A) Temporary support of the market price of IPO shares

B) Maximization of the return to a firm's original owners from an initial spike in the market price of IPO shares

C) Increase in the volume of trading for shares of a recent IPO

D) Limitation on the price volatility of recent IPO shares caused by day trading

E) Guarantee of a minimum number of sold shares for an IPO

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

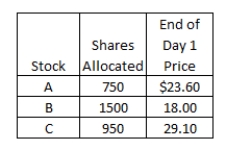

Gwen placed an order with her broker to purchase 1,500 shares of each of three IPOs that are being released this month.Each IPO has an offer price of $22 per share.The number of shares allocated to her along with the closing stock price at the end of the first day of trading for each stock, are as follows:  What is her total profit or loss on these three stocks as of the end of the first day of trading for each stock?

What is her total profit or loss on these three stocks as of the end of the first day of trading for each stock?

A) $1,945

B) $4,500

C) $5,145

D) $3,220

E) $2,450

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is correct?

A) IPO underpricing is minimal in China.

B) IPO underpricing is limited to the U.S.markets.

C) The percentage of underpricing remains stable over time in the U.S.

D) The only period in the U.S.when underpricing produced first day returns of 50 percent or more was during the tech bubble of 1999-2000.

E) Some of the greatest IPO underpricing has occurred in Saudi Arabia.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marti's BBQ is offering 5,000 shares of stock to the general public on a cash basis.Which one of the following terms best applies to this offer?

A) Rights offer

B) General cash offer

C) Green Shoe

D) Red herring

E) Prospectus

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Art Works needs to raise $6.2 million for a new facility.Assuming they issue new equity shares via a general cash offering, they expect to incur administrative costs of $412,000 in addition to the underwriting spread of 7.8 percent.If the offer price turns out to be $16 a share, how many shares need to be sold to finance the new facility?

A) 448,210 shares

B) 454,743 shares

C) 406,211 shares

D) 405,141 shares

E) 487,923 shares

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

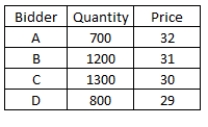

Salem Pet Supply would like to sell 1,400 shares of stock using the Dutch auction method.The bids received are as follows:  Bidder C will receive _____ shares and pay a price per share of _____.

Bidder C will receive _____ shares and pay a price per share of _____.

A) 0; $0

B) 1,400; $27.00

C) 455; $28.00

D) 455; $29.00

E) 700; $38.75

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following best describes a private placement?

A) Interim financing for a new, high-risk entity

B) Long-term loan by a limited number of investors

C) Two-year direct business loan

D) Three-year loan to a firm by its original founder

E) New equity issue offered to current shareholders

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An initial public offering refers to:

A) the shares held by a firm's founder.

B) the most recently issued shares that were offered to the firm's existing shareholders.

C) any shares issued to the public on a cash basis.

D) the first sale of equity shares to the general public.

E) all shares issued prior to the firm going public.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following correctly states a qualification an issuer must meet to be qualified to use Rule 415 for shelf registration?

A) The issuer must never have defaulted on its debt.

B) The issuer must have outstanding stock with a market value in excess of $250 million.

C) The issuer must never have violated the Securities Act of 1934.

D) The issuer must have an investment grade rating.

E) The issuer cannot have defaulted on its debt within the past five years.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Green Shoe option is most apt to be exercised when an IPO is ______ and _____.

A) underpriced; oversubscribed

B) underpriced; undersubscribed

C) correctly priced; neither over nor undersubscribed

D) overpriced; oversubscribed

E) overpriced; undersubscribed

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shelf registration:

A) only applies to initial public offerings.

B) only applies to debt securities.

C) only applies to securities issued through crowdfunding.

D) permits firms to sell the registered securities, if they so choose, over a two-year period.

E) requires that all registered securities be sold over a two-year period.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Florida Farms recently offered 12,000 shares of stock for sale but received payment for only 10,500 shares since that was all the shares the underwriters could sell.What type of underwriting was this?

A) Syndicated

B) Firm commitment

C) Private placement

D) Best efforts

E) Dutch auction

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is correct?

A) The underwriters pay the spread.

B) Taxes are an indirect underwriting cost.

C) Seasoned equity offerings (SEOs) tend to be less costly than IPOs.

D) Straight bonds are more costly to issue than convertible bonds.

E) The total direct cost as a percentage of gross proceeds for an IPO tends to decrease as the size of the offer decreases.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Phil and Terry started a new business three years ago.Two years ago, they incorporated the business and issued themselves each 20,000 shares of stock.Last year, they took the company public in an IPO and issued an additional 100,000 shares of stock at that time.The offer price was $14 a share, the spread was 8 percent, and the lockup period was six months.The stock closed at $17 a share at the end of the first day of trading.During the first six months of trading, the stock had a price range of $13 to $23 per share.During the second six months of trading, the stock sold between $15 and $21 per share.Both Tracie and Amy purchased 100 shares at the offer price.Given this, which one of the following statements is correct? Ignore trading costs and taxes.

A) Tracie could have earned a maximum profit of 100($23 - 17) on her investment.

B) Phil could have sold 5,000 shares at $23 per share.

C) The underwriters earned a spread per share equal to 8 percent of $17.

D) The maximum price at which Terry could have sold his shares is $21.

E) Amy paid 108 percent of $14 per share to purchase her 100 shares.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Currently, you own 1.2 percent of the outstanding shares of Home Security.The firm has decided to issue additional shares of stock and has given you the first option to purchase 1.2 percent of those additional shares.What type of offer is this?

A) Rights offer

B) Red herring offer

C) Private placement

D) IPO

E) General cash offer

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dingo Farms wants to raise $10 million to purchase equipment by issuing new securities.Management estimates the issue will cost the firm $625,500 for accounting, legal, and other costs.The underwriting spread is 8 percent and the issue price is $20 per share.How many shares of stock must be sold if the firm is to have sufficient funds remaining after costs to purchase all of the desired equipment?

A) 679,891 shares

B) 655,500 shares

C) 577,446 shares

D) 500,000 shares

E) 82,139 shares

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Free Trade Partners needs to raise $24.2million to expand its operations into South America.The company will sell new shares of common stock using a general cash offering.The underwriters will charge a spread of 7.6 percent, the administrative costs will be $631,000, and the offer price will be $32 per share.How many shares of stock must be sold if the firm is to raise the funds it desires?

A) 748,315 shares

B) 839,793 shares

C) 911,502 shares

D) 989,415 shares

E) 1,051,515 shares

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is an aftermarket function performed by the underwriters of a securities issue?

A) Distributing the registration statements

B) Distributing the red herrings

C) Filing a letter of comment with the SEC

D) Exercising the Green Shoe option

E) Setting the market price

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A new issue of common stock offered to the general public by a firm that is currently publicly held is called a(n) :

A) initial public offering.

B) private placement.

C) rights offer.

D) venture capital offer.

E) seasoned equity offering.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

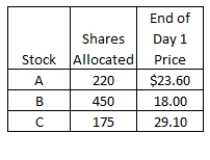

Wendy placed an order with her broker to purchase 500 shares of each of three IPOs that are being released this month.Each IPO has an offer price of $23 a share.The number of shares allocated to Wendy, along with the closing stock price at the end of the first day of trading for each stock, are as follows:  What is her total profit or loss on these three stocks as of the end of the first day of trading for each stock?

What is her total profit or loss on these three stocks as of the end of the first day of trading for each stock?

A) $639.50

B) -$369.50

C) -1,050.00

D) $572.00

E) $1,370

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 76

Related Exams