B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

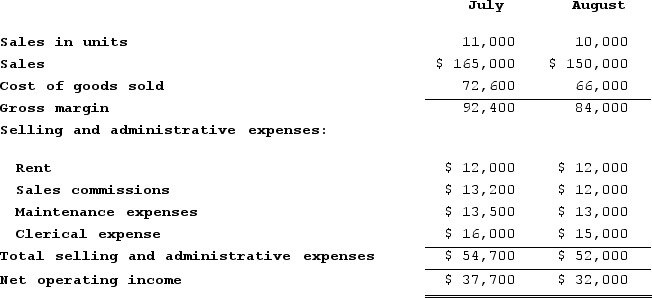

Comparative income statements for Boggs Sports Equipment Company for the last two months are presented below:  All of the company's costs are either fixed, variable, or a mixture of the two (i.e., mixed) . Assume that the relevant range includes all of the activity levels mentioned in this problem.Which of the selling and administrative expenses of the company is variable?

All of the company's costs are either fixed, variable, or a mixture of the two (i.e., mixed) . Assume that the relevant range includes all of the activity levels mentioned in this problem.Which of the selling and administrative expenses of the company is variable?

A) Rent

B) Sales Commissions

C) Maintenance Expense

D) Clerical Expense

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

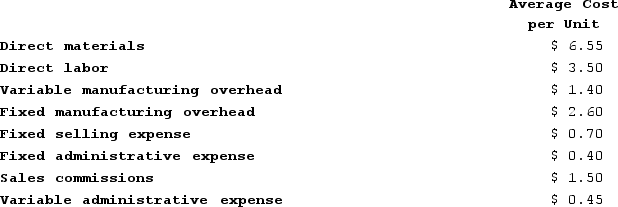

Dake Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows:  If 3,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

If 3,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

A) $4,200

B) $10,400

C) $14,600

D) $12,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

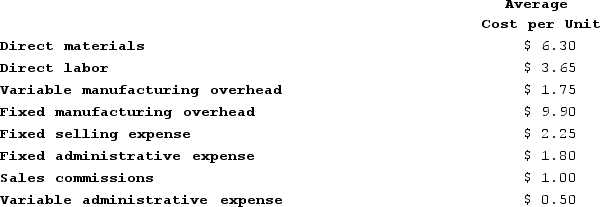

Mccaskell Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows:  If 8,000 units are produced, the total amount of direct manufacturing cost incurred is closest to:

If 8,000 units are produced, the total amount of direct manufacturing cost incurred is closest to:

A) $79,600

B) $93,600

C) $87,600

D) $172,800

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

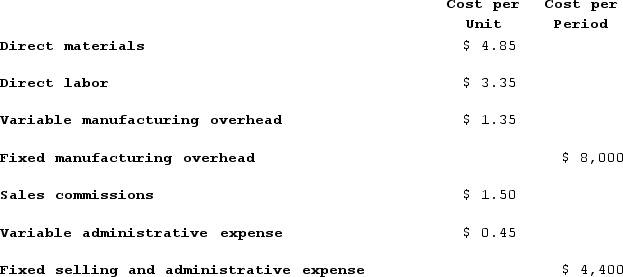

Lagle Corporation has provided the following information:  For financial reporting purposes, the total amount of product costs incurred to make 4,000 units is closest to:

For financial reporting purposes, the total amount of product costs incurred to make 4,000 units is closest to:

A) $46,200

B) $38,200

C) $8,000

D) $50,200

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cost incurred in the past that is not relevant to any current decision is classified as a(n) :

A) period cost.

B) opportunity cost.

C) sunk cost.

D) differential cost.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Norred Corporation has provided the following information:  If 8,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

If 8,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

A) $120,800

B) $134,300

C) $12,800

D) $121,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following cost data pertain to the operations of Quinonez Department Stores, Incorporated, for the month of September.  The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.What is the total amount of the costs listed above that are NOT direct costs of the Northridge Store?

The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.What is the total amount of the costs listed above that are NOT direct costs of the Northridge Store?

A) $150,900

B) $42,700

C) $43,680

D) $81,200

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vignana Corporation manufactures and sells hand-painted clay figurines of popular sports heroes. Shown below are some of the costs incurred by Vignana for last year:  What is the total of the product costs above?

What is the total of the product costs above?

A) $0

B) $81,000

C) $143,000

D) $161,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ouelette Corporation's relevant range of activity is 3,000 units to 7,000 units. When it produces and sells 5,000 units, its average costs per unit are as follows:  If 6,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

If 6,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

A) $15,000

B) $22,800

C) $7,800

D) $25,800

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would most likely NOT be included as manufacturing overhead in a furniture factory?

A) The cost of the glue in a chair.

B) The amount paid to the individual who stains a chair.

C) The workman's compensation insurance of the supervisor who oversees production.

D) The factory utilities of the department in which production takes place.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Traditional format income statements are widely used for preparing external financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

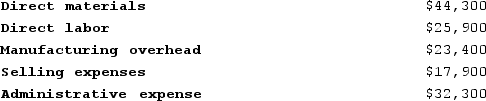

The following costs were incurred in May:  Prime costs during the month totaled:

Prime costs during the month totaled:

A) $93,600

B) $143,800

C) $70,200

D) $49,300

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of napkins put on each person's tray at a fast food restaurant is a variable cost with respect to how many persons are served.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Materials used in a factory that are not an integral part of the final product, such as cleaning supplies, should be classified as:

A) direct materials.

B) a period cost.

C) administrative expense.

D) manufacturing overhead.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

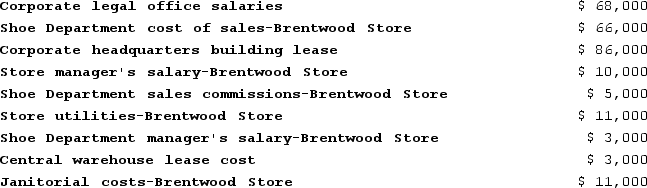

The following cost data pertain to the operations of Ladwig Department Stores, Incorporated, for the month of December.  The Brentwood Store is just one of many stores owned and operated by the company. The Shoe Department is one of many departments at the Brentwood Store. The central warehouse serves all of the company's stores.What is the total amount of the costs listed above that are NOT direct costs of the Brentwood Store?

The Brentwood Store is just one of many stores owned and operated by the company. The Shoe Department is one of many departments at the Brentwood Store. The central warehouse serves all of the company's stores.What is the total amount of the costs listed above that are NOT direct costs of the Brentwood Store?

A) $74,000

B) $32,000

C) $157,000

D) $86,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

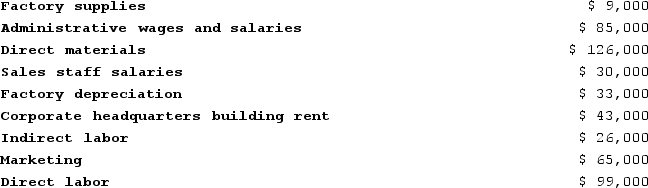

A partial listing of costs incurred during March at Febbo Corporation appears below:  The total of the period costs listed above for March is:

The total of the period costs listed above for March is:

A) $68,000

B) $293,000

C) $291,000

D) $223,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of a committed fixed cost is:

A) management training seminars.

B) a long-term equipment lease.

C) research and development.

D) advertising.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct in describing manufacturing overhead?

A) Manufacturing overhead when combined with direct materials cost forms conversion cost.

B) Manufacturing overhead consists of all manufacturing cost except for prime cost.

C) Manufacturing overhead is a period cost.

D) Manufacturing overhead when combined with direct labor cost forms prime cost.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

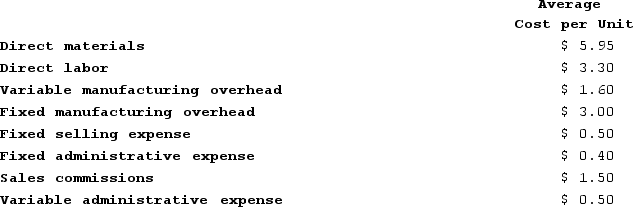

Varela Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows:  For financial reporting purposes, the total amount of product costs incurred to make 4,000 units is closest to:

For financial reporting purposes, the total amount of product costs incurred to make 4,000 units is closest to:

A) $43,400

B) $55,400

C) $59,400

D) $12,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 346

Related Exams