A) cr

B) dr

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a financing activity?

A) The business receives land and gives a check for $1,000.

B) The business receives $1,000 cash and in exchange gives a promissory note.

C) The business promises to hire an employee on the 15th of the month.

D) The business orders supplies and promises to pay for them at the end of the month.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

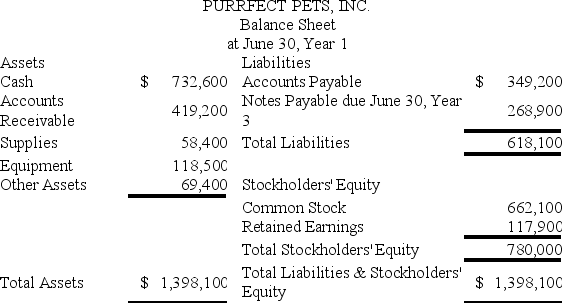

Which line items would be classified as noncurrent on a classified balance sheet?

Which line items would be classified as noncurrent on a classified balance sheet?

A) Cash;Supplies;Accounts Payable

B) Equipment;Other Assets;Notes Payable

C) Supplies;Equipment;Notes Payable

D) Accounts Receivable;Equipment;Other Assets

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a business issues stock,what does it give to its owners?

A) Note Payable

B) Common Stock

C) Retained Earnings

D) Cash

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each account name with the category that it would be included under in a classified balance sheet. -Supplies

A) NCA - Noncurrent Asset

B) CL - Current Liability

C) SE - Stockholders' Equity

D) CA - Current Asset

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During its first year of operations,a company entered into the following transactions: Borrowed $20,000 from the bank by signing a promissory note. Issued stock to owners for $40,000. Purchased $4,000 of supplies on account. Paid $1,600 to suppliers as payment on account for the supplies purchased. What is the amount of total assets at the end of the year?

A) $64,000

B) $22,400

C) $60,000

D) $62,400

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchased equipment for use in the business at a cost of $36,000,one-fourth was paid in cash,and the company signed a note for the balance.The journal entry to record this transaction will include a:

A) debit to Notes Payable of $27,000.

B) debit to Cash of $36,000.

C) credit to Notes Payable of $27,000.

D) debit to Equipment of $9,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term with its definition.(There are more definitions than terms. ) -Accounting Equation

A) The abbreviation for an item posted on the left side of a T-account.

B) A balance sheet that has not yet been publicly released.

C) A transaction that is triggered automatically merely by the passage of time.

D) When a company becomes included in the Fortune 500.

E) The account credited when cash is received in exchange for stock issued.

F) The value of a company's public relations campaign.

G) An event that has no effect on the balance sheet and is not recorded in the financial statements.

H) A balance sheet that has assets and liabilities categorized as current vs.noncurrent.

I) Amounts owed to suppliers for goods or services bought on credit.

J) The abbreviation for an item posted on the right side of a T-account.

K) An exchange or event that has a direct impact on a company's financial statements.

L) Liabilities divided by assets.

M) Another name for stockholders' equity or shareholders' equity.

N) A method of recording a transaction in debit/credit format.

O) The expression that assets must equal liabilities plus stockholders' equity.

Q) B) and J)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term with its definition.(There are more definitions than terms. ) -Journal Entry

A) A summary of account names and numbers.

B) A simplified version of an account in the General Ledger.

C) Compares balance sheet items from two different time periods.

D) When a dollar value is assigned to an item recorded in the accounting system.

E) A journal entry that lowers the balance of the account.

F) An amount that is posted on the left side of a T-account or ledger.

G) The concept that a company must keep separate accounts by time period.

H) An amount that is posted on the right side of a T-account or ledger.

I) Assets are initially recorded at the amount paid to acquire them.

J) When journal entries are recorded in the appropriate T-account or ledger.

K) When a company's balance sheet has been verified by an outside auditor.

L) The principle that a company should use the least optimistic measure,when uncertainty exists.

M) The concept that any transaction must have at least two effects on the accounting equation.

N) The mechanism used to record each transaction in the General Journal.

P) E) and J)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

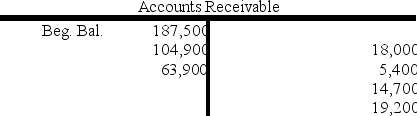

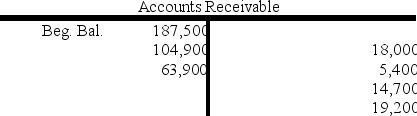

T-account:  Partial list of account balances at the end of the year:

Which of the following is an accurate description of the economic events involving Accounts Receivable as documented in the T-account above?

Partial list of account balances at the end of the year:

Which of the following is an accurate description of the economic events involving Accounts Receivable as documented in the T-account above?

A) Sales to customers on account exceeded the payments received from customers on account.

B) Payments received from customers on account exceeded the sales made to customers on account.

C) The company paid off its debt more than it incurred new debt.

D) The company incurred more debt than it paid off.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Constable Co.reported the following information at December 31,Year 1: What is the amount of current liabilities on the classified balance sheet?

A) $14,175

B) $10,425

C) $170,310

D) $6,750

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Every transaction increases at least one account and decreases at least one account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debit would make which of the following accounts increase?

A) Common Stock

B) Inventory

C) Notes Payable

D) Retained Earnings

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Sweet Smell of Success Fragrance Company borrowed $60,000 from the bank to be paid back in five years and used all of the money to purchase land for a new store.Sweet Smell's balance sheet would show this as:

A) $60,000 under Land and $60,000 under Notes Payable (long-term) .

B) $60,000 under Depreciation Expense and $60,000 under Notes Payable (long-term) .

C) $60,000 under Land and $60,000 under Notes Receivable (long-term) .

D) $60,000 under Other Assets and $60,000 under Other Liabilities.

F) All of the above

Correct Answer

verified

Correct Answer

verified

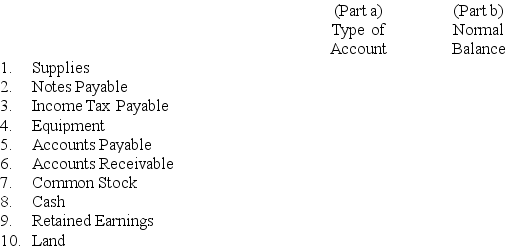

Essay

Selected accounts for Moonbills Corporation appear below.

Required:

For each account,indicate the following:

Part a.P1P1_0.95In the first column at the right,indicate the nature of each account,using the following abbreviations: Asset - A,Liability - L,Stockholders' Equity - SE.P1P1_E

Part b.In the second column,indicate the normal balance by inserting dr (for debit)or cr (for credit).

Correct Answer

verified

Correct Answer

verified

Multiple Choice

T-account:  Partial list of account balances at the end of the year:

The amount of total current assets that will be reported on the company's balance sheet at the end of the year is:

Partial list of account balances at the end of the year:

The amount of total current assets that will be reported on the company's balance sheet at the end of the year is:

A) $362,600.

B) $368,500.

C) $139,500.

D) $327,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term with its definition.(There are more definitions than terms. ) -Duality Of Effects

A) A summary of account names and numbers.

B) A simplified version of an account in the General Ledger.

C) Compares balance sheet items from two different time periods.

D) When a dollar value is assigned to an item recorded in the accounting system.

E) A journal entry that lowers the balance of the account.

F) An amount that is posted on the left side of a T-account or ledger.

G) The concept that a company must keep separate accounts by time period.

H) An amount that is posted on the right side of a T-account or ledger.

I) Assets are initially recorded at the amount paid to acquire them.

J) When journal entries are recorded in the appropriate T-account or ledger.

K) When a company's balance sheet has been verified by an outside auditor.

L) The principle that a company should use the least optimistic measure,when uncertainty exists.

M) The concept that any transaction must have at least two effects on the accounting equation.

N) The mechanism used to record each transaction in the General Journal.

P) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Transactions are first entered in the:

A) ledger.

B) journal.

C) T-accounts.

D) chart of accounts.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Accounts increase on the same side as they appear in the accounting equation: A = L + SE.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For each of the following,indicate how the event would most likely be categorized. -A company sells $2 million in goods for immediate payment.

A) NT - No Transaction

B) EE - External Exchange

C) IE - Internal Event

E) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 223

Related Exams