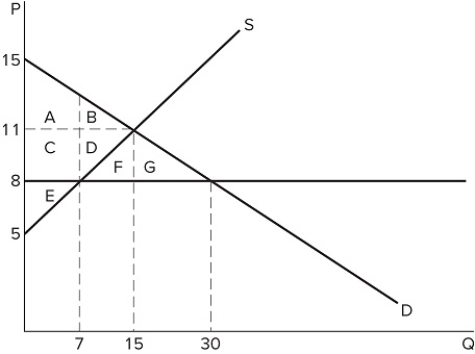

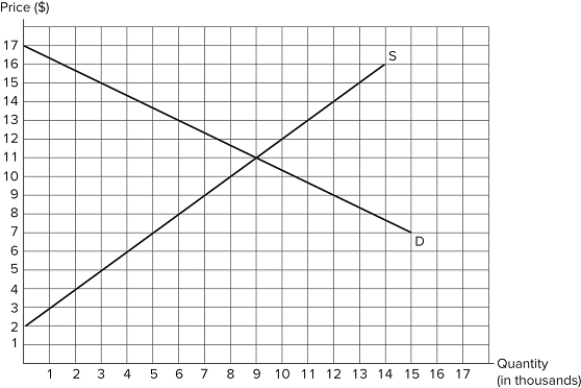

A) a shortage of 7 units will occur.

B) a shortage of 15 units will occur.

C) a shortage of 23 units will occur.

D) a shortage of 8 units will occur.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a binding price ceiling is set in the market shown in the graph:

If a binding price ceiling is set in the market shown in the graph:

A) quantity demanded will exceed quantity supplied.

B) quantity supplied will exceed quantity demanded.

C) the demand curve will have to shift.

D) the supply curve will have to shift.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

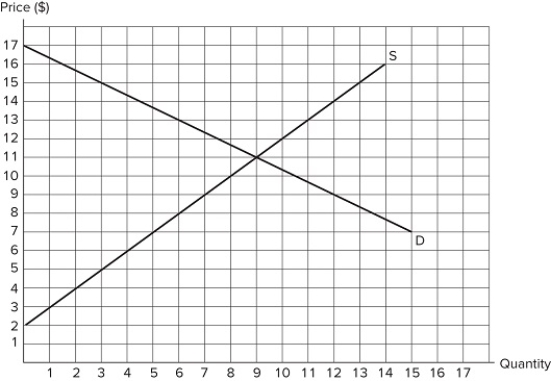

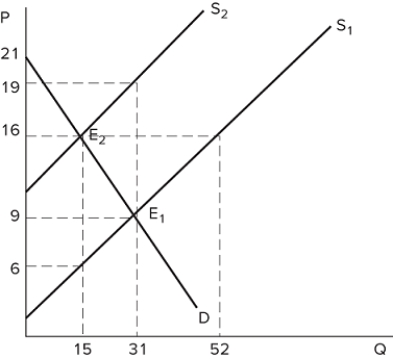

Which kind of tax is most likely demonstrated by the graph shown?

Which kind of tax is most likely demonstrated by the graph shown?

A) A tax on sellers

B) A tax on buyers

C) A tax on big corporations

D) None of these is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Policymakers who wish to discourage businesses that pollute by taxing them:

A) forget that businesses will pass the entire tax onto consumers.

B) should place a tax on consumers instead in order to increase the burden on sellers.

C) should place a tax on producers instead in order to increase the burden on sellers.

D) forget that some of the tax burden will be shared by consumers.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

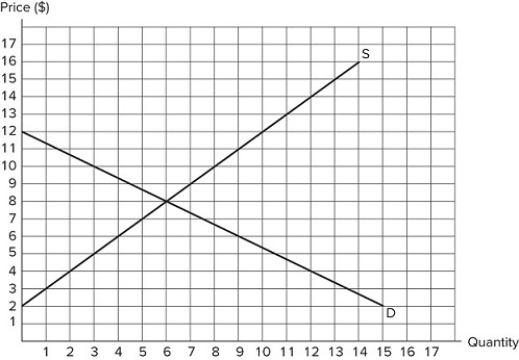

According to the market in the graph shown, at which of the following prices could a binding price ceiling be set?

According to the market in the graph shown, at which of the following prices could a binding price ceiling be set?

A) $15

B) $11

C) $8

D) A binding price ceiling could not be set at any of these prices.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Normative analysis:

A) involves the formulation and testing of hypotheses.

B) is a value-free evaluation of a policy.

C) involves a value judgement regarding the desirability of a policy.

D) examines if a policy actually accomplished its goal.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

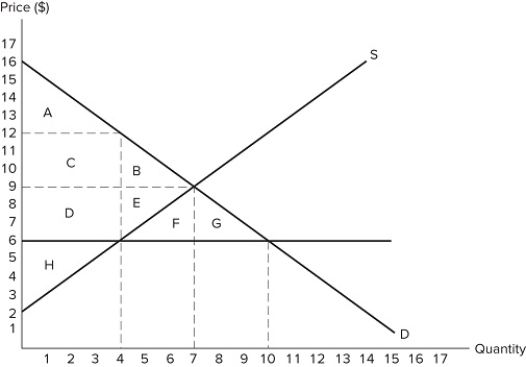

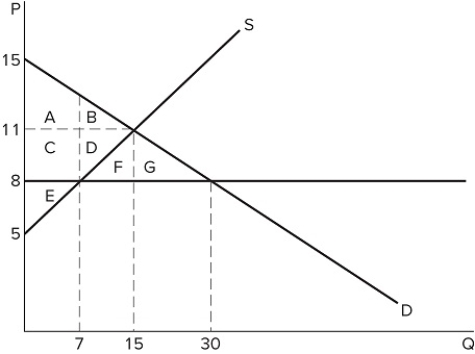

If the intended aim of the price ceiling set at $6, as shown in the graph, was a net increase in the well-being of consumers, then normative analysis would conclude that the policy was:

If the intended aim of the price ceiling set at $6, as shown in the graph, was a net increase in the well-being of consumers, then normative analysis would conclude that the policy was:

A) effective because the surplus gained by consumers through lower prices is less than the surplus they lost due to fewer transactions taking place.

B) ineffective because the surplus gained by consumers through lower prices is less than the surplus they lost due to fewer transactions taking place.

C) effective because the surplus lost by producers through lower prices is less than the surplus gained by consumers through lower prices.

D) There is no "right" conclusion to be reached (in a normative sense) because different people will have different opinions concerning what constitutes a better outcome.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Governments might choose to intervene in a market in an attempt to:

A) encourage the consumption of certain goods.

B) discourage the consumption of certain goods.

C) redistribute surplus.

D) All of these are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on sellers causes

A) equilibrium price to increase and equilibrium quantity to decrease.

B) equilibrium price and quantity to increase.

C) equilibrium price and quantity to decrease.

D) equilibrium price to decrease and equilibrium quantity to increase.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When would a subsidy to sellers benefit buyers more than sellers?

A) If the buyers are more deserving of the subsidy.

B) When the demand curve is relatively more elastic than the supply curve.

C) When the demand curve is relatively less elastic than the supply curve.

D) Buyers can never benefit more than sellers from a subsidy to sellers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If sellers bear a greater tax burden than buyers in a market, which of the following must be true?

A) The sellers are not as business savvy as the buyers.

B) The supply curve must be more inelastic than the demand curve.

C) The sellers face a very inelastic demand.

D) The supply curve must be more elastic than the demand curve.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Does a tax on buyers affect the supply curve?

A) Yes; the supply curve shifts to the left by the amount of the tax.

B) Yes; the supply curve shifts to the right by the amount of the tax.

C) Yes; the supply curve shifts up by the amount of the tax.

D) No; the supply curve does not move, as there is a change in the quantity supplied instead.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What do we call situations in which the assumption of efficient, competitive markets fails to hold?

A) Market failures

B) Inelastic-response markets

C) Missing markets

D) Market interventions

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a $5 tax is imposed on sellers in the market shown in the graph. Which of the following statements is true?Producers bear more of the tax burden than consumers.The tax-inclusive price (or after-tax price) received by sellers is $8.The deadweight loss is $15,000.

Suppose a $5 tax is imposed on sellers in the market shown in the graph. Which of the following statements is true?Producers bear more of the tax burden than consumers.The tax-inclusive price (or after-tax price) received by sellers is $8.The deadweight loss is $15,000.

A) I only

B) II and III only

C) I and II only

D) I, II, and III

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

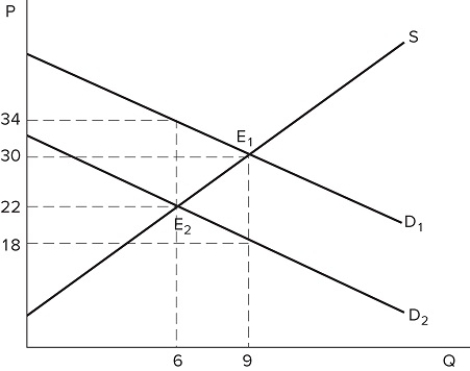

The graph shown demonstrates a tax on sellers. Who bears the greater economic tax incidence?

The graph shown demonstrates a tax on sellers. Who bears the greater economic tax incidence?

A) The sellers

B) The buyers

C) The government

D) The incidence is equally shared between buyers and sellers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In evaluating policy effectiveness, economists rely on:

A) positive analysis.

B) normative analysis.

C) both normative and positive analysis.

D) Economists can never fully analyze any real-world policy effectiveness.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Does a tax on sellers affect the demand curve?

A) Yes; the demand curve shifts to the left by the amount of the tax.

B) Yes; the demand curve shifts to the right by the amount of the tax.

C) Yes; the demand curve shifts up by the amount of the tax.

D) No; the demand curve does not move, as there is a change in the quantity demanded instead.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price ceiling is:

A) a legal maximum price.

B) a legal minimum price.

C) a legal maximum quantity that can be sold at a particular price.

D) a legal minimum quantity that can be sold at a particular price.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a price floor is set at $10 in the market shown in the graph. Which of the following statements is true?I. All consumers are worse off due to the higher price.II. All producers are better off, because producer surplus increases.III. The economy as a whole is worse off, because total surplus falls.

Suppose a price floor is set at $10 in the market shown in the graph. Which of the following statements is true?I. All consumers are worse off due to the higher price.II. All producers are better off, because producer surplus increases.III. The economy as a whole is worse off, because total surplus falls.

A) II only

B) I and III only

C) III only

D) I, II, and III

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price ceiling that is set at $8 in the market shown in the graph is:

A price ceiling that is set at $8 in the market shown in the graph is:

A) non-binding and would not affect the market.

B) binding and would cause a shortage.

C) binding and would cause excess supply.

D) non-binding and would not prevent the market from reaching equilibrium.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 171

Related Exams