A) B + C + D

B) B + C

C) C

D) B

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

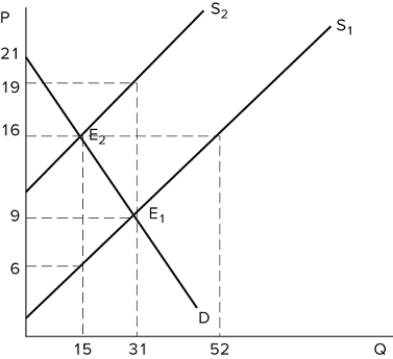

The graph shown demonstrates a tax on sellers. The post-tax price paid by buyers is _______ than that received by sellers, and the difference is the _______. Leading is incorrect on this QS.

The graph shown demonstrates a tax on sellers. The post-tax price paid by buyers is _______ than that received by sellers, and the difference is the _______. Leading is incorrect on this QS.

A) greater; tax wedge

B) less; total tax revenue

C) greater; total tax revenue

D) less; tax wedge

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

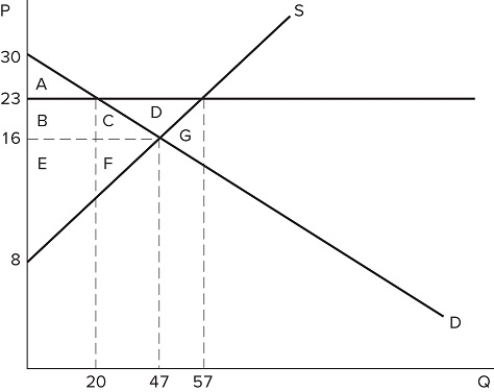

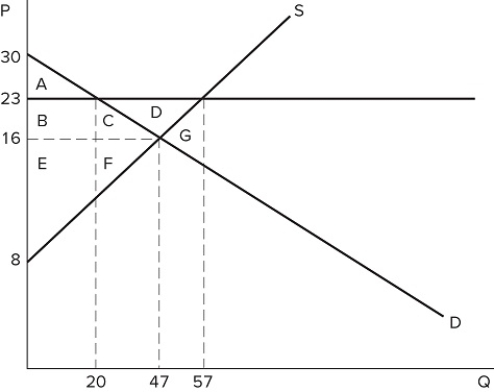

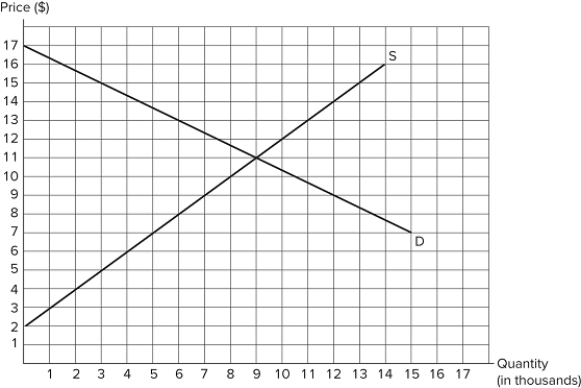

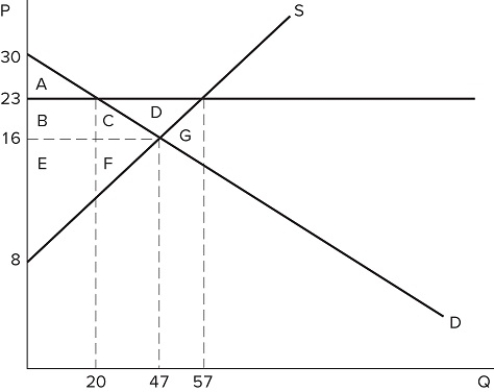

A price floor in the market shown in the graph would be non-binding if it were set at:

A price floor in the market shown in the graph would be non-binding if it were set at:

A) $30.

B) $23.

C) $16.

D) Any of these prices.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The graph shown demonstrates a tax on sellers. After the tax is in place, buyers experience:

The graph shown demonstrates a tax on sellers. After the tax is in place, buyers experience:

A) a decrease in demand.

B) an increase in demand.

C) a decrease in quantity demanded.

D) an increase in quantity demanded.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Does a subsidy to sellers affect the demand curve?

A) Yes; the demand curve shifts up by the amount of the subsidy.

B) Yes; the demand curve shifts to the right by the amount of the subsidy.

C) No; the demand curve does not move, as quantity demanded increases instead.

D) No; the demand curve does not move, as quantity demanded decreases instead.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price floor is set at $23 in the market shown in the graph:

If a price floor is set at $23 in the market shown in the graph:

A) excess supply of 27 will occur.

B) excess supply of 37 will occur.

C) excess supply of 10 will occur.

D) no excess supply will occur.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

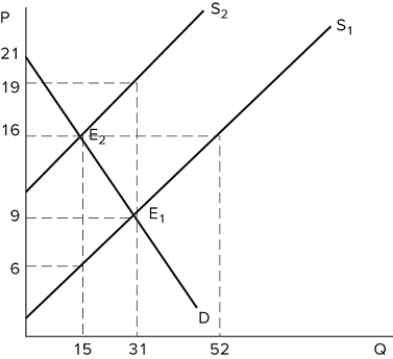

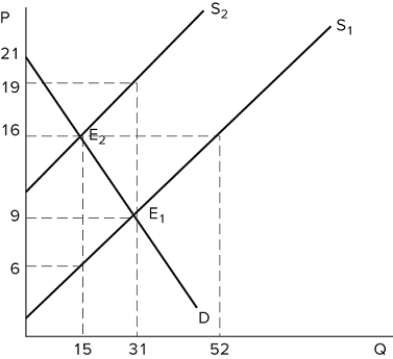

The graph shown demonstrates a tax on sellers. After the tax has been imposed, the sellers produce _______ units, and the post-tax price received for each one sold is _______.

The graph shown demonstrates a tax on sellers. After the tax has been imposed, the sellers produce _______ units, and the post-tax price received for each one sold is _______.

A) 15; $16

B) 15; $6

C) 31; $9

D) 31; $19

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What type of public policy could a government set in response to rising prices of a basic necessity?

A) Make it illegal to charge higher prices for the good

B) Hire more producers of the good

C) Subsidize the price of the good

D) All of these are ways a government can try to address rising prices of a basic necessity.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A binding price floor:

A) will cause quantity demanded to exceed quantity supplied.

B) will cause quantity supplied to exceed quantity demanded.

C) will increase total well-being.

D) will set a legal maximum price in a market.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

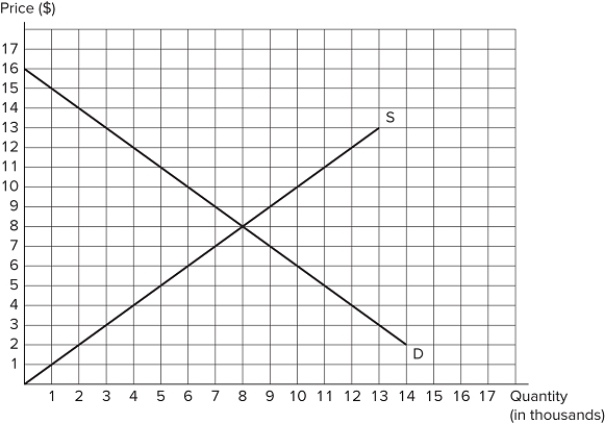

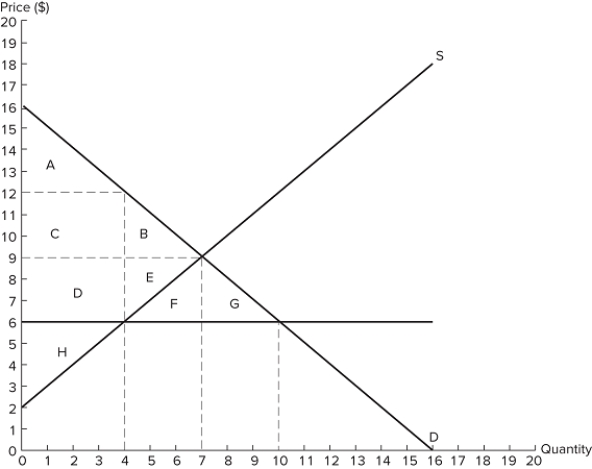

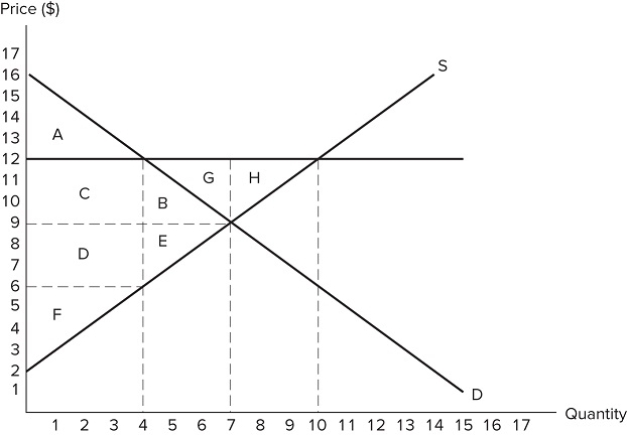

Suppose a $4 tax is imposed on sellers in the market shown in the graph. The tax-inclusive price (or after-tax price) paid by the buyer will be _______ and the tax-inclusive price (or after-tax price) received by the seller will be _______.

Suppose a $4 tax is imposed on sellers in the market shown in the graph. The tax-inclusive price (or after-tax price) paid by the buyer will be _______ and the tax-inclusive price (or after-tax price) received by the seller will be _______.

A) $12; $8

B) $11; $5

C) $8; $4

D) $10; $6

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A binding price ceiling:

A) will cause quantity supplied to exceed quantity demanded.

B) will increase total well-being.

C) will set a legal minimum price in a market.

D) will cause quantity demanded to exceed quantity supplied.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

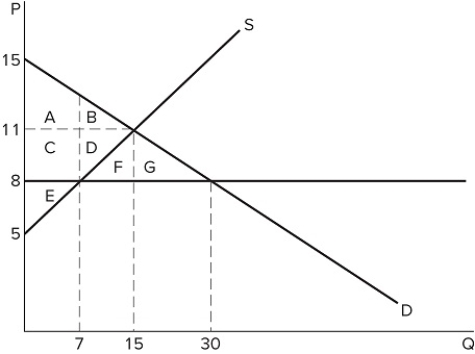

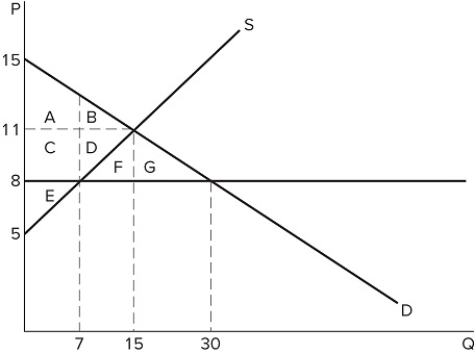

If a price ceiling is set at $8 in the market shown in the graph, which area(s) would represent deadweight loss?

If a price ceiling is set at $8 in the market shown in the graph, which area(s) would represent deadweight loss?

A) F + G

B) B + D

C) E

D) B + D + F + G

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

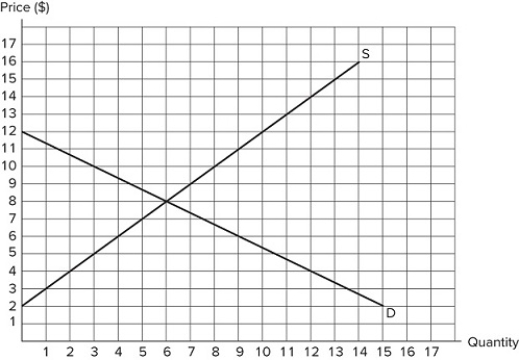

Suppose a $5 tax is imposed on buyers in the market shown in the graph. What will be the tax-inclusive price paid by the buyers as a result of this tax?

Suppose a $5 tax is imposed on buyers in the market shown in the graph. What will be the tax-inclusive price paid by the buyers as a result of this tax?

A) $8

B) $16

C) $13

D) $6

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price ceiling is set at $8 in the market in the graph shown:

If a price ceiling is set at $8 in the market in the graph shown:

A) some consumers will benefit because they pay a lower price.

B) producers will lose because they sell at a lower price.

C) the quantity traded in the market will fall.

D) All of these are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the intended aim of the price ceiling set at $6, as shown in the graph, was a net increase in the well-being of consumers, the policy was:

If the intended aim of the price ceiling set at $6, as shown in the graph, was a net increase in the well-being of consumers, the policy was:

A) effective because consumers gained in surplus overall.

B) ineffective because some consumers lost surplus.

C) ineffective because consumers lost surplus overall.

D) effective because all consumers gained surplus.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a price floor is set at $10 in the market shown in the graph. Which of the following statements is true?

Suppose a price floor is set at $10 in the market shown in the graph. Which of the following statements is true?

A) A shortage of five units occurs

B) Excess supply of five units occurs

C) Total surplus increases

D) Deadweight loss falls

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

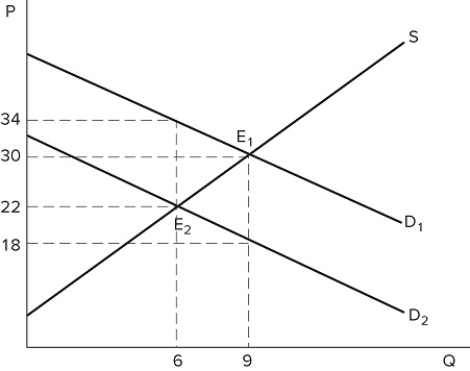

The graph shown best represents:

The graph shown best represents:

A) a binding price ceiling.

B) a binding price floor.

C) a missing market.

D) the market for an inferior good.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The graph shown demonstrates a tax on buyers. After the tax is in place, buyers purchase _______ units, and the post-tax price paid for each one is _______.

The graph shown demonstrates a tax on buyers. After the tax is in place, buyers purchase _______ units, and the post-tax price paid for each one is _______.

A) 6; $22

B) 6; $34

C) 9; $18

D) 9; $30

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the intended aim of the price floor set at $12, as shown in the graph, was a net increase in the well-being of producers, then positive analysis would consider the policy to be:

If the intended aim of the price floor set at $12, as shown in the graph, was a net increase in the well-being of producers, then positive analysis would consider the policy to be:

A) effective if area C is larger than area E.

B) effective if areas E + B are larger than areas C + D + F.

C) ineffective if area B is larger than area E.

D) ineffective if areas E + B are larger than areas A + C + D + F.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Who benefits from a subsidy to sellers?

A) Only buyers benefit.

B) Only sellers benefit.

C) The benefit is shared by sellers and buyers depending on the elasticity of the supply and demand curves.

D) None of these statements are true.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 171

Related Exams