A) there is always perfect consensus before a program is funded.

B) there is often widespread disagreement.

C) a popular vote for new programs is conducted.

D) each individual is able to decide where tax dollars are spent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is imposed, the surplus that is lost to buyers and sellers but converted into tax revenue is:

A) considered a cost of taxation.

B) part of deadweight loss.

C) the sole source of deadweight loss.

D) not part of deadweight loss.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Considering a given increase in price due to a tax, the more price elastic the supply curve is, the:

A) larger the drop in equilibrium quantity.

B) smaller the drop in equilibrium quantity.

C) smaller the amount of deadweight loss created.

D) less surplus is transferred to consumers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A progressive tax:

A) takes the same percentage from all taxpayers, regardless of income.

B) requires those with low incomes to pay a smaller percentage of their income than high-income people.

C) is levied such that low-income taxpayers pay a greater proportion of their income than high-income taxpayers.

D) taxes everyone the same amount, regardless of income.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A sales tax is charged on:

A) the earnings of individuals and corporations.

B) income earned from buying and selling them investments.

C) the wages paid to an employee.

D) the value of a good or service being purchased.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The administrative burden of taxes:

A) is smallest with a lump-sum tax.

B) depends on the amount of revenue generated.

C) grows smaller as a tax gets larger.

D) is the same across all types of taxes.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept of incidence is used to describe:

A) which tax bears the bigger burden.

B) the unexpected tax revenue generated.

C) who bears the burden of a tax.

D) how often people are taxed.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lump-sum tax is also known as a(n) :

A) income tax.

B) property tax.

C) sales tax.

D) head tax.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A proportional tax:

A) takes the same percentage from all taxpayers, regardless of income.

B) requires those with low incomes to pay a smaller percentage of their income than high-income people.

C) is levied such that low-income taxpayers pay a greater proportion of their income than high-income taxpayers.

D) taxes everyone the same amount, regardless of income.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is imposed and some of the lost surplus becomes tax revenue, which group benefits?

A) Consumers

B) Producers

C) Recipients of government services

D) Only the government

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the _______ effect is greater than the _______ effect, a tax cut will increase revenue.

A) price; quantity

B) quantity; income

C) income; price

D) quantity; price

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Bob earns $20,000 per year and Sue earns $100,000 a year. If a flat tax of 10 percent is imposed, Bob will pay _______ in taxes and Sue will pay_______ in taxes. This is an example of a _______ tax.

A) $2,000; $10,000; proportional

B) $2,000; $10,000; progressive

C) $2,000; $10,000; lump-sum tax

D) $200; $1,000; flat tax

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which term is defined as the logistical costs associated with implementing a tax?

A) Deadweight loss

B) Administrative burden

C) Economic incidence

D) Mandatory burden

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

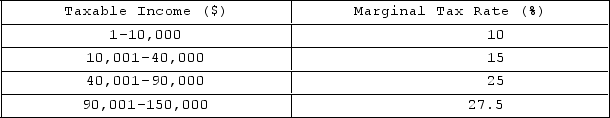

The table shown displays the marginal tax rates that correspond to each taxable income bracket for an individual.

Consider two individuals: Griffin and Dalia. Griffin has $90,000 of taxable income and Dalia has $95,000 of taxable income. Which of the following statements is true?

Consider two individuals: Griffin and Dalia. Griffin has $90,000 of taxable income and Dalia has $95,000 of taxable income. Which of the following statements is true?

A) Dalia owes $3,625 more in taxes than Griffin.

B) Griffin owes $1,250 more in taxes than Dalia.

C) Dalia owes $1,250 more in taxes than Griffin.

D) None of these are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

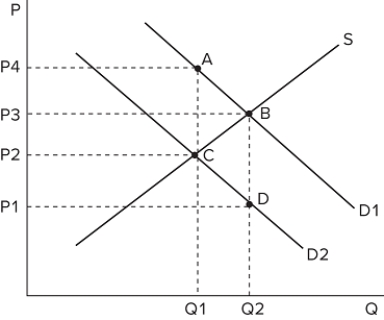

The graph shown depicts a tax being imposed, causing demand to shift from D1 to D2.  The amount of the tax imposed is equal to:

The amount of the tax imposed is equal to:

A) (P1 − P3) .

B) (P2 − P1) .

C) (P4 − P2) .

D) (P4 − P3) .

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax will sometimes alter consumers' incentives. Which of the following statements about such a tax is true? This type of tax is meant to increase consumption. A tax designed to raise revenue may sometimes alter consumer incentives as a side effect. This type of tax is called a sin tax.

A) III only

B) I and II only

C) II only

D) I, II, and III

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an example of a commonly tax-funded program?

A) Public education

B) Highways

C) Housing for those in need

D) Oil and gas production

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Considering a given increase in price due to a tax, the less price elastic the demand curve is, the:

A) larger the drop in equilibrium quantity.

B) smaller the amount of deadweight loss created.

C) larger the amount of deadweight loss created.

D) more surplus is transferred to consumers.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is imposed, the surplus that is lost to buyers and sellers but converted into tax revenue is:

A) transferred to others through public programs.

B) considered a cost of taxation.

C) part of deadweight loss.

D) All of these are true.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A proportional tax:

A) takes the same percentage from all taxpayers, regardless of income.

B) requires those with low incomes to pay a smaller percentage of their income than high-income people.

C) is levied such that low-income taxpayers pay a greater proportion of their income than high-income taxpayers.

D) taxes everyone the same amount, regardless of income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 163

Related Exams