A) increase efficiency.

B) increase income inequality.

C) provide basic human needs.

D) transfer surplus from producers to consumers.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

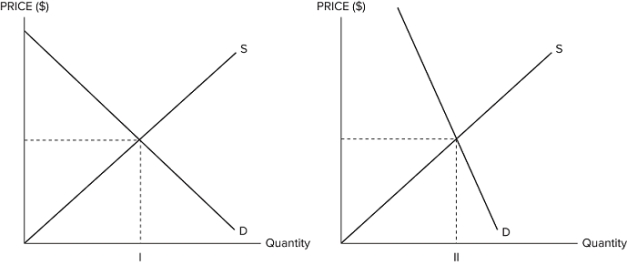

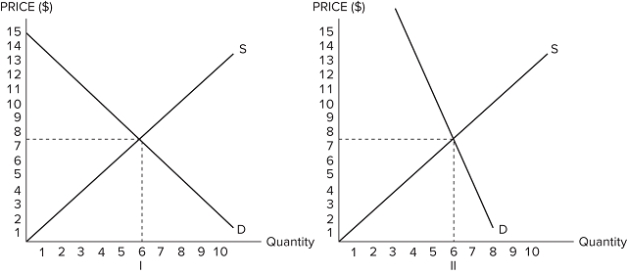

Suppose the government is considering imposing a tax in one of the markets shown in graphs I, II, III, and IV.  <p><b><span style="font-size:20pt;"><span style="color:#FF0000;">

<p><b><span style="font-size:20pt;"><span style="color:#FF0000;">  If the government's goal is to raise as much revenue as possible while minimizing deadweight loss, it should impose the tax in the market in which graph?

If the government's goal is to raise as much revenue as possible while minimizing deadweight loss, it should impose the tax in the market in which graph?

A) I

B) II

C) III

D) IV

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the price effect outweighs the quantity effect, then a tax _______ will _______ revenue.

A) increase; raise

B) decrease; raise

C) increase; lower

D) increase; not change

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of entitlement spending?

A) National defense

B) Social Security

C) Police protection

D) Garbage collection

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Instead of trying to balance the budget every year, it is easier for a government to:

A) balance the budget over the business cycle.

B) allow deficit spending only in times of economic downturn.

C) allow surpluses to build during times of economic booms.

D) All of these are true.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Raising taxes:

A) always raises tax revenues.

B) always decreases tax revenues.

C) can sometimes decrease tax revenues.

D) never decreases tax revenues.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Research shows that people rearrange their income from different sources to reduce their:

A) tax rate.

B) necessary work hours.

C) total bill.

D) tax burden.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Federal government spending in the United States:

A) has historically been greater than the revenues generated.

B) is mostly not discretionary.

C) is majorly discretionary.

D) has historically been less than the revenues generated, until the last 20 years.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

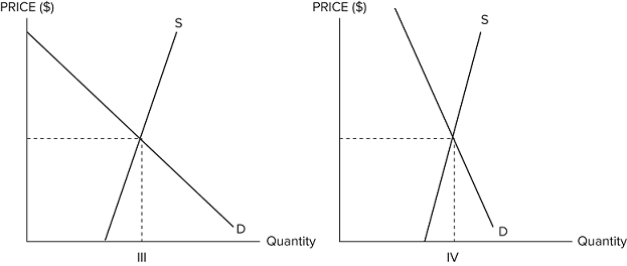

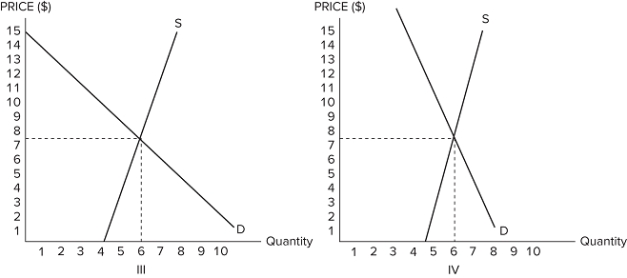

Suppose the government is considering imposing a $6 per unit tax in one of the markets shown in graphs I, II, III, and IV.  <p><b><span style="font-size:20pt;"><span style="color:#FF0000;">

<p><b><span style="font-size:20pt;"><span style="color:#FF0000;">  In which graph would this tax generate the largest revenue?

In which graph would this tax generate the largest revenue?

A) I

B) II

C) III

D) IV

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the real world, lump-sum taxes are:

A) often perceived as unfair.

B) rarely used.

C) very efficient.

D) All of these are true.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The side of the market that is more inelastic:

A) will bear more of the tax burden.

B) will bear less of the tax burden.

C) will share an equal amount of the tax burden.

D) can determine who will shoulder the majority of the tax burden.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal income tax _______ than a state sales tax.

A) has a lower administrative burden

B) is less efficient

C) is less complex

D) is easier to administer

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Bob earns $20,000 per year and pays $2,000 in taxes, while Cindy earns $40,000 per year and pays $4,000 in taxes. This is an example of a _______ tax.

A) progressive

B) regressive

C) proportional

D) lump-sum

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In general, more efficient taxes have:

A) lower administrative burdens.

B) more complexity.

C) lower revenues given the size of the tax.

D) All of these are true.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

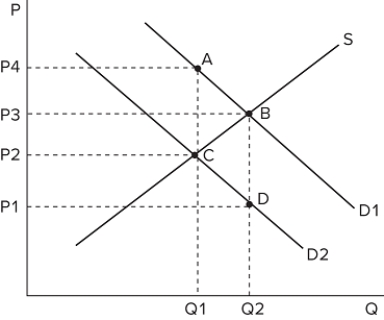

The graph shown depicts a tax being imposed, causing demand to shift from D1 to D2.  What change does this tax cause?

What change does this tax cause?

A) An increase in consumption from Q1 to Q2

B) A decrease in consumption from Q2 to Q1

C) A decrease in the price consumers pay from P3 to P1

D) A decrease in the price suppliers receive from P3 to P1

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

FICA, the tax that supports U.S. Medicare and Social Security programs, is generally:

A) proportional.

B) progressive.

C) regressive.

D) a flat tax that adjusts with inflation.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a tax-funded program intended to provide basic human needs?

A) Public education

B) Police protection

C) Health care

D) National defense

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Jayden earns $80,000 per year and pays $16,000 in taxes, while Giada earns $100,000 per year and pays $16,000 in taxes. This tax system must be:

A) flat.

B) proportional.

C) progressive.

D) lump-sum.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary intent of a tax on tobacco is to:

A) reduce its consumption.

B) raise government revenues.

C) increase market surplus.

D) support producers of tobacco.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

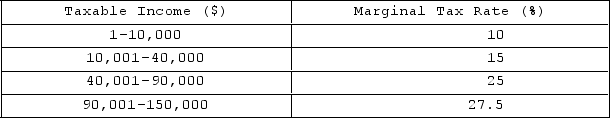

The table shown displays the marginal tax rates that correspond to each taxable income bracket for an individual.

What is the average tax rate for a person with $45,000 of taxable income?

What is the average tax rate for a person with $45,000 of taxable income?

A) 10 percent

B) 15 percent

C) 25 percent

D) 17 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 163

Related Exams