A) $0.67 per British pound.

B) $1.50 per British pound.

C) $0.57 per British pound.

D) $1.75 per British pound.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

International transactions fall into what two broad categories?

A) manufacturing trade and services trade

B) international trade and international asset transactions

C) currency transactions and services trade

D) newly created assets and preexisting assets

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In the dollar/yen market, if the supply of yen increases, other things being equal, the dollar will appreciate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The United States has had significant trade and current account surpluses in recent years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current account on a nation's balance of payments statement includes all of the following except

A) the nation's goods exports.

B) the nation's goods imports.

C) net investment income.

D) net purchases of assets abroad.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S. supply of Japanese yen is

A) downsloping because a lower dollar price of yen means U.S. goods are cheaper to the Japanese.

B) upsloping because when the dollar price of yen rises (and the yen price of a dollar falls) it means that U.S. goods are cheaper to the Japanese.

C) upsloping because when the dollar price of yen falls (and the yen price of a dollar rises) it means that U.S. goods are cheaper to the Japanese.

D) downsloping because a higher dollar price of yen means U.S. goods are cheaper to the Japanese.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

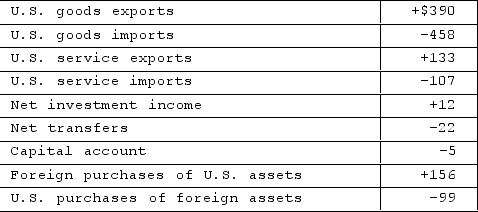

The accompanying table contains hypothetical data for the U.S. balance of payments in a year. All figures are in billions of dollars. The balance on the financial account was a

The accompanying table contains hypothetical data for the U.S. balance of payments in a year. All figures are in billions of dollars. The balance on the financial account was a

A) $57 billion surplus.

B) $52 billion surplus.

C) $57 billion deficit.

D) $52 billion deficit.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All else being equal, an increased demand for U.S. products in the European Union will create a

A) demand for euros.

B) supply of euros.

C) shortage of euros.

D) surplus of euros.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose interest rates fall sharply in the United States but are unchanged in Great Britain. Other things equal, under a system of floating exchange rates, we can expect the demand for pounds in the United States to

A) decrease, the supply of pounds to increase, and the dollar to appreciate relative to the pound.

B) increase, the supply of pounds to increase, and the dollar may either appreciate or depreciate relative to the pound.

C) increase, the supply of pounds to decrease, and the dollar to depreciate relative to the pound.

D) decrease, the supply of pounds to increase, and the dollar to depreciate relative to the pound.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The exchange-rate system that we now have for major currencies like the U.S. dollar, yen, and euro is a "managed-floating" system.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A declining amount of foreign-exchange reserves resulting from maintaining a pegged exchange rate would have which of the following effects?

A) a decrease in domestic money supply

B) a negative item entry in the balance of payments statement

C) rising inflationary pressure

D) an increase in the supply of local currency coming from this nation's central bank

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If real interest rates rise in the United Kingdom relative to the United States, then this event is most likely to cause the British pound to

A) depreciate and the U.S. dollar to depreciate.

B) depreciate and the U.S. dollar to appreciate.

C) appreciate and the U.S. dollar to appreciate.

D) appreciate and the U.S. dollar to depreciate.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The official reserves of a nation's central bank include

A) foreign currencies only.

B) foreign currencies, bonds issued by foreign governments, gold reserves, and special reserves held at the International Monetary Fund.

C) its stock of domestic and foreign currencies.

D) all domestic and foreign financial assets held by the central bank, including gold reserves.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Econland adopts a fixed exchange-rate system and pegs the value of its peso to the U.S. dollar. If Econlanders' demand for dollars increases in the foreign exchange markets, then Econland's foreign-exchange reserves will

A) increase.

B) decrease.

C) stay the same.

D) equal the trade balance.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two of the implications of large U.S. trade deficits for the United States are

A) decreased current consumption and decreased indebtedness to foreigners.

B) reduced budget deficits and decreased indebtedness to foreigners.

C) reduced current consumption and higher saving.

D) increased current consumption and increased indebtedness to foreigners.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"International trade" refers to

A) purchasing or selling currently produced goods or services across an international border.

B) any transaction across an international border.

C) any financial transaction across an international border.

D) buying or selling of preexisting assets across an international border.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the price of British pounds, measured in terms of U.S. dollars, is rising, then the price of U.S. dollars, measured in terms of British pounds, is also rising.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under flexible (floating)exchange rates, a U.S. trade deficit with Japan will eventually cause the dollar price of yen to rise.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the dollar price of the British pound will

A) increase the pound price of dollars.

B) decrease the pound price of dollars.

C) leave the pound price of dollars unchanged.

D) cause Britain's terms of trade with the United States to deteriorate.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the economy recovers from a recession, economists expect its

A) imports to grow, and therefore its trade deficit would also grow.

B) exports to grow, and therefore its trade deficit would shrink.

C) imports and exports to grow at roughly the same rate, so its trade deficit will stay constant.

D) imports and exports to start declining. Therefore, its trade deficit will also decline a little bit.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 318

Related Exams