A) IRR

B) ACRS

C) AAR

D) straight-line to zero

E) straight-line with salvage

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current book value of a fixed asset that was purchased two years ago is used in the computation of which one of the following?

A) depreciation tax shield

B) tax due on the salvage value of that asset

C) current year's operating cash flow

D) change in net working capital

E) MACRS depreciation for the current year

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jefferson & Sons is evaluating a project that will increase annual sales by $145,000 and annual cash costs by $94,000.The project will initially require $110,000 in fixed assets that will be depreciated straight-line to a zero book value over the 4-year life of the project.The applicable tax rate is 32 percent.What is the operating cash flow for this project?

A) $11,220

B) $29,920

C) $43,480

D) $46,480

E) $46,620

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering the purchase of a new machine.Your analysis includes the evaluation of two machines which have differing initial and ongoing costs and differing lives.Whichever machine is purchased will be replaced at the end of its useful life.You should select the machine which has the:

A) longest life.

B) highest annual operating cost.

C) lowest annual operating cost.

D) highest equivalent annual cost.

E) lowest equivalent annual cost.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hollister & Hollister is considering a new project.The project will require $522,000 for new fixed assets, $218,000 for additional inventory, and $39,000 for additional accounts receivable.Short-term debt is expected to increase by $165,000.The project has a 6-year life.The fixed assets will be depreciated straight-line to a zero book value over the life of the project.At the end of the project, the fixed assets can be sold for 20 percent of their original cost.The net working capital returns to its original level at the end of the project.The project is expected to generate annual sales of $875,000 and costs of $640,000.The tax rate is 34 percent and the required rate of return is 14 percent.What is the amount of the earnings before interest and taxes for the first year of this project?

A) $97,680

B) $130,000

C) $148,000

D) $217,320

E) $235,000

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The stand-alone principle advocates that project analysis should be based solely on which one of the following costs?

A) sunk

B) total

C) variable

D) incremental

E) fixed

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be included in the analysis of a new product? I.money already spent for research and development of the new product II.reduction in sales for a current product once the new product is introduced III.increase in accounts receivable needed to finance sales of the new product IV.market value of a machine owned by the firm which will be used to produce the new product

A) I and III only

B) II and IV only

C) I, II, and III only

D) II, III, and IV only

E) I, II, III, and IV

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following best describes pro forma financial statements?

A) financial statements expressed in a foreign currency

B) financial statements where the assets are expressed as a percentage of total assets and costs are expressed as a percentage of sales

C) financial statements showing projected values for future time periods

D) financial statements expressed in real dollars, given a stated base year

E) financial statements where all accounts are expressed as a percentage of last year's values

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Phone Home, Inc.is considering a new 6-year expansion project that requires an initial fixed asset investment of $5.876 million.The fixed asset will be depreciated straight-line to zero over its 6-year tax life, after which time it will be worthless.The project is estimated to generate $5,328,000 in annual sales, with costs of $2,131,200.The tax rate is 32 percent.What is the annual operating cash flow for this project?

A) $1,894,318

B) $2,211,407

C) $2,487,211

D) $2,663,021

E) $2,848,315

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kelley's Baskets makes handmade baskets for distribution to upscale retail outlets.The firm is currently considering making handmade wreaths as well.Which one of the following is the best example of an incremental operating cash flow related to the wreath project?

A) storing supplies in the same space currently used for materials storage

B) utilizing the basket manager to oversee wreath production

C) hiring additional employees to handle the increased workload should the firm accept the wreath project

D) researching the market to determine if wreath sales might be profitable before deciding to proceed

E) planning on lower interest expense by assuming the proceeds of the wreath sales will be used to reduce the firm's currently outstanding debt

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Decreasing which one of the following will increase the acceptability of a project?

A) sunk costs

B) salvage value

C) depreciation tax shield

D) equivalent annual cost

E) accounts payable requirement

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following will increase a bid price?

A) a decrease in the fixed costs

B) a reduction in the net working capital requirement

C) a reduction in the firm's tax rate

D) an increase in the salvage value

E) an increase in the required rate of return

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following costs was incurred in the past and cannot be recouped?

A) incremental

B) side

C) sunk

D) opportunity

E) erosion

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

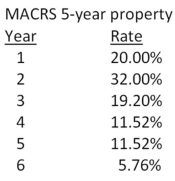

Edward's Manufactured Homes purchased some machinery 2 years ago for $319,000.These assets are classified as 5-year property for MACRS.The company is replacing this machinery today with newer machines that utilize the latest in technology.The old machines are being sold for $140,000 to a foreign firm for use in its production facility in South America.What is the aftertax salvage value from this sale if the tax rate is 35 percent?

A) $135,408

B) $140,000

C) $142,312

D) $144,592

E) $146,820

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a project to supply 60,800,000 postage stamps to the U.S.Postal Service for the next 5 years.You have an idle parcel of land available that cost $760,000 five years ago; if the land were sold today, it would net you $912,000, aftertax.The land can be sold for $1,500,000 after taxes in 5 years.You will need to install $2,356,000 in new manufacturing plant and equipment to actually produce the stamps; this plant and equipment will be depreciated straight-line to zero over the project's 5-year life.The equipment can be sold for $456,000 at the end of the project.You will also need $469,000 in initial net working capital for the project, and an additional investment of $38,000 in every year thereafter.All net working capital will be recovered when the project ends.Your production costs are 0.38 cents per stamp, and you have fixed costs of $608,000 per year.Your tax rate is 31 percent and your required return on this project is 11 percent.What bid price per stamp should you submit?

A) $0.018

B) $0.020

C) $0.023

D) $0.026

E) $0.029

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Keyser Mining is considering a project that will require the purchase of $980,000 in new equipment.The equipment will be depreciated straight-line to a zero book value over the 7-year life of the project.The equipment can be scraped at the end of the project for 5 percent of its original cost.Annual sales from this project are estimated at $420,000.Net working capital equal to 25 percent of sales will be required to support the project.All of the net working capital will be recouped.The required return is 16 percent and the tax rate is 35 percent.What is the recovery amount attributable to net working capital at the end of the project?

A) $21,000

B) $54,600

C) $105,000

D) $178,000

E) $196,000

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hollister & Hollister is considering a new project.The project will require $522,000 for new fixed assets, $218,000 for additional inventory, and $39,000 for additional accounts receivable.Short-term debt is expected to increase by $165,000.The project has a 6-year life.The fixed assets will be depreciated straight-line to a zero book value over the life of the project.At the end of the project, the fixed assets can be sold for 20 percent of their original cost.The net working capital returns to its original level at the end of the project.The project is expected to generate annual sales of $875,000 and costs of $640,000.The tax rate is 34 percent and the required rate of return is 14 percent.What is the cash flow recovery from net working capital at the end of this project?

A) $14,000

B) $75,000

C) $92,000

D) $344,000

E) $422,000

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Increasing which one of the following will increase the operating cash flow assuming that the bottom-up approach is used to compute the operating cash flow?

A) erosion effects

B) taxes

C) fixed expenses

D) salaries

E) depreciation expense

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kelly's Corner Bakery purchased a lot in Oil City 6 years ago at a cost of $302,000.Today, that lot has a market value of $340,000.At the time of the purchase, the company spent $15,000 to level the lot and another $20,000 to install storm drains.The company now wants to build a new facility on that site.The building cost is estimated at $1.51 million.What amount should be used as the initial cash flow for this project?

A) -$1,470,000

B) -$1,850,000

C) -$1,875,000

D) -$1,925,000

E) -$1,945,000

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gateway Communications is considering a project with an initial fixed asset cost of $2.46 million which will be depreciated straight-line to a zero book value over the 10-year life of the project.At the end of the project the equipment will be sold for an estimated $300,000.The project will not directly produce any sales but will reduce operating costs by $725,000 a year.The tax rate is 35 percent.The project will require $45,000 of inventory which will be recouped when the project ends.Should this project be implemented if the firm requires a 14 percent rate of return? Why or why not?

A) No; The NPV is -$172,937.49.

B) No; The NPV is -$87,820.48.

C) Yes; The NPV is $251,860.34.

D) Yes; The NPV is $387,516.67.

E) Yes; The NPV is $466,940.57.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 108

Related Exams