A) depreciate the dollar.

B) appreciate the euro.

C) reduce the equilibrium quantity of euros.

D) cause a surplus of euros.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a result of the 2007-2009 recession,

A) declining imports created a trade surplus for the United States.

B) the U.S. trade deficit grew significantly.

C) declining imports reduced the size of the U.S. trade deficit.

D) roughly equivalent declines in both exports and imports left the U.S. trade balance unchanged.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the exchange rate changes so that more Mexican pesos are required to buy a dollar, then

A) the peso has appreciated in value.

B) Americans will buy more Mexican goods and services.

C) more U.S. goods and services will be demanded by the Mexicans.

D) the dollar has depreciated in value.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A nation's annual balance of payments statement must always balance because

A) a nation's imports are limited to the value of its exports.

B) a nation's exports and imports are always paid with dollars.

C) all international transactions must be settled in one way or another.

D) a trade deficit must be matched by an equal surplus of investment income.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A system of fixed exchange rates is more likely to result in exchange controls than is a system of flexible (floating)exchange rates.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

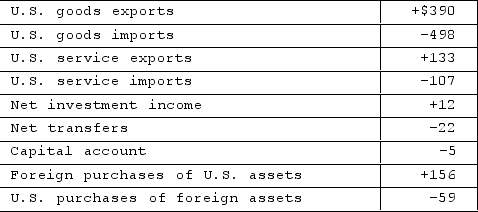

The accompanying table contains hypothetical data for the U.S. balance of payments in a year. All figures are in billions of dollars. The balance on the financial account was a

The accompanying table contains hypothetical data for the U.S. balance of payments in a year. All figures are in billions of dollars. The balance on the financial account was a

A) $92 billion surplus.

B) $97 billion surplus.

C) $92 billion deficit.

D) $97 billion deficit.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the financing of international trade is correct?

A) International trade means the trading of financial assets for foreign exchange.

B) Most international transactions are made with gold.

C) Imports are more important than exports to the economy of a nation.

D) Exports provide the foreign currencies needed to pay for imports.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following, other things equal, will directly alter the U.S. balance of trade?

A) an increase in the balance on capital account

B) a decrease in U.S. goods exports

C) an increase in net transfers

D) a decrease in U.S. purchases of assets abroad

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the U.S. dollar depreciates relative to the Russian ruble, the ruble

A) will be less expensive to Americans.

B) may either appreciate or depreciate relative to the dollar.

C) will appreciate relative to the dollar.

D) will depreciate relative to the dollar.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions represents an inflow of money on the financial account of the U.S. balance of payments?

A) Oil is imported from Venezuela.

B) United States firms pay dividends to foreigners.

C) United States citizens purchase foreign securities.

D) A Canadian firm increases its direct investment in its U.S. branch.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under an international gold standard,

A) a nation's exchange rate is virtually fixed.

B) domestic output and the price level will fall in those nations receiving international gold flows.

C) a nation's balance of payments surplus will be corrected by an outflow of gold.

D) a nation's balance of payments deficit will be corrected by an inflow of gold.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the purchasing power parity theory of exchange rates,

A) a dollar, when converted to other currencies at the prevailing floating exchange rate, has the same purchasing power in various countries.

B) in equilibrium, national currencies have equal value in terms of gold.

C) the higher a nation's price level in terms of its own currency, the greater is the amount of foreign exchange it can obtain for a unit of its currency.

D) nominal currency values will tend to equalize (become 1 = 1) in the long run.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Econland has a fixed exchange-rate system. Econland's government (its central bank) will exchange as much local currency (say pesos) for foreign currency (say dollars) and as much foreign currency (say dollars) for local currency (say pesos) as is necessary to maintain the peg. Which of the following statements is not true?

A) Satisfying requests by people to get local pesos in exchange for foreign dollars is easy for the central bank to do.

B) The central bank has a restricted capacity to satisfy requests by people to get foreign dollars in exchange for local pesos.

C) Being the central bank, it has an equal capacity to satisfy requests to exchange dollars for pesos, and pesos for dollars.

D) The central bank needs to stockpile some foreign-exchange reserves in order to maintain the peg.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a graph showing the market supply and demand for British pounds in terms of U.S. dollars, the demand-for-pounds curve is downsloping because

A) fewer British pounds can be purchased if pounds become less expensive.

B) fewer U.S. dollars can be purchased if British pounds become less expensive.

C) more U.S. dollars can be purchased if British pounds become more expensive.

D) more British pounds can be purchased if pounds become less expensive.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the balance on the current account is +$100 billion and the balance on the capital account is −$1 billion. The balance on the financial account is

A) +$101 billion.

B) −$100 billion.

C) −$99 billion.

D) −$101 billion.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following lists of exchange-rate systems is arranged in proper historical order, from earliest to most current?

A) Bretton Woods system, gold standard, managed float

B) gold standard, managed float, Bretton Woods system

C) managed float, Bretton Woods system, gold standard

D) gold standard, Bretton Woods system, managed float

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

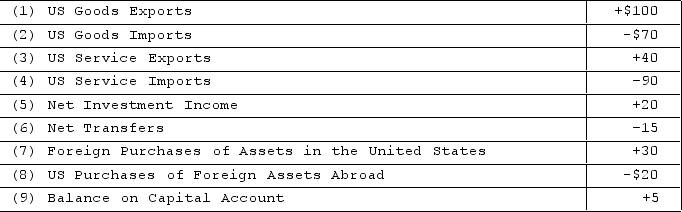

The table contains hypothetical data for the U.S. balance of payments. All figures are in billions of dollars. The United States has a balance of goods

The table contains hypothetical data for the U.S. balance of payments. All figures are in billions of dollars. The United States has a balance of goods

A) surplus of $30 billion.

B) deficit of $20 billion.

C) surplus of -$20billion.

D) deficit of $170 billion.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It may be misleading to label a trade deficit as unfavorable or adverse, because

A) the multiplier does not apply to a trade deficit.

B) a trade deficit increases a nation's aggregate output and employment.

C) a nation's consumers benefit from a trade deficit during the period it occurs.

D) a trade deficit precludes inflation.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the rate of exchange for a pound is $4, the rate of exchange for the dollar is

A) ¼ pound.

B) 4 pounds.

C) $0.25.

D) $1.00.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What are the effects on U.S. imports and exports when the U.S. experiences economic growth stronger than its major trading partners?

A) U.S. imports will increase more than U.S. exports.

B) U.S. exports will increase more than U.S. imports.

C) U.S. imports will decrease, but U.S. exports will increase.

D) There will be no effect on U.S. imports and exports.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 318

Related Exams