B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Leas Corporation staffs a helpline to answer questions from customers. The costs of operating the helpline are variable with respect to the number of calls in a month. At a volume of 25,000 calls in a month, the costs of operating the helpline total $452,500.To the nearest whole dollar, what should be the total cost of operating the helpline costs at a volume of 23,900 calls in a month? (Assume that this call volume is within the relevant range.) (Round intermediate calculations to 2 decimal places.)

A) $442,545

B) $452,500

C) $473,326

D) $432,590

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

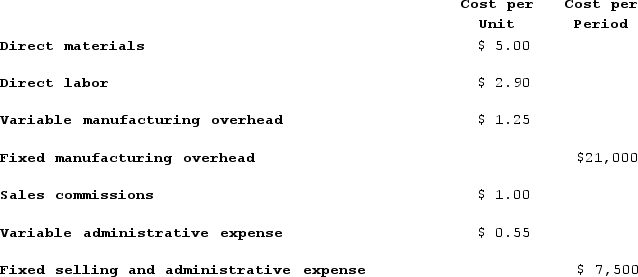

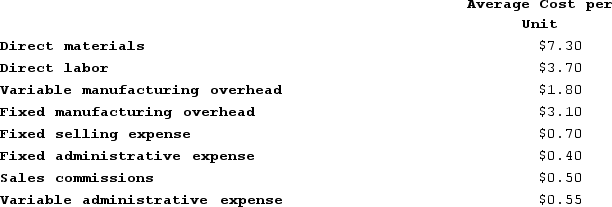

Perkey Corporation has provided the following information:  If 4,000 units are produced, the total amount of direct manufacturing cost incurred is closest to:

If 4,000 units are produced, the total amount of direct manufacturing cost incurred is closest to:

A) $53,400

B) $35,600

C) $36,600

D) $31,600

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Advertising is not considered as a product cost even if it promotes a specific product.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mark is an engineer who has designed a telecommunications device. He is convinced that there is a big potential market for the device. Accordingly, he has decided to quit his present job and start a company to manufacture and market the device.The cost of the raw materials that will be used in manufacturing the computer board is:

A) a sunk cost

B) a fixed cost

C) a period cost

D) a variable cost

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a period cost?

A) Depreciation of factory maintenance equipment.

B) Salary of a clerk who handles customer billing.

C) Insurance on a company showroom where customers can view new products.

D) Cost of a seminar concerning tax law updates that was attended by the company's controller.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At a sales volume of 20,000 units, Choice Corporation's sales commissions (a cost that is variable with respect to sales volume) total $132,000.To the nearest whole cent, what should be the average sales commission per unit at a sales volume of 18,500 units? (Assume that this sales volume is within the relevant range.)

A) $6.60

B) $6.87

C) $7.17

D) $7.14

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dizzy Amusement Park is open from 8:00 am till midnight every day of the year. Dizzy charges its patrons a daily entrance fee of $30 per person which gives them unlimited access to all of the park's 35 rides.Dizzy donates $2 of every entrance fee to a local homeless shelter. This charitable contribution would best be described as a:

A) fixed cost

B) mixed cost

C) step-variable cost

D) true variable cost

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

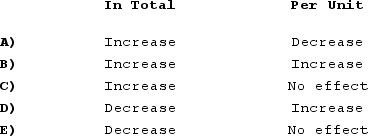

As the level of activity increases, how will a mixed cost in total and per unit behave?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

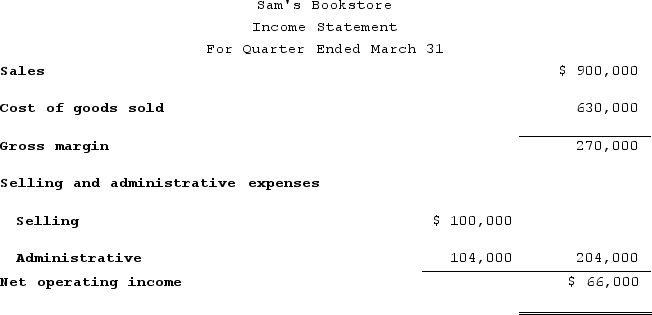

An income statement for Sam's Bookstore for the first quarter of the year is presented below:  On average, a book sells for $50. Variable selling expenses are $5 per book with the remaining selling expenses being fixed. The variable administrative expenses are 4% of sales with the remainder being fixed.If 20,000 books are sold during the second quarter and this activity is within the relevant range, the company's expected contribution margin would be:

On average, a book sells for $50. Variable selling expenses are $5 per book with the remaining selling expenses being fixed. The variable administrative expenses are 4% of sales with the remainder being fixed.If 20,000 books are sold during the second quarter and this activity is within the relevant range, the company's expected contribution margin would be:

A) $300,000

B) $160,000

C) $860,000

D) $58,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

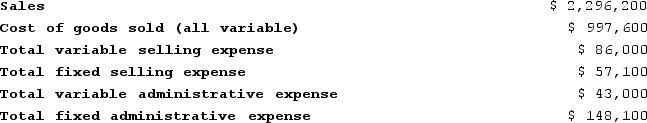

Essay

Wippert Corporation, a merchandising company, reported the following results for December:

Required:a. Prepare a traditional format income statement for December.b. Prepare a contribution format income statement for December.

Required:a. Prepare a traditional format income statement for December.b. Prepare a contribution format income statement for December.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Batterson Corporation leases its corporate headquarters building. This lease cost is fixed with respect to the company's sales volume. In a recent month in which the sales volume was 28,000 units, the lease cost was $697,200.To the nearest whole dollar, what should be the total lease cost at a sales volume of 29,200 units in a month? (Assume that this sales volume is within the relevant range.)

A) $712,140

B) $697,200

C) $727,080

D) $668,548

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The contribution format income statement is used as an internal planning and decision-making tool. Its emphasis on cost behavior aids cost-volume-profit analysis, management performance appraisals, and budgeting.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

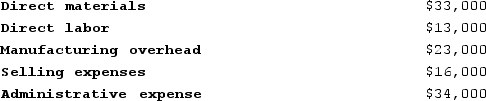

The following costs were incurred in May:  Prime costs during the month totaled:

Prime costs during the month totaled:

A) $36,000

B) $119,000

C) $69,000

D) $46,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The amount that a manufacturing company could earn by renting unused portions of its warehouse is an example of an opportunity cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

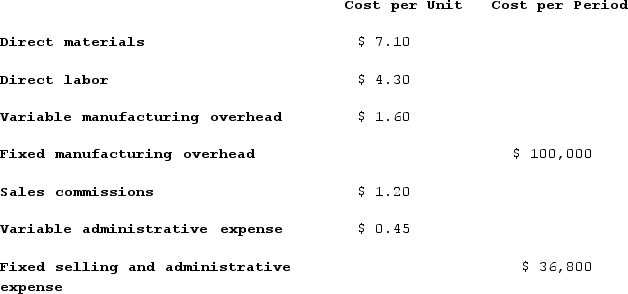

Bellucci Corporation has provided the following information:  The incremental manufacturing cost that the company will incur if it increases production from 8,000 to 8,001 units is closest to (assume that the increase is within the relevant range) :

The incremental manufacturing cost that the company will incur if it increases production from 8,000 to 8,001 units is closest to (assume that the increase is within the relevant range) :

A) $27.55

B) $13.00

C) $31.75

D) $25.50

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

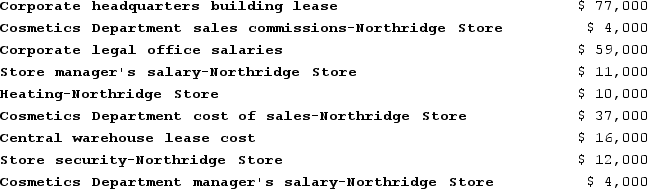

The following cost data pertain to the operations of Quinonez Department Stores, Incorporated, for the month of September.  The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.What is the total amount of the costs listed above that are direct costs of the Cosmetics Department?

The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.What is the total amount of the costs listed above that are direct costs of the Cosmetics Department?

A) $78,000

B) $45,000

C) $41,000

D) $37,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true when referring to fixed costs?

A) Committed fixed costs arise from the annual decisions by management.

B) As volume increases, unit fixed cost and total fixed cost will change.

C) Fixed costs increase in total throughout the relevant range.

D) Discretionary fixed costs can often be reduced to zero for short periods of time without seriously impairing the long-run goals of the company.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

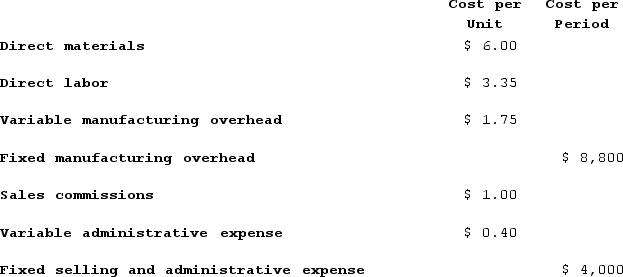

Glew Corporation has provided the following information:  For financial reporting purposes, the total amount of product costs incurred to make 4,000 units is closest to:

For financial reporting purposes, the total amount of product costs incurred to make 4,000 units is closest to:

A) $57,200

B) $8,800

C) $44,400

D) $53,200

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Perteet Corporation's relevant range of activity is 6,600 units to 13,000 units. When it produces and sells 9,800 units, its average costs per unit are as follows:  If 6,400 units are produced, the total amount of manufacturing overhead cost is closest to:

If 6,400 units are produced, the total amount of manufacturing overhead cost is closest to:

A) $31,360

B) $54,060

C) $41,900

D) $24,320

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 346

Related Exams