A) The loss of surplus always outweighs the benefits of the policy.

B) Non-price rationing must occur and can lead to bribes.

C) The transfer of surplus from producer to consumer rarely is recognized.

D) Producers will increase the quality of the goods sold.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

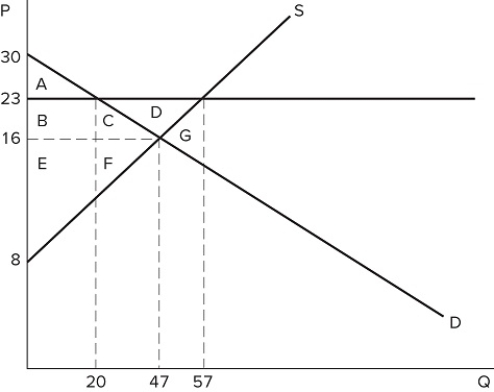

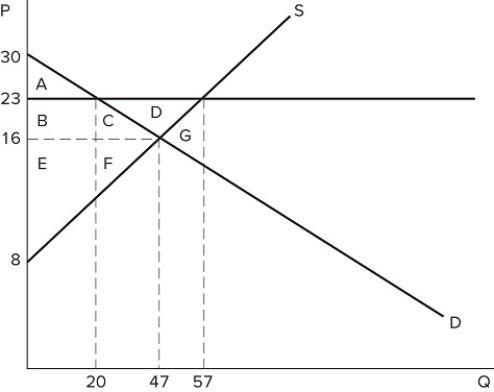

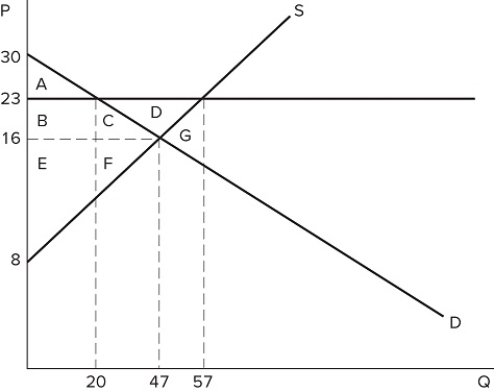

If a price floor is set at $23 in the market shown in the graph, which area(s) would represent total surplus?

If a price floor is set at $23 in the market shown in the graph, which area(s) would represent total surplus?

A) A

B) B + C + E + F

C) A + B + E

D) A + B + C + E + F

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a tax has been imposed in the market shown in the graph. Which kind of tax is most likely demonstrated by this graph?

Suppose a tax has been imposed in the market shown in the graph. Which kind of tax is most likely demonstrated by this graph?

A) A tax on sellers

B) A tax on buyers

C) A tax on big corporations

D) A price ceiling

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why do governments tend to set price ceilings?

A) To ensure everyone can afford certain goods.

B) To encourage producers to make enough for everyone.

C) To help producers make enough profit to stay in the industry.

D) To prevent consumers from choosing the wrong goods.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

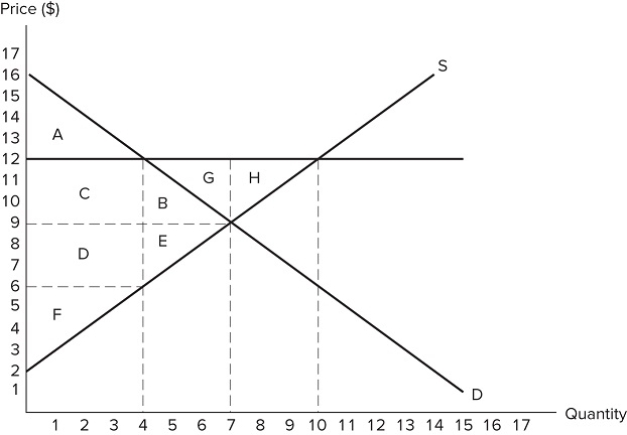

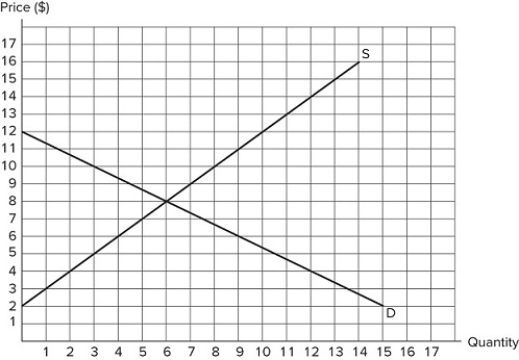

If the intended aim of the price floor set at $12, as shown in the graph, was a net increase in the well-being of producers, then normative analysis would conclude that the policy was:

If the intended aim of the price floor set at $12, as shown in the graph, was a net increase in the well-being of producers, then normative analysis would conclude that the policy was:

A) effective because the surplus gained by producers through higher prices is greater than the surplus they lost through deadweight loss.

B) ineffective because the surplus gained by producers through higher prices is greater than the surplus they lost through deadweight loss.

C) effective because the surplus gained by producers through higher prices is greater than the surplus lost by consumers through higher prices.

D) There is no "right" conclusion to be reached in a normative sense, because normative analysis is not based on value judgements.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In evaluating policy effectiveness, economists rely on:

A) positive analysis.

B) normative analysis.

C) both normative and positive analysis.

D) Economists can never fully analyze any real-world policy effectiveness.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How can one allocate a good that is undersupplied due to a binding price ceiling?

A) Offer it on a first-come, first-served basis.

B) Ration a certain quantity per household.

C) Give the good to the friends and family of the producers.

D) All of these are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the demand curve is less elastic than the supply curve in a market that is taxed, then:

A) buyers will bear a greater tax burden than sellers.

B) sellers will bear a greater tax burden than buyers.

C) the tax burden will be shared equally by buyers and sellers.

D) None of these are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

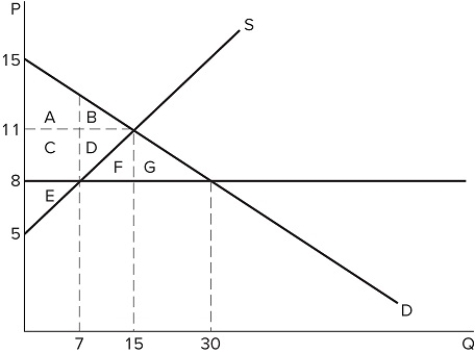

If a price ceiling is set at $8 in the market shown in the graph, which areas would represent total surplus?

If a price ceiling is set at $8 in the market shown in the graph, which areas would represent total surplus?

A) A + B + C + D + E + F + G

B) A + B + C + D + E

C) A + C + E

D) A + B + C + D + E + F

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

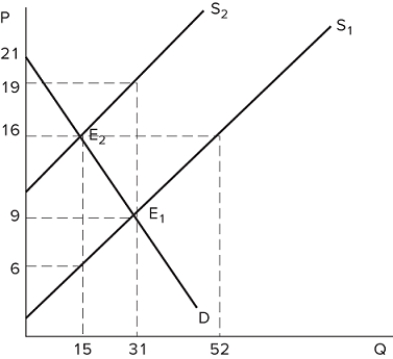

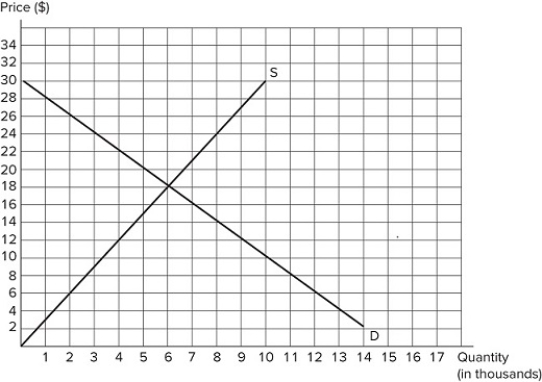

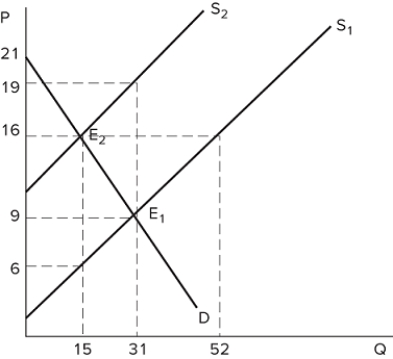

The graph shown portrays a subsidy to buyers. What is the deadweight loss that arises from this subsidy?

The graph shown portrays a subsidy to buyers. What is the deadweight loss that arises from this subsidy?

A) $400

B) $3,600

C) $750

D) $800

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The graph shown best represents:

The graph shown best represents:

A) a non-binding price ceiling.

B) a non-binding price floor.

C) a missing market.

D) the market for an inferior good.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Price controls:

A) are regulations that set a maximum or minimum legal price for a particular good.

B) allow a market to reach equilibrium.

C) prevent a good from being bought or sold.

D) All of these are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If sellers bear a greater tax burden than buyers in a market, which of the following must be true?

A) The sellers are not as business savvy as the buyers.

B) The supply curve must be more inelastic than the demand curve.

C) The sellers face a very inelastic demand.

D) The supply curve must be more elastic than the demand curve.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Does a subsidy to sellers affect the supply curve?

A) Yes; the supply curve shifts down by the amount of the subsidy.

B) Yes; the supply curve shifts to the right by the amount of the subsidy.

C) No; the supply curve does not move, as quantity supplied increases instead.

D) No; the supply curve does not move, as quantity supplied decreases instead.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

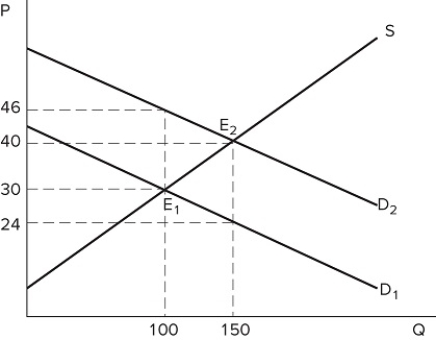

Suppose a $10 tax is imposed on sellers in the market shown in the graph. What will be the deadweight loss?

Suppose a $10 tax is imposed on sellers in the market shown in the graph. What will be the deadweight loss?

A) $15,000

B) $20,000

C) $12,500

D) $10,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a $5 subsidy to buyers is imposed on the market in the graph shown. What is the cost to the government to fund this subsidy?

Suppose a $5 subsidy to buyers is imposed on the market in the graph shown. What is the cost to the government to fund this subsidy?

A) $45

B) $27

C) $90

D) $30

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

We would expect that a tax on cigarettes will be more effective at discouraging consumption over the _______ because demand becomes _______ elastic over time.

A) long run; more

B) long run; less

C) short run; more

D) short run; less

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price floor is set at $23 in the market shown in the graph, which area(s) would represent the surplus that is transferred from consumers to producers?

If a price floor is set at $23 in the market shown in the graph, which area(s) would represent the surplus that is transferred from consumers to producers?

A) B + C + D

B) B + C

C) C

D) B

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The graph shown demonstrates a tax on sellers. How many fewer units are being sold due to the imposition of a tax on this market?

The graph shown demonstrates a tax on sellers. How many fewer units are being sold due to the imposition of a tax on this market?

A) 15

B) 16

C) 31

D) 37

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Does a tax on buyers affect the supply curve?

A) Yes; the supply curve shifts to the left by the amount of the tax.

B) Yes; the supply curve shifts to the right by the amount of the tax.

C) Yes; the supply curve shifts up by the amount of the tax.

D) No; the supply curve does not move, as there is a change in the quantity supplied instead.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 170

Related Exams