B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an oligopolist is faced with a marginal revenue curve that has a gap in it, we may assume that

A) it is colluding with its rivals to maximize joint profits.

B) its demand curve is kinked.

C) it is selling a standardized product.

D) it is selling a differentiated product.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A sequential game can be modeled in two forms: payoff-matrix form and game-tree form.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an oligopolist's demand curve has a "kink" in it, then over some interval,

A) the oligopolist's marginal cost curve will have a break in it.

B) the oligopolist need not fear entry into the industry by new firms.

C) the oligopolist's competitors will not react to its price changes, either up or down.

D) changes in marginal cost will not cause a change in the profit-maximizing price.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Potential entry by new firms and competition from imports tend to worsen the economic inefficiency in an oligopoly.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Game-theory analyzes oligopoly behavior by using concepts derived from the study of games-of-chance such as dice games, solitaire, and roulette.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The high concentration ratio for the aluminum industry understates the competition in that industry that comes from the copper industry. This is an example of

A) overt collusion.

B) covert collusion.

C) import competition.

D) interindustry competition.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

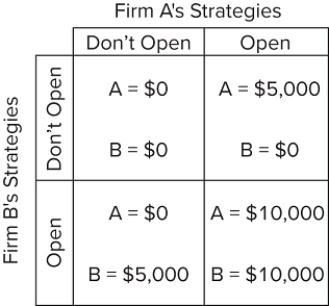

Answer the question based on the payoff matrix for a duopoly in which the numbers indicate the profit from either opening a coffee shop in a small town or not opening the coffee shop. If the firms are playing a sequential game, then

Answer the question based on the payoff matrix for a duopoly in which the numbers indicate the profit from either opening a coffee shop in a small town or not opening the coffee shop. If the firms are playing a sequential game, then

A) there is first-mover advantage.

B) the firm with the first move will choose not to open a coffee shop.

C) the firm with the first move will choose to open a coffee shop.

D) both firms will choose not to open a coffee shop, regardless of which firm chooses first.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

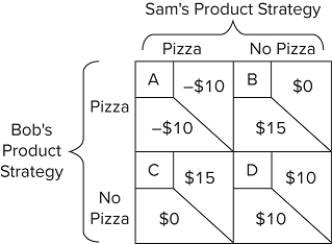

Refer to the payoff matrix. Bob's Burgers and Sam's Sandwiches are competing restaurants in a small town. Both are considering adding pizza to their line of products. If this is a sequential game,

Refer to the payoff matrix. Bob's Burgers and Sam's Sandwiches are competing restaurants in a small town. Both are considering adding pizza to their line of products. If this is a sequential game,

A) whoever moves first to add pizza will discourage the other from adding pizza.

B) neither firm will add pizza, regardless of who moves first.

C) both firms will add pizza, regardless of who moves first.

D) there is only one possible Nash equilibrium for this game.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Oligopolists use limit pricing to maximize short-run profits.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Herfindahl index for an industry is 2,550. Which of the following sets of market shares and industry with four firms would produce such an index?

A) 20, 20, 30, and 30

B) 25, 25, 25, and 25

C) 20, 25, 25, and 30

D) 10, 20, 30, and 40

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The kinked-demand curve model helps to explain price rigidity because

A) there is a gap in the marginal revenue curve within which changes in marginal cost will not affect output or price.

B) demand is inelastic above and elastic below the going price.

C) the model assumes firms are engaging in some form of collusion.

D) the associated marginal revenue curve is perfectly elastic at the going price.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the four-firm concentration ratio for industry X is 60,

A) the four largest firms account for 60 percent of total sales.

B) each of the four largest firms accounts for 15 percent of total sales.

C) the four largest firms account for 60 percent of total advertising expenditures.

D) the industry is monopolistically competitive, but on the threshold of being an oligopoly.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Microsoft

A) dominates the primary Internet markets.

B) is attempting to gain market share in the Internet, smartphone, and tablet markets in an effort to offset a shrinking PC market.

C) has colluded with Amazon and Google to fix online advertising prices.

D) holds a near-monopoly in the Internet search market.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If an oligopolist's competitors follow its price cuts but ignore its price increases, the oligopolist would end up holding its price constant even if its marginal cost changes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

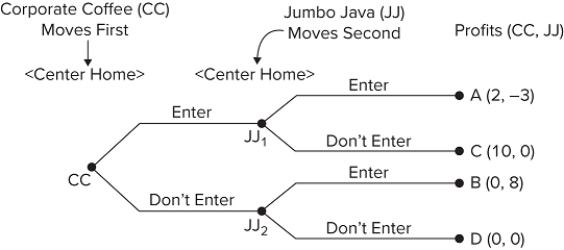

The diagram shows the extensive form version of a strategic game between the two nationally dominant coffee sellers, Corporate Coffee and Jumbo Java, both of whom are considering opening coffee shops in a new town. The payoffs represent, in thousands per month, the profit (or loss) the firm will realize from its decision. Which of the following statements is true about this game?

The diagram shows the extensive form version of a strategic game between the two nationally dominant coffee sellers, Corporate Coffee and Jumbo Java, both of whom are considering opening coffee shops in a new town. The payoffs represent, in thousands per month, the profit (or loss) the firm will realize from its decision. Which of the following statements is true about this game?

A) It would be a Stackelberg duopoly if both firms gained from entering the new market.

B) It represents a Stackelberg duopoly.

C) It would be a Stackelberg duopoly if Jumbo Java could prevent Corporate Coffee's entry into the market.

D) It would be a Stackelberg duopoly if the two firms moved simultaneously.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cartel is

A) a form of covert collusion.

B) legal in the United States.

C) always successful in raising profits.

D) a formal agreement among firms to collude.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

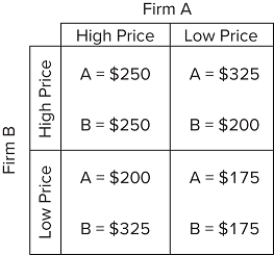

Answer the question based on the payoff matrix for a duopoly in which the numbers indicate the profit in millions of dollars for each firm. If the two firms collude to maximize joint profits, the total profits for the two firms will be

Answer the question based on the payoff matrix for a duopoly in which the numbers indicate the profit in millions of dollars for each firm. If the two firms collude to maximize joint profits, the total profits for the two firms will be

A) $350 million.

B) $400 million.

C) $500 million.

D) $525 million.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A strategy that is better than any alternative strategy-regardless of what the other firm does-is called a

A) dominant strategy.

B) simultaneous strategy.

C) positive-sum strategy.

D) one-time strategy.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

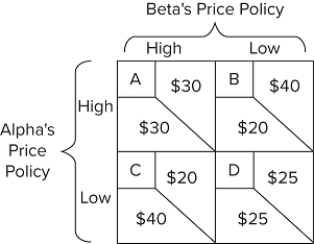

Refer to the payoff matrix. Which cell represents the equilibrium outcome of this game?

Refer to the payoff matrix. Which cell represents the equilibrium outcome of this game?

A) A

B) B

C) C

D) D

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 362

Related Exams