A) 10%

B) 20%

C) 40%

D) 60%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Asset A has an expected return of 15% and a reward-to-variability ratio of .4. Asset B has an expected return of 20% and a reward-to-variability ratio of .3. A risk-averse investor would prefer a portfolio using the risk-free asset and ________.

A) asset A

B) asset B

C) no risky asset

D) The answer cannot be determined from the data given.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term complete portfolio refers to a portfolio consisting of ________.

A) the risk-free asset combined with at least one risky asset

B) the market portfolio combined with the minimum-variance portfolio

C) securities from domestic markets combined with securities from foreign markets

D) common stocks combined with bonds

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio is composed of two stocks, A and B. Stock A has a standard deviation of return of 35%, while stock B has a standard deviation of return of 15%. The correlation coefficient between the returns on A and B is .45. Stock A comprises 40% of the portfolio, while stock B comprises 60% of the portfolio. The standard deviation of the return on this portfolio is ________.

A) 23%

B) 19.76%

C) 18.45%

D) 17.67%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rational risk-averse investors will always prefer portfolios ________.

A) located on the efficient frontier to those located on the capital market line

B) located on the capital market line to those located on the efficient frontier

C) at or near the minimum-variance point on the risky asset efficient frontier

D) that are risk-free to all other asset choices

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market value weighted-average beta of firms included in the market index will always be ________.

A) 0

B) between 0 and 1

C) 1

D) none of these options (There is no particular rule concerning the average beta of firms included in the market index.)

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Semitool Corp. has an expected excess return of 6% for next year. However, for every unexpected 1% change in the market, Semitool's return responds by a factor of 1.2. Suppose it turns out that the economy and the stock market do better than expected by 1.5% and Semitool's products experience more rapid growth than anticipated, pushing up the stock price by another 1%. Based on this information, what was Semitool's actual excess return?

A) 7%

B) 8.5%

C) 8.8%

D) 9.25%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39%. Stock B has an expected return of 14% and a standard deviation of return of 20%. The correlation coefficient between the returns of A and B is .4. The risk-free rate of return is 5%. The expected return on the optimal risky portfolio is approximately ________. (Hint: Find weights first.)

A) 14%

B) 16%

C) 18%

D) 19%

F) A) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Investing in two assets with a correlation coefficient of -.5 will reduce what kind of risk?

A) market risk

B) nondiversifiable risk

C) systematic risk

D) unique risk

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk that can be diversified away is ________.

A) beta

B) firm-specific risk

C) market risk

D) systematic risk

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

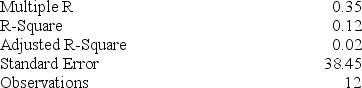

You run a regression for a stock's return on a market index and find the following Excel output:

The beta of this stock is ________.

The beta of this stock is ________.

A) .12

B) .35

C) 1.32

D) 4.05

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has a 60% chance of doubling your investment in 1 year and a 40% chance of losing half your money. What is the standard deviation of this investment?

A) 25%

B) 50%

C) 62%

D) 73%

F) All of the above

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

The efficient frontier represents a set of portfolios that

A) maximize expected return for a given level of risk.

B) minimize expected return for a given level of risk.

C) maximize risk for a given level of return.

D) None of the options.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a standard expected return versus standard deviation graph, investors will prefer portfolios that lie to the ________ the current investment opportunity set.

A) left and above

B) left and below

C) right and above

D) right and below

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lear Corp. has an expected excess return of 8% next year. Assume Lear's beta is 1.43. If the economy booms and the stock market beats expectations by 5%, what was Lear's actual excess return?

A) 7.15%

B) 13%

C) 15.15%

D) 18.59 %

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39%. Stock B has an expected return of 14% and a standard deviation of return of 20%. The correlation coefficient between the returns of A and B is .4. The risk-free rate of return is 5%. The proportion of the optimal risky portfolio that should be invested in stock B is approximately ________.

A) 29%

B) 44%

C) 56%

D) 71%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering adding a new security to your portfolio. To decide whether you should add the security, you need to know the security's: I. Expected return II. Standard deviation III. Correlation with your portfolio

A) I only

B) I and II only

C) I and III only

D) I, II, and III

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ decision should take precedence over the ________ decision.

A) asset allocation; stock selection

B) bond selection; mutual fund selection

C) stock selection; asset allocation

D) stock selection; mutual fund selection

F) A) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Which of the following statements is (are) true regarding time diversification? I. The standard deviation of the average annual rate of return over several years will be smaller than the 1-year standard deviation. II. For a longer time horizon, uncertainty compounds over a greater number of years. III. Time diversification does not reduce risk.

A) I only

B) II only

C) II and III only

D) I, II, and III

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

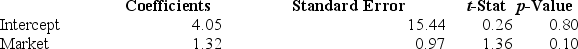

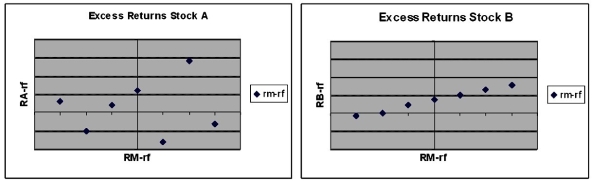

The figures below show plots of monthly excess returns for two stocks plotted against excess returns for a market index.  Which stock is riskier to a nondiversified investor who puts all his money in only one of these stocks?

Which stock is riskier to a nondiversified investor who puts all his money in only one of these stocks?

A) Stock A is riskier.

B) Stock B is riskier.

C) Both stocks are equally risky.

D) The answer cannot be determined from the information given.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 89

Related Exams