A) 0.4

B) 0.3

C) 0.2

D) 0.1

E) 0

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Outsourcing some production is a means of _________ a capacity constraint.

A) identifying

B) modifying

C) supporting

D) overcoming

E) repeating

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following makes using present value approaches in capacity decisions difficult?

A) The discount rate must be adjusted to account for inflation.

B) Some cash flows are positive and other cash flows are negative.

C) The payback period might not be long enough to justify a capacity decision.

D) Capacity decisions are made amidst much uncertainty, so cash flows cannot be estimated with great accuracy.

E) There is a cash outflow at the outset followed by, possibly, net cash inflows.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tabular presentation that shows the outcome for each decision alternative under the various possible states of nature is called a:

A) payoff table.

B) feasible region.

C) Laplace table.

D) decision tree.

E) payback period matrix.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two professors at a nearby university want to coauthor a new textbook in either economics or statistics. They feel that if they write an economics book, they have a 50 percent chance of placing it with a major publisher, and it should ultimately sell about 40,000 copies. If they cannot get a major publisher to take it, then they feel they have an 80 percent chance of placing it with a smaller publisher, with ultimate sales of 30,000 copies. On the other hand, if they write a statistics book, they feel they have a 40 percent chance of placing it with a major publisher, and it should result in ultimate sales of about 50,000 copies. If they cannot get a major publisher to take it, they feel they have a 50 percent chance of placing it with a smaller publisher, with ultimate sales of 35,000 copies. What is the probability that the economics book would wind up being placed with a smaller publisher?

A) 0.8

B) 0.5

C) 0.4

D) 0.2

E) 0.1

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

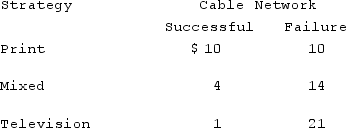

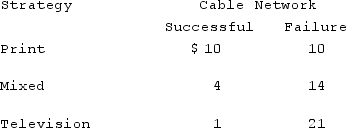

The advertising manager for Roadside Restaurants, Inc., needs to decide whether to spend this month's budget for advertising on print media, television, or a mixture of the two. She estimates that the cost per thousand "hits" (readers or viewers) will vary depending upon the success of the new cable television network she plans to use, as follows:

If she feels that there is a 60 percent chance that the new cable network will be successful, what is her expected cost (per thousand "hits") under certainty?

If she feels that there is a 60 percent chance that the new cable network will be successful, what is her expected cost (per thousand "hits") under certainty?

A) $3.40

B) $4.60

C) $8.00

D) $9.00

E) $10.00

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decision making involving certainty about potential future conditions will have a relatively _____ decision.

A) uncertain

B) straightforward

C) unknown

D) probabilistic

E) irrational

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maximum capacity commonly refers to the upper limit on:

A) utilization.

B) the rate of demand.

C) efficiency.

D) the rate of output.

E) finances.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The method of financial analysis which results in an equivalent interest rate is:

A) payback.

B) net present value.

C) internal rate of return.

D) queuing.

E) cost-volume.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a criterion for developing capacity alternatives?

A) design structured, rigid systems

B) take a big-picture approach to capacity changes

C) prepare to deal with capacity in "chunks"

D) attempt to smooth out capacity requirements

E) identify the optimal operating level

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a factor that influences how frequently or infrequently capacity choices are made?

A) supply chain disruption

B) stability of demand

C) product design

D) technological change

E) competitive factors

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

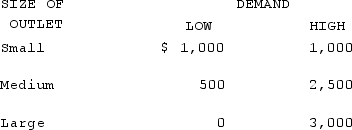

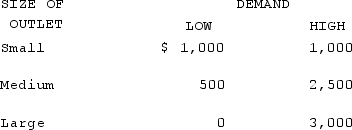

The owner of Tastee Cookies needs to decide whether to lease a small, medium, or large new retail outlet. She estimates that monthly profits will vary with demand for her cookies as follows:

If she uses the maximax criterion, what size outlet will she decide to lease?

If she uses the maximax criterion, what size outlet will she decide to lease?

A) small

B) medium

C) large

D) either small or medium

E) either medium or large

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

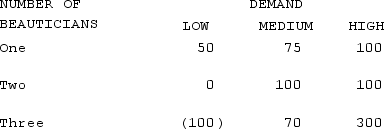

The new owner of a beauty shop is trying to decide whether to hire one, two, or three beauticians. She estimates that profits next year (in thousands of dollars) will vary with demand for her services, and she has estimated demand in three categories, low, medium, and high.

If she uses the Laplace criterion, how many beauticians will she decide to hire?

If she uses the Laplace criterion, how many beauticians will she decide to hire?

A) one

B) two

C) three

D) either one or two

E) either two or three

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

According to the reading on restaurant sourcing practices, only fast-food restaurants are able to bring in outsourced foods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

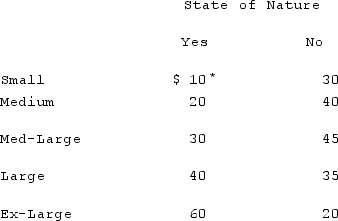

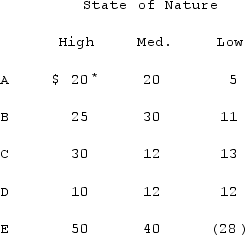

Consider the following decision scenario:

*PV for profits ($000)

The maximax strategy would be:

*PV for profits ($000)

The maximax strategy would be:

A) small.

B) medium.

C) med.-large.

D) large.

E) ex-large.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following decision scenario:

*PV for profits ($000)

With equally likely states of nature, the alternative that has the largest expected monetary value is:

*PV for profits ($000)

With equally likely states of nature, the alternative that has the largest expected monetary value is:

A) A.

B) B.

C) C.

D) D.

E) E.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The advertising manager for Roadside Restaurants, Inc., needs to decide whether to spend this month's budget for advertising on print media, television, or a mixture of the two. She estimates that the cost per thousand "hits" (readers or viewers) will vary depending upon the success of the new cable television network she plans to use, as follows:

If she feels that there is a 60 percent chance that the new cable network will be successful, what is her expected value (per thousand "hits") of perfect information?

If she feels that there is a 60 percent chance that the new cable network will be successful, what is her expected value (per thousand "hits") of perfect information?

A) $3.40

B) $4.60

C) $8.00

D) $9.00

E) $10.00

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The dean of a college wants to determine which of two new classes to offer for the upcoming semester. Due to facility constraints only one class can be offered at this time. The dean feels that the first class has an 80 percent chance of earning the college about $75,000, but a 20 percent chance of losing $35,000. If the class is successful, then its next level class will be offered, with a 75 percent chance of earning $60,000, but a 20 percent chance of losing $30,000. Weighing the options, the dean feels that the second class has a 60 percent chance of earning $85,000, but a 40 percent chance of losing $40,000. If the second class is successful, then its next level class will be offered with a 50 percent chance of earning $80,000, but a 50 percent chance of losing $45,000. If both classes are not successful, neither of their next level classes will be offered to the students.What is the expected value for selecting the first class?

A) $90,000

B) $83,000

C) $75,500

D) $50,000

E) $45,500

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Among decision environments, risk implies that certain parameters have probabilistic outcomes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The owner of Tastee Cookies needs to decide whether to lease a small, medium, or large new retail outlet. She estimates that monthly profits will vary with demand for her cookies as follows:

For what range of probability that demand will be high, will she decide to lease the large facility?

For what range of probability that demand will be high, will she decide to lease the large facility?

A) 0-0.25

B) 0-0.33

C) 0.25-0.5

D) 0.33-1

E) 0.5-1

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 210

Related Exams