B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A general sales tax on food is regressive when low-income taxpayers spend a larger proportion of their income on food than high-income taxpayers.

B) A general sales tax on food is regressive when middle income taxpayers spend a smaller proportion of their income on food than high-income taxpayers.

C) A general sales tax on food is regressive when high-income taxpayers spend a larger proportion of their income on food than middle income taxpayers.

D) A general sales tax on food is regressive when high-income taxpayers spend a larger proportion of their income on food than low-income taxpayers.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which tax system requires higher-income taxpayers to have lower tax rates,even though they pay a larger amount of tax when compared to lower-income taxpayers?

A) a proportional tax

B) a progressive tax

C) a regressive tax

D) a lump-sum tax

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a state levies a sales tax,the tax

A) is paid only by the state's residents.

B) occasionally excludes items that are deemed to be necessities.

C) is commonly levied on labor services.

D) applies to wholesale purchases but not retail purchases.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rank the following state and local government expenditure categories from largest to smallest.

A) education, public welfare, highways

B) education, highways, public welfare

C) highways, education, public welfare

D) public welfare, education, highways

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009,federal government receipts were approximately

A) $6,800 per person and federal government spending was approximately $11,400 per person, resulting in a budget surplus.

B) $6,800 per person and federal government spending was approximately $11,400 per person, resulting in a budget deficit.

C) $11,400 per person and federal government spending was approximately $6,800 per person, resulting in a budget surplus.

D) $11,400 per person and federal government spending was approximately $6,800 per person, resulting in a budget surplus

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A payroll tax is also referred to as a social insurance tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-3 Suppose that Bob places a value of $10 on a movie ticket and that Lisa places a value of $7 on a movie ticket. In addition, suppose the price of a movie ticket is $5. -Refer to Scenario 12-3.What is total consumer surplus for Bob and Lisa?

A) $0

B) $2

C) $5

D) $7

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the government levies a tax on a corporation,

A) all the burden of the tax ultimately falls on the corporation's owners.

B) the corporation is more like a tax collector than a taxpayer.

C) output must increase to compensate for reduced profits.

D) less deadweight loss will occur since corporations are entities and not people who respond to incentives.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sue earns income of $80,000 per year.Her average tax rate is 30 percent.Sue paid 20 percent in taxes on the first $30,000 she earned.What was the marginal tax rate on the rest of her income?

A) 20 percent

B) 24 percent

C) 30 percent

D) 36 percent

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For state and local governments,sales taxes and property taxes make up approximately

A) 19 percent of all receipts.

B) 22 percent of all receipts.

C) 35 percent of all receipts.

D) 48 percent of all receipts.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

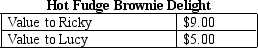

Table 12-4

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $4.00 to $6.00.Total consumer surplus

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $4.00 to $6.00.Total consumer surplus

A) falls by less than the tax revenue generated.

B) falls by more than the tax revenue generated.

C) falls by the same amount as the tax revenue generated.

D) will not fall since Jennifer will no longer be in the market.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.tax burden is

A) about the same as most European countries.

B) higher than most European countries.

C) lower than most European countries.

D) higher than all European countries.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Medicare is the

A) government's health plan for the elderly.

B) government's health plan for the poor.

C) another name for Social Security.

D) Both a and c are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With a lump-sum tax,the

A) marginal tax rate is always less than the average tax rate.

B) average tax rate is always less than the marginal tax rate.

C) marginal tax rate falls as income rises.

D) marginal tax rate rises as income rises.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A family's income tax liability is

A) a standard percentage of all income earned.

B) determined by wage income rather than dividend and interest income.

C) based on total income.

D) constant from year to year.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss of an income tax is determined by the

A) amount of total tax revenue to the government.

B) marginal tax rate.

C) average tax rate.

D) ability-to-pay principle.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mark,Kerry,Greg,and Carlos each like Chicago Cubs baseball games.The single-game ticket price for an infield box seat is $50.Mark values a ticket at $70,Kerry at $65,Greg at $60,and Carlos at $55.Suppose that if the government taxes tickets at $5 each,the selling price will rise to $55.A consequence of the tax is that

A) consumer surplus shrinks by $50 and tax revenues increase by $20, so there is a deadweight loss of $30.

B) consumer surplus shrinks by $30 and tax revenues increase by $20, so there is a deadweight loss of $10.

C) consumer surplus shrinks by $20 and tax revenues increase by $20, so there is no deadweight loss.

D) consumer surplus shrinks by $50 and tax revenues increase by $20, so there is no deadweight loss.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

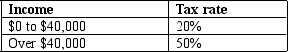

Table 12-5

-Refer to Table 12-5.What is the marginal tax rate for a person who makes $35,000?

-Refer to Table 12-5.What is the marginal tax rate for a person who makes $35,000?

A) 20%

B) 30%

C) 40%

D) 50%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Changing the basis of taxation from income earned to amount spent will

A) necessarily reduce tax revenues.

B) lower effective interest rates on savings.

C) distort incentives to earn income.

D) eliminate disincentives to save.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 478

Related Exams