A) they had to pay huge fines for obstruction of justice

B) their 401k accounts were held outside the company

C) their 401k accounts were not well diversified

D) none of these options

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the standard deviation of a portfolio of two stocks given the following data: Stock A has a standard deviation of 18%. Stock B has a standard deviation of 14%. The portfolio contains 40% of stock A, and the correlation coefficient between the two stocks is -.23.

A) 9.7%

B) 12.2%

C) 14%

D) 15.6%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A security's beta coefficient will be negative if ________.

A) its returns are negatively correlated with market-index returns

B) its returns are positively correlated with market-index returns

C) its stock price has historically been very stable

D) market demand for the firm's shares is very low

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are recalculating the risk of ACE stock in relation to the market index, and you find that the ratio of the systematic variance to the total variance has risen. You must also find that the ________.

A) covariance between ACE and the market has fallen

B) correlation coefficient between ACE and the market has fallen

C) correlation coefficient between ACE and the market has risen

D) unsystematic risk of ACE has risen

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You put half of your money in a stock portfolio that has an expected return of 14% and a standard deviation of 24%. You put the rest of your money in a risky bond portfolio that has an expected return of 6% and a standard deviation of 12%. The stock and bond portfolios have a correlation of .55. The standard deviation of the resulting portfolio will be ________.

A) more than 18% but less than 24%

B) equal to 18%

C) more than 12% but less than 18%

D) equal to 12%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which risk can be partially or fully diversified away as additional securities are added to a portfolio? I. Total risk II. Systematic risk III. Firm-specific risk

A) I only

B) I and II only

C) I, II, and III

D) I and III

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are constructing a scatter plot of excess returns for stock A versus the market index. If the correlation coefficient between stock A and the index is -1, you will find that the points of the scatter diagram ________ and the line of best fit has a ________.

A) all fall on the line of best fit; positive slope

B) all fall on the line of best fit; negative slope

C) are widely scattered around the line; positive slope

D) are widely scattered around the line; negative slope

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Harry Markowitz is best known for his Nobel Prize-winning work on ________.

A) strategies for active securities trading

B) techniques used to identify efficient portfolios of risky assets

C) techniques used to measure the systematic risk of securities

D) techniques used in valuing securities options

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

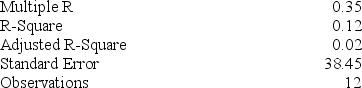

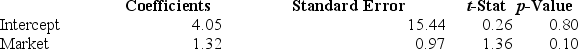

You run a regression for a stock's return on a market index and find the following Excel output:

This stock has greater systematic risk than a stock with a beta of ________.

This stock has greater systematic risk than a stock with a beta of ________.

A) .50

B) 1.5

C) 2

D) 3

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following stock return statistics fluctuates the most over time?

A) covariance of returns

B) variance of returns

C) average return

D) correlation coefficient

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firm-specific risk is also called ________ and ________.

A) systematic risk; diversifiable risk

B) systematic risk; nondiversifiable risk

C) unique risk; nondiversifiable risk

D) unique risk; diversifiable risk

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Asset A has an expected return of 20% and a standard deviation of 25%. The risk-free rate is 10%. What is the reward-to-variability ratio?

A) .40

B) .50

C) .75

D) .80

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ is the covariance divided by the product of the standard deviations of the returns on each fund.

A) covariance

B) correlation coefficient

C) standard deviation

D) reward-to-variability ratio

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you want to know the portfolio standard deviation for a three-stock portfolio, you will have to ________.

A) calculate two covariances and one trivariance

B) calculate only two covariances

C) calculate three covariances

D) average the variances of the individual stocks

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As you lengthen the time horizon of your investment period and decide to invest for multiple years, you will find that: I. The average risk per year may be smaller over longer investment horizons. II. The overall risk of your investment will compound over time. III. Your overall risk on the investment will fall.

A) I only

B) I and II only

C) III only

D) I, II, and III

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 18% and a standard deviation of return of 20%. Stock B has an expected return of 14% and a standard deviation of return of 5%. The correlation coefficient between the returns of A and B is .50. The risk-free rate of return is 10%. The expected return on the optimal risky portfolio is ________.

A) 14%

B) 15.6%

C) 16.4%

D) 18%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The plot of a security's excess return relative to the market's excess return is called the ________.

A) efficient frontier

B) security characteristic line

C) capital allocation line

D) capital market line

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio is composed of two stocks, A and B. Stock A has a standard deviation of return of 24%, while stock B has a standard deviation of return of 18%. Stock A comprises 60% of the portfolio, while stock B comprises 40% of the portfolio. If the variance of return on the portfolio is .0380, the correlation coefficient between the returns on A and B is ________.

A) .583

B) .225

C) .327

D) .128

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following correlation coefficients will produce the least diversification benefit?

A) -.6

B) -.3

C) 0

D) .8

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor can design a risky portfolio based on two stocks, A and B. The standard deviation of return on stock A is 24%, while the standard deviation on stock B is 14%. The correlation coefficient between the returns on A and B is .35. The expected return on stock A is 25%, while on stock B it is 11%. The proportion of the minimum-variance portfolio that would be invested in stock B is approximately ________.

A) 45%

B) 67%

C) 85%

D) 92%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 89

Related Exams