A) marginal burden.

B) incidence.

C) payee.

D) marginal tax rate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deadweight loss as a result of taxation occurs because the:

A) quantity of the good that is bought and sold is above the market equilibrium quantity.

B) price that is charged to the consumer is lower than the price the seller receives.

C) price that is charged to the consumer is above the market equilibrium quantity.

D) quantity of the good that is bought and sold is below the market equilibrium quantity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

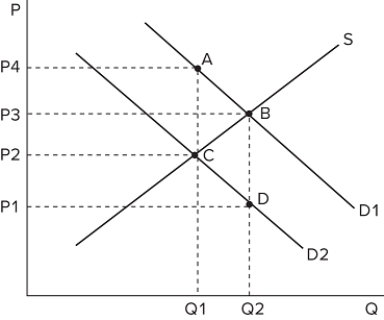

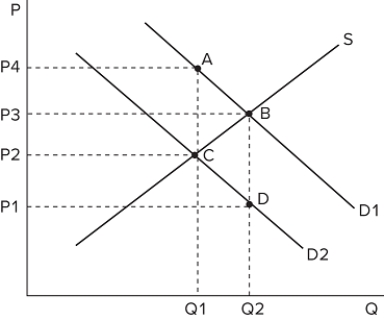

The graph shown depicts a tax being imposed, causing demand to shift from D1 to D2.  Which area of the graph represents the deadweight loss associated with the tax?

Which area of the graph represents the deadweight loss associated with the tax?

A) CBD

B) ABC

C) ABCD

D) P1DCP2

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the federal government brings in $3 trillion in tax revenues and spends $4 trillion, the government has a budget _______ of _______ trillion.

A) surplus; $1

B) deficit; $1

C) surplus; $7

D) deficit; $0.75

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A helpful way to put government revenues into context is to think about them:

A) as an average amount paid per taxpayer.

B) as a percentage of the country's GDP.

C) by comparing the percentage of a country's GDP collected in taxes to other countries' percentage of GDP.

D) All of these approaches can be helpful in understanding tax revenues.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between the loss of surplus to taxpayers and the tax revenue collected is called:

A) an externality.

B) deadweight loss.

C) consumer surplus.

D) producer surplus.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Discretionary spending involves public expenditures that:

A) have to be approved each year.

B) are planned in the federal budget and do not need annual approval.

C) are mandated and regulated by permanent laws.

D) entitle people to benefits by virtue of age, income, or some other factor.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In general, the _______ complicated and _______ efficient the design of a tax system is, the more equitable its incidence.

A) less; more

B) more; less

C) more; more

D) less; less

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A payroll tax is charged on:

A) the earnings of individuals.

B) income earned from buying and selling investments.

C) the wages paid to an employee.

D) the value of a good or service being purchased.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The graph shown depicts a tax being imposed, causing demand to shift from D1 to D2.  What change does this tax cause?

What change does this tax cause?

A) Positive government revenue and decreased consumption

B) Zero government revenue and decreased consumption

C) A transfer of revenue to surplus and increased consumption

D) Positive government revenue and increased consumption

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a tax-funded program primarily intended to stimulate economic growth?

A) Maintenance of public highways

B) Provision of housing to those in need

C) Provision of basic healthcare

D) Provision of national defense

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporate taxes in the United States are:

A) regressive.

B) proportional.

C) progressive.

D) a flat tax that adjusts with inflation.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

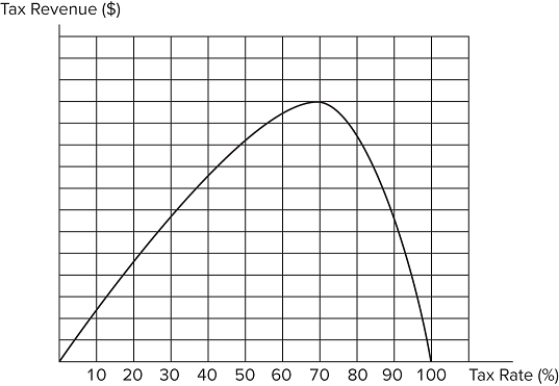

Consider the Laffer curve for a hypothetical good as displayed in the graph shown.  If the current tax rate is 90 percent: the quantity effect currently outweighs the price effect.the government could increase revenue by lowering the tax rate.deadweight loss will increase if the tax rate is lowered.

If the current tax rate is 90 percent: the quantity effect currently outweighs the price effect.the government could increase revenue by lowering the tax rate.deadweight loss will increase if the tax rate is lowered.

A) I and III only

B) II only

C) I, II, and III

D) I and II only

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Javier earns $50,000 per year and pays $500 in taxes, while Camilla earns $100,000 per year and pays $20,000 in taxes. In this scenario, Javier's effective tax rate is _______ and Camilla's effective tax rate is _______.

A) 2 percent; 20 percent

B) 5 percent; 20 percent

C) 5 percent; 10 percent

D) 10 percent; 10 percent

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marginal tax rate is charged on:

A) the last dollar a taxpayer earns.

B) income earned from buying and selling investments.

C) the earnings of individuals.

D) the value of a good or service being purchased.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How much deadweight loss a tax causes depends on all of the following except:

A) how responsive buyers and sellers are to a price change.

B) the price elasticity of supply.

C) the price elasticity of demand.

D) who the tax is imposed upon.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The burden of a tax placed on buyers is:

A) shared between buyers and sellers.

B) the buyers' incidence.

C) the sellers' incidence.

D) higher than the burden of a tax placed on sellers.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When policy makers are deciding where to place the statutory incidence of a tax, it is helpful to remember that:

A) this decision will have no effect on the economic incidence of the tax.

B) the economic incidence will fall to the more elastic party.

C) this decision will largely determine the economic incidence of the tax.

D) this decision will have a large impact on the efficiency of the tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To calculate tax revenue, we:

A) divide total revenue by the tax per unit.

B) multiply total revenue by the tax per unit.

C) multiply the tax per unit by the number of units being taxed.

D) multiply the tax per unit by the price of the good being taxed.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The _______ tells us that when the government raises taxes, fewer units will be sold.

A) quantity

B) price

C) government spending

D) quality

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 163

Related Exams