A) Exchange rate equilibrium

B) Exchange rate parity

C) Universal parity

D) Market equilibrium

E) Purchasing power parity

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the spot rate between the UK and the U.S.is £.6789 = $1, while the one-year forward rate is £.6782 = $1.The risk-free rate in the UK is 3.1 percent.The risk-free rate in the U.S.is 2.9 percent.How much profit can you earn for the year on a loan of $1,500 by utilizing covered interest arbitrage?

A) $4.09

B) $2.78

C) $3.15

D) $4.60

E) $3.55

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is an example of the political risks associated with foreign operations?

A) Technological changes

B) Exchange rate fluctuations

C) Translation exposure to exchange rate risk

D) Changes in foreign tax laws

E) Changes in relative wage rates between the home country and the foreign country

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is the risk arising from changes in value caused by political actions?

A) Exchange rate risk

B) Political risk

C) Translation risk

D) LIBOR risk

E) Cross-rate risk

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these must be significantly eliminated if interest rate parity is to exist?

A) Absolute purchasing power parity

B) Short-run exposure to exchange rate risk

C) Covered interest arbitrage opportunities

D) Relative purchasing power parity

E) Translation exposure

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these is defined as an agreement to exchange two securities or two currencies?

A) Hedge

B) Swap

C) SWIFT

D) Gilt

E) Arbitrage

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume you can currently exchange $100 for €80.25.The inflation rate in Europe is expected to be 1.8 percent as compared to 2.4 percent in the U.S.Based on relative purchasing power parity, what should the exchange rate be four years from now?

A) €.8219/$1

B) €.8014/$1

C) €.7970/$1

D) €.8073/$1

E) €.7834/$1

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The spot rate on the Canadian dollar is 1.21.Interest rates in Canada are expected to average 2.8 percent while they are anticipated to be 3.2 percent in the U.S.What is the expected exchange rate three years from now?

A) C$1.31

B) C$1.20

C) C$1.29

D) C$1.26

E) C$1.28

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are given the exchange rate between the U.S.dollar and the Canadian dollar.You are also given the exchange rate between the U.S.dollar and the Mexican peso.What is the name given to the Canadian dollar per Mexican peso exchange rate derived from the information that was provided?

A) Swap rate

B) Depositary rate

C) Forward rate

D) London Interbank rate

E) Cross-rate

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Interest rate parity defines the relationships among which of the following?

A) Spot exchange rates, future exchange rates, interest rates, and inflation rates

B) Real and nominal interest rates across countries

C) Real interest and inflation rates

D) Forward exchange rates, relative interest rates, and spot exchange rates

E) Spot exchange rates, forward exchange rates, nominal interest rates, and real interest rates

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are debating between spending a week in Brazil or a week in Chile.You've estimated the cost of the Brazilian trip at 56,300 reals and the Chilean trip at 13.6 million pesos.The currency per U.S.dollar is 2.5658 reals and 609.10 pesos.If you prefer the less expensive trip, as measured in U.S.dollars, you should travel to _____ because you can save ____.

A) Brazil; you can save $460.45

B) Brazil; you can save $518.74

C) Chile; you can save $384.29

D) Chile; you can save $613.33

E) Brazil; you can save $385.55

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The spot rate on the Canadian dollar is 1.34.Interest rates in Canada are expected to average 3.4 percent while they are anticipated to be 3.9 percent in the U.S.What is the expected exchange rate three years from now?

A) C$1.37

B) C$1.32

C) C$1.36

D) C$1.29

E) C$1.28

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

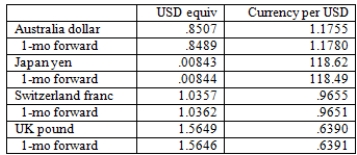

Given the following exchange rates, which of the following currencies are selling at a premium against the dollar?

A) Japanese yen only

B) Swiss franc and Australian dollar only

C) UK pound only

D) Australian dollar, Swiss franc, and UK pound only

E) Japanese yen and Swiss franc only

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the one-year forward rate for the Swiss franc is SF.9655 = $1.The spot rate is SF .9702 = $1.The interest rate on a risk-free asset in Switzerland is 3.8 percent.If interest rate parity exists, a one-year risk-free security in the U.S.is yielding _____ percent.

A) 4.21

B) 4.51

C) 3.98

D) 4.40

E) 4.31

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are going to London and plan on spending £4,200.How many dollars will this trip cost you if the currency per $1 is £.82?

A) $5,875.95

B) $5,892.16

C) $5,121.95

D) $5,890.01

E) $6,044.04

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the USD equivalent of the Norwegian krone is .1425.If you have NKr5,500, how much do you have in US dollars?

A) $861.42

B) $42,608.14

C) $38,596.49

D) $783.75

E) $16,216.50

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An agreement to exchange currencies sometime in the future is referred to as which one of the following?

A) Forward trade

B) Hedge

C) Gilt

D) Forward exchange rate

E) Spot trade

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume you can exchange $1 for ¥110.23 or €0.86 in New York.In Tokyo, the exchange rate is ¥1 = €0.009.If you have $900, how much profit can you earn using triangle arbitrage?

A) $130.58

B) $127.56

C) $138.21

D) $129.87

E) $135.88

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Currently, you can exchange €100 for $112.55.The inflation rate in Europe is expected to be 1.4 percent.In one year, it is expected that €100 can be exchanged for $113.50.Assume relative purchasing power parity exists.What is the expected inflation rate in the U.S.?

A) 4.99 percent

B) 5.92 percent

C) 5.05 percent

D) 5.69 percent

E) 5.48 percent

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following terms is used to describe international bonds issued in a single country and generally denominated in that country's currency?

A) Eurobonds

B) American Depositary Receipts

C) Foreign bonds

D) Swaps

E) Gilts

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 95

Related Exams