A) idiosyncratic.

B) diversifiable.

C) systemic.

D) time preference.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hermione is considering an investment that has a ? chance of paying a 10 percent rate of return and a ? chance of paying 2 percent. What is the average expected rate of return on the investment?

A) 2 percent

B) 6 percent

C) 8 percent

D) 10 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Portfolio diversification

A) reduces the likelihood that the entire amount invested will be lost.

B) eliminates all risk of loss.

C) ensures that investors will receive a positive rate of return.

D) provides the maximum possible rate of return from an investment portfolio.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If an asset has a beta of 1.5, it has 50 percent more nondiversifiable risk than the market portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ownership of a single corporation is represented by what investment?

A) stock

B) bonds

C) mutual funds

D) commercial paper

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investors evaluate an investment by estimating its average expected rate of return, and this estimation process assigns higher weights to

A) higher returns.

B) more likely outcomes.

C) higher risks.

D) smaller returns.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed can regularly influence and change the risk-free rate of financial investments through its

A) open-market operations.

B) quantitative easing.

C) required reserve ratio.

D) bank supervision.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The underlying cause of risk in finance is

A) danger.

B) uncertainty.

C) fear.

D) complexity.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

You believe that a certain asset, such as a business or shop, is going to be worth $100 million in five years. If the interest rate is 5 percent, then that asset will be worth $75 million today.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Because of arbitrage, any given financial asset will be expected to return to the Security Market Line.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

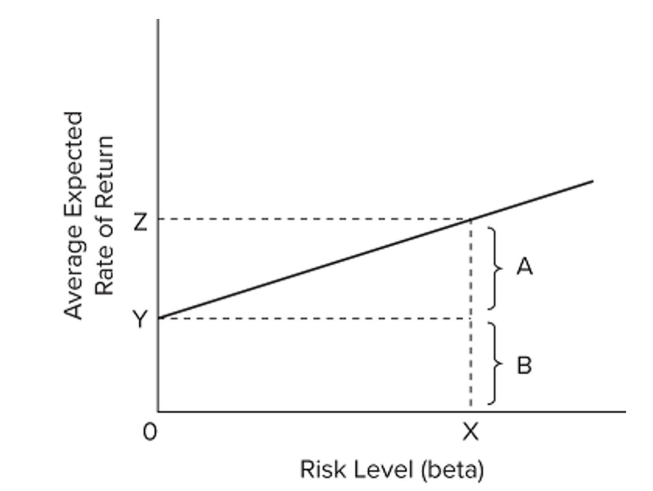

Refer to the graph. The average expected rate of return for an asset with a beta equal to X would be

Refer to the graph. The average expected rate of return for an asset with a beta equal to X would be

A) Y.

B) A plus B.

C) Z minus A.

D) Z minus Y.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If stockholders sell their shares for more than they paid for those shares, the stockholders

A) realize a share of equal profits.

B) receive a dividend.

C) realize a capital gain.

D) obtain a mutual fund.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The buying and selling activities that tend to equalize the rates of return on identical or nearly identical assets is called

A) beta.

B) risk.

C) arbitrage.

D) diversification.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arbitrage is the process by which investors simultaneously sell

A) assets with higher rates of return and buy otherwise identical assets with lower rates of return.

B) assets with lower rates of return and buy otherwise identical assets with higher rates of return.

C) riskier assets and buy less risky assets.

D) less risky assets and buy riskier assets.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed raises the interest rates on short-term U.S. government bonds, then the Security Market Line shifts

A) downward as the risk-free interest rate increases.

B) downward as the risk-free interest rate decreases.

C) upward as the risk-free interest rate increases.

D) upward as the risk-free interest rate decreases.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Compound interest refers to the multiple interest rates an investor will be paid in a diversified portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Myrna borrows $500 at an annually compounded interest rate of 8 percent that she will repay at the end of 10 years. How much will be required to pay off the loan at the end of 10 years?

A) $900

B) $962.85

C) $1,079.46

D) $1,123.21

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price of an asset should

A) exactly equal the total present value of all of the asset's future payments.

B) exactly equal the total future value of all of the asset's future payments.

C) approximately equal X(1 + i) t, where X is the value of the asset, i is the interest rate, and t is the number of years.

D) exactly equal the total present and future value of all of the asset's future payments.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected rate of return from an investment is

A) the rate that compensates for time preference only.

B) the rate that compensates for risk only.

C) the rate that compensates for time preference plus the rate that compensates for risk.

D) the rate that compensates for time preference minus the rate that compensates for risk.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arbitrage causes all financial assets

A) of the same risk level to have the same price.

B) to have the same expected rate of return.

C) to have the same beta.

D) of the same risk level to have the same average expected rate of return.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 356

Related Exams