A) the monetary base to M2

B) the monetary base to M1

C) M1 to M2

D) the monetary base to fiat money

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The narrowest definition of money is:

A) the monetary base.

B) M1.

C) M2.

D) L.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Central banks have two essential functions:

A) managing the money supply and acting as a lender of last resort.

B) creating full employment and acting as a lender of last resort.

C) regulating financial markets and creating full employment.

D) regulating financial markets and collecting taxes.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

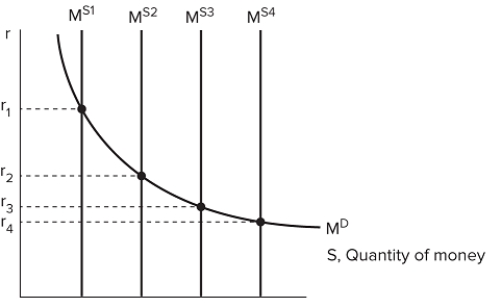

The graph shown displays the relationship between money and the interest rate.  The Fed could use open market operations to expand the economy from:

The Fed could use open market operations to expand the economy from:

A) M S1 to M S3.

B) M S3 to M S2.

C) M S4 to M S3.

D) M S2 to M S1.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money has replaced the need to barter, which is:

A) changing the price of goods in response to inflation.

B) using a medium of exchange to purchase goods and services.

C) directly offering a good or service in exchange for some other good or service you want.

D) comparing different goods to create a standard unit of worth.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

We say that money is a store of value because it:

A) represents a certain amount of purchasing power held over time.

B) can be used to purchase goods and services.

C) holds a fixed value over time.

D) provides a standard unit of comparison.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Banks earn money:

A) by lending funds and collecting interest on those loans.

B) through the accumulation of deposits.

C) by lending money to the government.

D) through government payments for regulation of the financial system.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

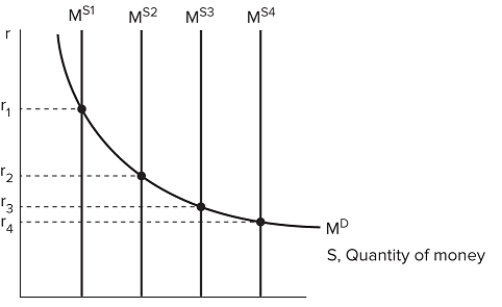

The graph shown displays the relationship between money and the interest rate.  The Fed could use open market operations to contract the economy from:

The Fed could use open market operations to contract the economy from:

A) M S1 to M S3.

B) M S3 to M S4.

C) M S4 to M S3.

D) M S2 to M S3.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The discount window provides:

A) guaranteed emergency funds for banks in trouble at a higher interest rate than the federal funds rate.

B) loans to banks at low interest rates, so they can lend more money out to the public.

C) guaranteed emergency funds for banks in trouble at a lower interest rate.

D) loans to banks at low interest rates only when the economy is doing well.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed buys bonds through open market operations it gives banks money in return, which ______ banks' ability to lend and _______ aggregate demand.

A) increases; increases

B) decreases; increases

C) increases; decreases

D) decreases; decreases

F) A) and B)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

The reserve requirement is:

A) the regulation that sets the minimum fraction of deposits banks must hold in reserve.

B) the dollar amount of cash banks must keep on hand and not loan out.

C) the amount of gold the federal government needs to keep on hand to support the value of the dollar.

D) the cooling period between when money is created and when it can be spent in the economy.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiat money is:

A) any form of money that can be legally exchanged into a fixed amount of an underlying commodity.

B) money created by rule.

C) money used together with the barter of goods.

D) any form of money that trades goods with intrinsic value.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The nominal interest rate is determined by:

A) the intersection of money supply and money demand.

B) a country's central bank.

C) the demand for credit.

D) the amount of money supplied by the reserve requirement.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a good with intrinsic value?

A) Cigarettes

B) Fish

C) Gold

D) All of these goods have intrinsic value.

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

If the Fed wishes to slow economic activity, it might actively pursue:

A) expansionary fiscal policy.

B) expansionary monetary policy.

C) contractionary fiscal policy.

D) contractionary monetary policy.

F) A) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

The goal of contractionary monetary policy is to _______ the economy by _______ interest rates.

A) stimulate; reducing

B) stimulate; raising

C) slow down; reducing

D) slow down; raising

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What must be true when banks hold excess reserves?

A) The money multiplier overestimates how much money will be created in the economy.

B) The money multiplier underestimates how much money will be created in the economy.

C) The reserve ratio is not fully functioning and should be raised.

D) The reserve ratio is working too well and should be lowered.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the interest rate earned on government bonds is high, most people will try to hold _______ bonds and _______ cash.

A) more; less

B) fewer; more

C) more; more

D) fewer; less

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the simple liquidity-preference model, the money supply curve is:

A) vertical, and it moves at the sole discretion of the Fed.

B) horizontal, and it moves at the sole discretion of the Fed.

C) vertical, and it moves when people change their rate of savings.

D) horizontal, and it moves when people change their rate of savings.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Open Market Committee:

A) includes all regional bank presidents and the Board of Governors.

B) is the most important policy-making body of the Federal Reserve.

C) is responsible for regulatory oversight and implementation of monetary policy of regional banks.

D) is responsible for monitoring how goods and services are being sold on the open market.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 146

Related Exams