A) increase aggregate supply, decrease aggregate demand, and cause the price level to fall.

B) increase aggregate supply, increase aggregate demand, and cause real GDP to rise.

C) decrease aggregate supply, decrease aggregate demand, and cause real GDP to fall.

D) decrease aggregate supply, increase aggregate demand, and cause the price level to rise.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

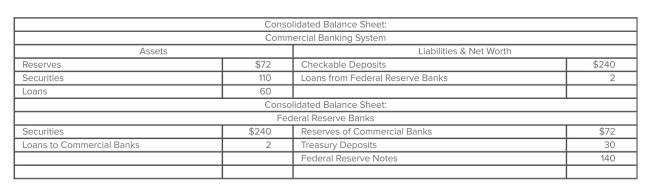

Refer to the given balance sheets. If the reserve ratio is 25 percent, the maximum money-creating potential of the commercial banking system is

Refer to the given balance sheets. If the reserve ratio is 25 percent, the maximum money-creating potential of the commercial banking system is

A) $36.

B) $17.

C) $48.

D) $24.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Federal Reserve gives much more weight to inflation than to unemployment when considering policy actions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most accurate about the Fed's use of the federal funds rate target since the 2008 financial crisis?

A) It stimulated quick recovery from the Great Recession, and the target is now at pre-crisis levels.

B) The target has become significantly more important as a tool for signaling policy changes.

C) The Fed effectively lost the ability to use the target for monetary policy since there is a lack of reserves today.

D) The Fed effectively lost the ability to use the target for monetary policy since banks no longer have a problem meeting their reserve requirement.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A) increase the interest rate from 6 percent to 8 percent.

B) decrease the interest rate from 6 percent to 4 percent.

C) decrease the interest rate from 6 percent to 2 percent.

D) maintain the interest rate at 6 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A) increase aggregate demand by increasing the interest rate.

B) decrease aggregate demand by increasing the interest rate.

C) increase aggregate demand by decreasing the interest rate.

D) make no change in the interest rate.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Answer the question based on the information in the table. The equilibrium interest rate in this economy is

A) 3 percent.

B) 4 percent.

C) 5 percent.

D) 6 percent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The liquidity trap refers to the situation where

A) the Fed adds excess reserves to the banking system, but it has minimal positive effect on lending, investment, or aggregate demand.

B) excessive consumer debt limits the growth in consumer spending necessary to bring the economy out of recession.

C) the public debt is so large that federal borrowing drives up interest rates and discourages private sector spending.

D) a financial crisis causes a run on banks and the elimination of billions in excess reserves.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the Fed creates excess reserves in the banking system by buying government bonds, but banks do not make more loans because economic conditions are bad. This situation is a problem of

A) "putting all your eggs in one basket."

B) "not in my backyard."

C) "There ain't no such thing as a free lunch."

D) "You can lead a horse to water, but you can't make it drink."

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things equal, an increase in consumer wealth will

A) increase aggregate supply.

B) increase aggregate demand.

C) reduce the price level.

D) reduce the money supply.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will increase commercial bank reserves?

A) the purchase of government bonds in the open market by the Federal Reserve Banks

B) a decrease in the reserve ratio

C) an increase in the discount rate

D) the sale of government bonds in the open market by the Federal Reserve Banks

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If, in the market for money, the amount of money supplied exceeds the amount of money households and businesses want to hold, the interest rate will

A) fall, causing households and businesses to hold less money.

B) rise, causing households and businesses to hold less money.

C) rise, causing households and businesses to hold more money.

D) fall, causing households and businesses to hold more money.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A) decrease the interest rate from 10 to 8 percent.

B) decrease the interest rate from 8 to 6 percent.

C) decrease the interest rate from 6 to 4 percent.

D) increase investment spending from $30 to $60 billion.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All else equal, when the Federal Reserve Banks engage in a restrictive monetary policy, the prices of government bonds usually

A) fall.

B) rise.

C) remain constant.

D) move in the same direction as the bonds' interest rate yield.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the required reserve ratio is 25 percent. If the Federal Reserve sells $120 million in government securities to the general public, the money supply will immediately

A) decrease by $120 million with this transaction, and the decrease in money supply could eventually reach a maximum of $480 million.

B) decrease by $120 million with this transaction, and the decrease in money supply could eventually reach a maximum of $360 million.

C) increase by $120 million with this transaction, and the increase in money supply could eventually reach a maximum of $480 million.

D) increase by $120 million with this transaction, and the increase in money supply could eventually reach a maximum of $360 million.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The opportunity cost of holding money

A) is zero because money is not an economic resource.

B) varies inversely with the interest rate.

C) varies directly with the interest rate.

D) varies inversely with the level of economic activity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If nominal GDP is $4,000 billion and the amount of money demanded for transactions purposes is $800 billion, it can generally be concluded that

A) the asset demand for money is $3,200 billion.

B) the total demand for money is $4,800 billion.

C) on average, each dollar will be spent five times a year.

D) the supply of money needs to be increased to meet the demand.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions by the Fed most likely increase commercial bank lending?

A) raising the reserve ratio

B) increasing the federal funds rate target

C) reducing the interest paid on excess reserves held at the Fed

D) selling bonds to commercial banks and the public

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the commercial banking system has checkable deposits of $10 billion and excess reserves of $1 billion at a time when the reserve requirement is 20 percent. If the reserve requirement is now raised to 30 percent, the banking system then has

A) excess reserves of $2 billion.

B) neither an excess nor a deficiency of reserves.

C) a deficiency of reserves of $.5 billion.

D) excess reserves of only $.5 billion.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If nominal GDP is $600 billion and, on the average, each dollar is spent three times per year, then the amount of money demanded for transactions purposes will be

A) $1,800 billion.

B) $600 billion.

C) $200 billion.

D) $1,200 billion.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 405

Related Exams