A) deficit, and smaller than the current account deficit.

B) surplus, and equal to the current account deficit.

C) balance, with no deficit or surplus.

D) surplus, and smaller than the current account deficit.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Canadian dollar price of United States dollars increases from C$0.80 to C$1.00, it can be concluded that

A) both countries are on the international gold standard.

B) the Canadian dollar has appreciated in value relative to the United States dollar.

C) the United States dollar has depreciated in value relative to the Canadian dollar.

D) the Canadian dollar has depreciated in value relative to the United States dollar.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

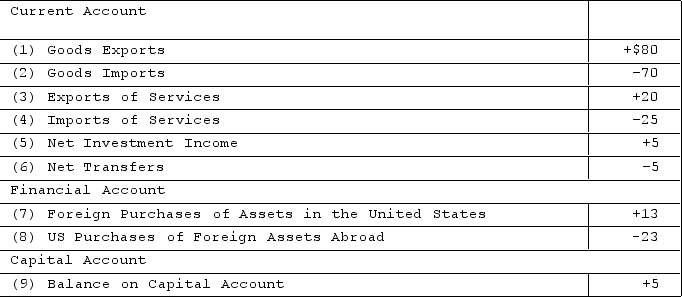

The table contains balance of payments data (+ and −) for the hypothetical nation of Zabella. All figures are in billions of dollars. Zabella's balance on goods and services shows a

The table contains balance of payments data (+ and −) for the hypothetical nation of Zabella. All figures are in billions of dollars. Zabella's balance on goods and services shows a

A) $5 billion deficit.

B) $5 billion surplus.

C) $10 billion surplus.

D) $15 billion deficit.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following combinations is plausible, as it relates to a nation's balance of payments?

A) Current account = +$40 billion; capital account = +$20 billion; financial account = −$50 billion.

B) Current account = −$50 billion; capital account = +$20 billion; financial account = +$30 billion.

C) Current account = +$10 billion; capital account = +$40 billion; financial account = +$50 billion.

D) Current account = +$30 billion; capital account = −$20 billion; financial account = −$50 billion.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the consequences of the U.S. trade deficit is that

A) domestic inflation has resulted.

B) the accumulation of American dollars in foreign hands has enabled foreign firms to build factories in America.

C) the distribution of income in the United States has become less unequal.

D) the system of flexible exchange rates has been abandoned in favor of a new gold standard.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

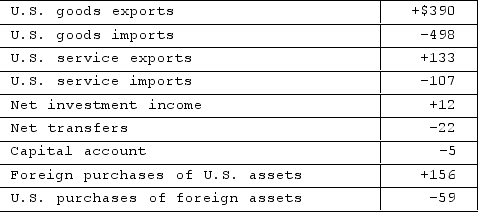

The accompanying table contains hypothetical data for the U.S. balance of payments in a year. All figures are in billions of dollars. The data indicate that there was a trade

The accompanying table contains hypothetical data for the U.S. balance of payments in a year. All figures are in billions of dollars. The data indicate that there was a trade

A) deficit in goods and also a trade deficit in services.

B) surplus in goods and also a trade surplus in services.

C) deficit in goods and a trade surplus in services.

D) surplus in goods and a trade deficit in services.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

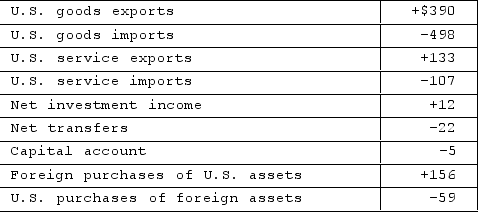

The accompanying table contains hypothetical data for the U.S. balance of payments in a year. All figures are in billions of dollars. The balance on the current account was a

The accompanying table contains hypothetical data for the U.S. balance of payments in a year. All figures are in billions of dollars. The balance on the current account was a

A) $51 billion surplus.

B) $92 billion deficit.

C) $22 billion surplus.

D) $82 billion deficit.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the dollar-euro market, an increased demand for European products among U.S. buyers will create an increase in

A) supply of euros.

B) demand for dollars.

C) demand for euros.

D) shortage of dollars.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To maintain a fixed exchange rate, the government can use the following tools, except

A) currency market intervention.

B) controlling the flow of trade through various barriers.

C) rationing of foreign exchange.

D) keeping its level of international reserves strictly fixed.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a U.S. importer can purchase 10,000 British pounds for $20,000, the rate of exchange is

A) $1 = 2 British pounds in the United States.

B) $2 = 1 British pound in the United States.

C) $1 = 2 British pounds in Great Britain.

D) $0.50 = 1 British pound in Great Britain.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A trade deficit for the United States is generally financed by

A) lending to the federal government.

B) borrowing from the federal government.

C) buying securities or assets from other nations.

D) selling securities or assets to other nations.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the exchange rate between the U.S. dollar and the Japanese yen is $1 = 250 yen, then the dollar price of yen is

A) $0.004.

B) $4.

C) $0.40.

D) $0.04.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The purchase of a foreign hotel by a U.S. company is recorded as an inflow of money in the financial account of the U.S. balance-of-payments statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the United States fixes the dollar-pound exchange rate. In the process of maintaining the fixed exchange rate, the U.S. central bank regularly finds itself in a position of having to increase its reserves of pounds. Based on this, we could conclude that

A) the fixed dollar-pound exchange rate is consistently below the equilibrium exchange rate that would be produced by a private foreign exchange market.

B) the fixed dollar-pound exchange rate consistently exceeds the equilibrium exchange rate that would be produced by a private foreign exchange market.

C) the fixed dollar-pound exchange rate is a good approximation of the exchange rate that would be produced by a private foreign exchange market.

D) the U.S. central bank is regularly having to reduce the domestic money supply.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the managed floating system of exchange rates,

A) all exchange rates vary with changes in the free-market prices of gold.

B) industrialized nations meet once each year to negotiate readjustments in their exchange rates.

C) exchange rates are essentially flexible, but governments intervene to offset disorderly fluctuations in rates.

D) exchange rates are adjusted at the discretion of the IMF.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following combinations is plausible, as it relates to a nation's balance of payments?

A) Current account = +$40 billion; capital account = −$10 billion; financial account = −$50 billion.

B) Current account = +$50 billion; capital account = −$20 billion; financial account = +$30 billion.

C) Current account = +$10 billion; capital account = +$40 billion; financial account = +$50 billion.

D) Current account = +$30 billion; capital account = −$20 billion; financial account = −$10 billion.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

U.S. businesses are demanders of foreign currencies because they need them to

A) sell goods and services exported to foreign countries.

B) pay for goods and services imported from foreign countries.

C) receive interest payments from foreign governments.

D) receive interest payments from foreign businesses.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The current account portion of a nation's balance of payments statement includes net investment income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The U.S. often has a significant surplus in services trade, even though it has a deficit in goods trade.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mainly because of large current account deficits, the United States

A) is the leading exporting nation in the world.

B) has experienced increased foreign ownership of assets in the United States.

C) has the world's highest saving rate.

D) is experiencing an increase in its net inflow of investment income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 318

Related Exams