A) Yes, both divisions are always better off regardless of whether the selling division has enough idle capacity to handle all of the buying division's needs.

B) No, the selling division's price to outside customers is higher than the price that the buying division has to pay its outside supplier.

C) Yes, the minimum transfer price that the selling division should be willing to accept is less than the maximum transfer price that the buying division would accept.

D) The answer cannot be determined from the information that has been provided.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

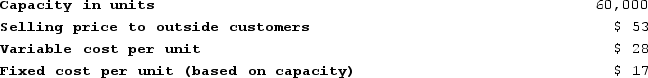

Bacot Products, Incorporated, has a Valve Division that manufactures and sells a number of products, including a standard valve that could be used by another division in the company, the Pump Division, in one of its products. Data concerning that valve appear below:  The Pump Division is currently purchasing 8,000 of these valves per year from an overseas supplier at a cost of $47 per valve.What is the maximum price that the Pump Division should be willing to pay for valves transferred from the Valve Division?

The Pump Division is currently purchasing 8,000 of these valves per year from an overseas supplier at a cost of $47 per valve.What is the maximum price that the Pump Division should be willing to pay for valves transferred from the Valve Division?

A) $45 per unit

B) $28 per unit

C) $47 per unit

D) $17 per unit

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Southern Division of Barstol Company makes and sells a single product, which is a part used in manufacturing trucks. The annual production capacity is 12,000 units and the variable cost of each unit is $35. Presently the Southern Division sells 11,000 units per year to outside customers at $49 per unit. The Northern Division of Barstol Company would like to buy 4,000 units a year from Southern to use in its production. There would be no savings in variable costs from transferring the units internally rather than selling them externally. The lowest acceptable transfer price from the standpoint of the Southern Division should be closest to:

A) $45.50 per unit

B) $35.00 per unit

C) $32.00 per unit

D) $49.00 per unit

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Tipton Division of Dudley Company reported the following data last year:  The division's net operating income last year was:

The division's net operating income last year was:

A) $250,000

B) $125,000

C) $100,000

D) $75,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If net operating income is $70,000, average operating assets are $250,000, and the minimum required rate of return is 16%, what is the residual income?

A) $11,200

B) $40,000

C) $110,000

D) $30,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

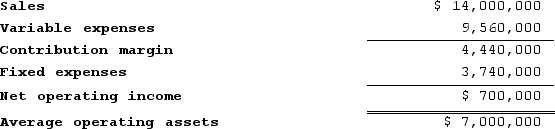

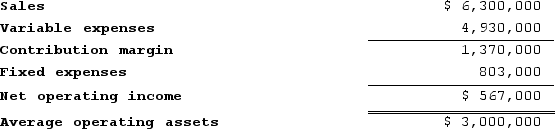

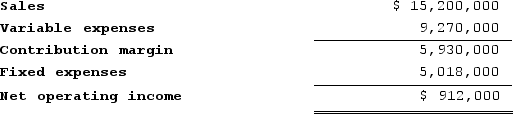

Weafer Incorporated reported the following results from last year's operations:  Last year's return on investment (ROI) was closest to:

Last year's return on investment (ROI) was closest to:

A) 10.0%

B) 50.0%

C) 5.0%

D) 63.4%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

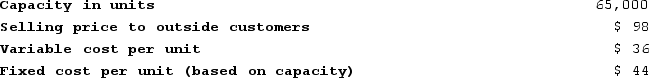

Germano Products, Incorporated, has a Pump Division that manufactures and sells a number of products, including a standard pump that could be used by another division in the company, the Pool Products Division, in one of its products. Data concerning that pump appear below:  The Pool Products Division is currently purchasing 10,000 of these pumps per year from an overseas supplier at a cost of $94 per pump.Assume that the Pump Division is selling all of the pumps it can produce to outside customers. Does there exist a transfer price that would make both the Pump and Pool Products Division financially better off than if the Pool Products Division were to continue buying its pumps from the outside supplier?

The Pool Products Division is currently purchasing 10,000 of these pumps per year from an overseas supplier at a cost of $94 per pump.Assume that the Pump Division is selling all of the pumps it can produce to outside customers. Does there exist a transfer price that would make both the Pump and Pool Products Division financially better off than if the Pool Products Division were to continue buying its pumps from the outside supplier?

A) Yes, both divisions are always better off regardless of whether the selling division has enough idle capacity to handle all of the buying division's needs.

B) Yes, the minimum transfer price that the selling division should be willing to accept is less than the maximum transfer price that the buying division should be willing to accept.

C) The answer cannot be determined from the information that has been provided.

D) No, the minimum transfer price that the selling division should be willing to accept exceeds the maximum transfer price that the buying division should be willing to accept.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

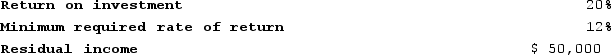

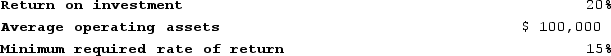

The following data has been provided for a company's most recent year of operations:  The residual income for the year was closest to:

The residual income for the year was closest to:

A) $20,000

B) $3,000

C) $5,000

D) $15,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tallon Incorporated has a $1,200,000 investment opportunity that involves sales of $1,680,000, fixed expenses of $336,000, and a contribution margin ratio of 30% of sales. The turnover for this investment opportunity is closest to:

A) 1.40

B) 0.10

C) 10.00

D) 0.71

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chavin Company had the following results during August: net operating income, $220,000; turnover, 5; and return on investment (ROI) 25%. Chavin Company's average operating assets were:

A) $880,000

B) $44,000

C) $55,000

D) $1,100,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

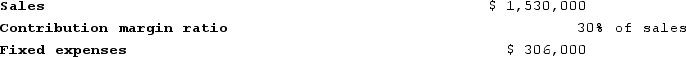

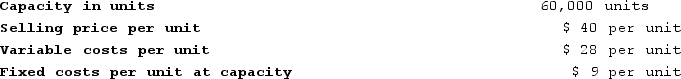

Robichau Incorporated reported the following results from last year's operations:  At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 20%.Last year's return on investment (ROI) was closest to:

The company's minimum required rate of return is 20%.Last year's return on investment (ROI) was closest to:

A) 47.6%

B) 18.9%

C) 9.0%

D) 45.7%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

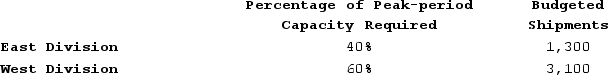

Wollan Corporation has two operating divisions-an East Division and a West Division. The company's Logistics Department services both divisions. The variable costs of the Logistics Department are budgeted at $44 per shipment. The Logistics Department's fixed costs are budgeted at $237,600 for the year. The fixed costs of the Logistics Department are determined based on peak-period demand.  At the end of the year, actual Logistics Department variable costs totaled $332,880 and fixed costs totaled $253,960. The East Division had a total of 4,300 shipments and the West Division had a total of 3,000 shipments for the year.How much actual Logistics Department cost should not be allocated to the operating divisions at the end of the year?

At the end of the year, actual Logistics Department variable costs totaled $332,880 and fixed costs totaled $253,960. The East Division had a total of 4,300 shipments and the West Division had a total of 3,000 shipments for the year.How much actual Logistics Department cost should not be allocated to the operating divisions at the end of the year?

A) $28,040

B) $0

C) $16,360

D) $11,680

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nasser Incorporated reported the following results from last year's operations:  Last year's return on investment (ROI) was closest to:

Last year's return on investment (ROI) was closest to:

A) 9.0%

B) 47.6%

C) 18.9%

D) 80.7%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

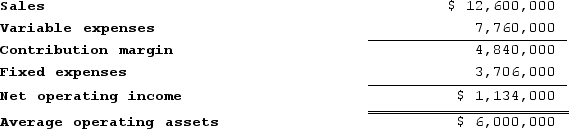

Brull Products, Incorporated, has a Sensor Division that manufactures and sells a number of products, including a standard sensor. Data concerning that sensor appear below:  The Safety Products Division of Brull Products, Inc needs 6,000 special heavy-duty sensors per year. The Sensor Division's variable cost to manufacture and ship this special sensor would be $60 per unit. Because these special sensors require more manufacturing resources than the standard sensor, the Sensor Division would have to reduce its production and sales of standard sensors to outside customers from 56,000 units per year to 46,400 units per year.From the standpoint of the Sensor Division, what is the minimal acceptable transfer price for the special sensors for the Safety Products Division?

The Safety Products Division of Brull Products, Inc needs 6,000 special heavy-duty sensors per year. The Sensor Division's variable cost to manufacture and ship this special sensor would be $60 per unit. Because these special sensors require more manufacturing resources than the standard sensor, the Sensor Division would have to reduce its production and sales of standard sensors to outside customers from 56,000 units per year to 46,400 units per year.From the standpoint of the Sensor Division, what is the minimal acceptable transfer price for the special sensors for the Safety Products Division?

A) $75.00 per unit

B) $77.00 per unit

C) $83.00 per unit

D) $96.80 per unit

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Parts Division of Nydron Corporation makes Part Y6P, which it sells to outside companies for $17.00 per unit. According to the cost accounting system, the costs of making one unit of Part Y6P consist of $7.00 for direct materials, $3.00 for direct labor, $4.50 for variable manufacturing overhead, and $1.20 for fixed manufacturing overhead. The Parts Division has enough idle capacity to make 1,000 units of Part Y6P each month. The Assembly Division of Nydron Corporation can use Part Y6P in one of its products. At present, the Assembly Division is purchasing an equivalent part from an outside supplier for $16.85 per unit. The Assembly Division needs 2,000 units of the part each month. It has been suggested that the Assembly Division buy Part Y6P from the Parts Division instead of buying the equivalent part from the outside supplier. The transfer price for this transaction would lie within what limits?

A) equal to or greater than $15.75 and less than or equal to $16.85

B) equal to or greater than $15.70 and less than or equal to $17.00

C) equal to or greater than $14.50 and less than or equal to $17.00

D) equal to or greater than $14.50 and less than or equal to $16.85

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wiswell Incorporated reported the following results from last year's operations:  The average operating assets were $8,000,000.At the beginning of this year, the company has a $900,000 investment opportunity that would involve sales of $2,070,000, a contribution margin ratio of 30% of sales, and fixed expenses of $538,200. The company's minimum required rate of return is 10%. If the company pursues the investment opportunity, this year's combined residual income for the entire company will be closest to:

The average operating assets were $8,000,000.At the beginning of this year, the company has a $900,000 investment opportunity that would involve sales of $2,070,000, a contribution margin ratio of 30% of sales, and fixed expenses of $538,200. The company's minimum required rate of return is 10%. If the company pursues the investment opportunity, this year's combined residual income for the entire company will be closest to:

A) $104,800

B) $925,600

C) ($19,800)

D) $994,800

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

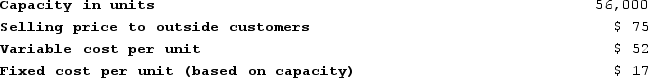

Division A of Tripper Company produces a part that it sells to other companies. Sales and cost data for the part follow:  Division B, another division of Tripper Company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $38 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.Assume that Division A is presently operating at capacity. According to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

Division B, another division of Tripper Company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $38 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.Assume that Division A is presently operating at capacity. According to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

A) $37 per unit

B) $39 per unit

C) $36 per unit

D) $38 per unit

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

Smurnov Company has a purchasing department that provides services to two factories located in Austin and the other in Belmont. Budgeted costs for the purchasing department consist of $91,000 per year of fixed costs and $7 per purchase order for variable costs. The level of budgeted fixed costs is determined by the peak-period requirements. The Austin factory requires 3/7 of the peak-period capacity and the Belmont factory requires 4/7.During the year, 2,700 purchase orders were processed for the Austin factory and 3,900 purchase orders for the Belmont factory.Required:Compute the amount of purchasing department cost that should be charged to each factory for the year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

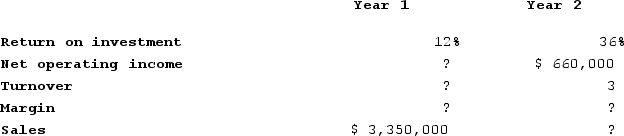

The Millard Division's operating data for the past two years are provided below:  Millard Division's margin in Year 2 was 150% of the margin in Year 1.The sales for Year 2 were:

Millard Division's margin in Year 2 was 150% of the margin in Year 1.The sales for Year 2 were:

A) $2,200,000

B) $3,350,000

C) $5,500,000

D) $5,833,333

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two of the decentralized divisions of Gamberi Electronics Corporation are the Plastics Division and the Components Division. The Plastics Division sells molded parts to both the Components Division and to customers outside the corporation.Assume that the Plastics Division is currently operating with idle capacity. Also assume that the Components Division wants to purchase from Plastics all of the additional parts that could be made with this idle capacity. In order to increase its current level of profitability, the Plastics Division should accept any transfer price on these additional parts that is above the:

A) variable cost of the additional parts.

B) full (absorption) cost of the additional parts.

C) variable cost of the additional parts plus the lost contribution margin on all units that could no longer be sold to customers outside the corporation.

D) full (absorption) cost of the additional parts plus the lost contribution margin on all units that could no longer be sold to customers outside the corporation.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 335

Related Exams