A) deflation may reduce its purchasing power.

B) in doing so, one sacrifices interest income.

C) bond prices are highly variable.

D) the rate at which money is spent may decline.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monetary policy is thought to be

A) equally effective in moving the economy out of a depression as in controlling demand-pull inflation.

B) more effective in moving the economy out of a depression than in controlling demand-pull inflation.

C) more effective in controlling demand-pull inflation than in moving the economy out of a recession.

D) only effective in moving the economy out of a depression.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond with no expiration date has a face value of $10,000 and pays a fixed 10 percent interest. If the market price of the bond rises to $11,000, the annual yield approximately equals

A) 11 percent.

B) 10 percent.

C) 9 percent.

D) 8 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the demand for money and the supply of money increase simultaneously. We can

A) expect the interest rate to rise and bond prices to fall.

B) expect the interest rate to fall and bond prices to rise.

C) expect the nominal GDP to expand.

D) not accurately predict what will happen to interest rates or bond prices.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a result of policy actions taken by the Fed since 2008, it (the Fed) can no longer expect to affect the federal funds rate through traditional open market operations to alter the overall amount of excess reserves in the banking system. This is because

A) Congress has taken this power away from the Fed.

B) there is a massive amount of excess reserves already in the banking system.

C) the federal funds rate has become rigidly fixed by law.

D) banks are no longer holding any excess reserves.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When the Fed raises the interest rate paid on reserves, it discourages bank lending.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If severe demand-pull inflation was occurring in the economy, proper government policies would involve a government

A) budget deficit, the purchase of securities in the open market, a higher discount rate, and higher reserve requirements.

B) budget deficit, the sale of securities in the open market, a higher discount rate, and lower reserve requirements.

C) budget surplus, the sale of securities in the open market, a higher discount rate, and higher reserve requirements.

D) budget surplus, the purchase of securities in the open market, a lower discount rate, and lower reserve requirements.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

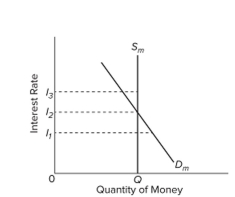

The equilibrium rate of interest in the market for money is determined by the intersection of the

A) supply-of-money curve and the asset-demand-for-money curve.

B) supply-of-money curve and the transactions-demand-for-money curve.

C) supply-of-money curve and the total-demand-for-money curve.

D) investment-demand curve and the total-demand-for-money curve.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the diagram of the market for money. The vertical money supply curve re?ects the fact that

Refer to the diagram of the market for money. The vertical money supply curve re?ects the fact that

A) bond prices and interest rates are inversely related.

B) the stock of money is determined by the Federal Reserve System and does not change when the interest rate changes.

C) the rate at which money is spent is zero.

D) lower interest rates result in lower opportunity costs of supplying money.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Ben Bernanke is the current (2019) chair of the Board of Governors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

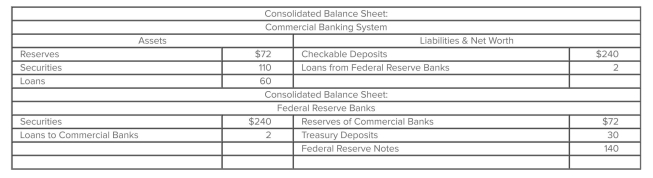

Refer to the given balance sheets and assume the reserve ratio is 25 percent. Suppose the Federal Reserve Banks sell $2 in securities directly to the commercial banks. As a result of this transaction, the supply of money

Refer to the given balance sheets and assume the reserve ratio is 25 percent. Suppose the Federal Reserve Banks sell $2 in securities directly to the commercial banks. As a result of this transaction, the supply of money

A) will decrease by $2, but the money-creating potential of the commercial banking system will not be affected.

B) is not directly affected, but the money-creating potential of the commercial banking system will decrease by $8.

C) will directly increase by $2, and the money-creating potential of the commercial banking system will decrease by an additional $8.

D) will directly increase by $2, and the money-creating potential of the commercial banking system will increase by an additional $8.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The higher the interest rate, the larger will be the amount of money demanded for transaction purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Before the financial crisis of 2008, when the Federal Reserve Banks decided to buy government bonds from commercial banks and the general public, the supply of reserves in the federal funds market

A) increased and the Federal funds rate decreased.

B) increased and the Federal funds rate increased.

C) decreased and the Federal funds rate decreased.

D) decreased and the Federal funds rate increased.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Before the financial crisis of 2008, if the Fed bought government securities in the open market, it

A) decreased the excess reserves of the banking system, reducing excess reserves for overnight loans in the Federal funds market, thus lowering the Federal funds rate.

B) increased the excess reserves of the banking system, reducing excess reserves for overnight loans in the Federal funds market, thus lowering the Federal funds rate.

C) decreased the excess reserves of the banking system, reducing excess reserves for overnight loans in the Federal funds market, thus increasing the Federal funds rate.

D) increased the excess reserves of the banking system, raising excess reserves for overnight loans in the Federal funds market, thus lowering the Federal funds rate.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the economy faces high unemployment but stable prices. Which combination of government policies is most likely to reduce unemployment?

A) the purchase of government securities in the open market and an increase in taxes

B) the sale of government securities in the open market and a decrease in taxes

C) the sale of government securities in the open market and a decrease in government spending

D) the purchase of government securities in the open market and an increase in government spending

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purchase of government securities from the public by the Fed will cause

A) commercial bank reserves to decrease.

B) the money supply to increase.

C) demand deposits to decrease.

D) the interest rate to increase.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The main goal of quantitative easing (QE) is to reduce the federal funds rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a diagram where the interest rate and the quantity of money demanded are shown on the vertical and horizontal axes, respectively, the transactions demand for money can be represented by

A) a line parallel to the horizontal axis.

B) a vertical line.

C) a downsloping line or curve from left to right.

D) an upsloping line or curve from left to right.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Open-market operations change

A) the size of the monetary multiplier but not commercial bank reserves.

B) commercial bank reserves but not the size of the monetary multiplier.

C) neither commercial bank reserves nor the size of the monetary multiplier.

D) both commercial bank reserves and the size of the monetary multiplier.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The fundamental objective of monetary policy is to assist the economy in achieving

A) a rapid pace of economic growth.

B) a money supply that is based on the gold standard.

C) a full-employment, noninflationary level of total output.

D) a balanced-budget consistent with full employment.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 321 - 340 of 405

Related Exams